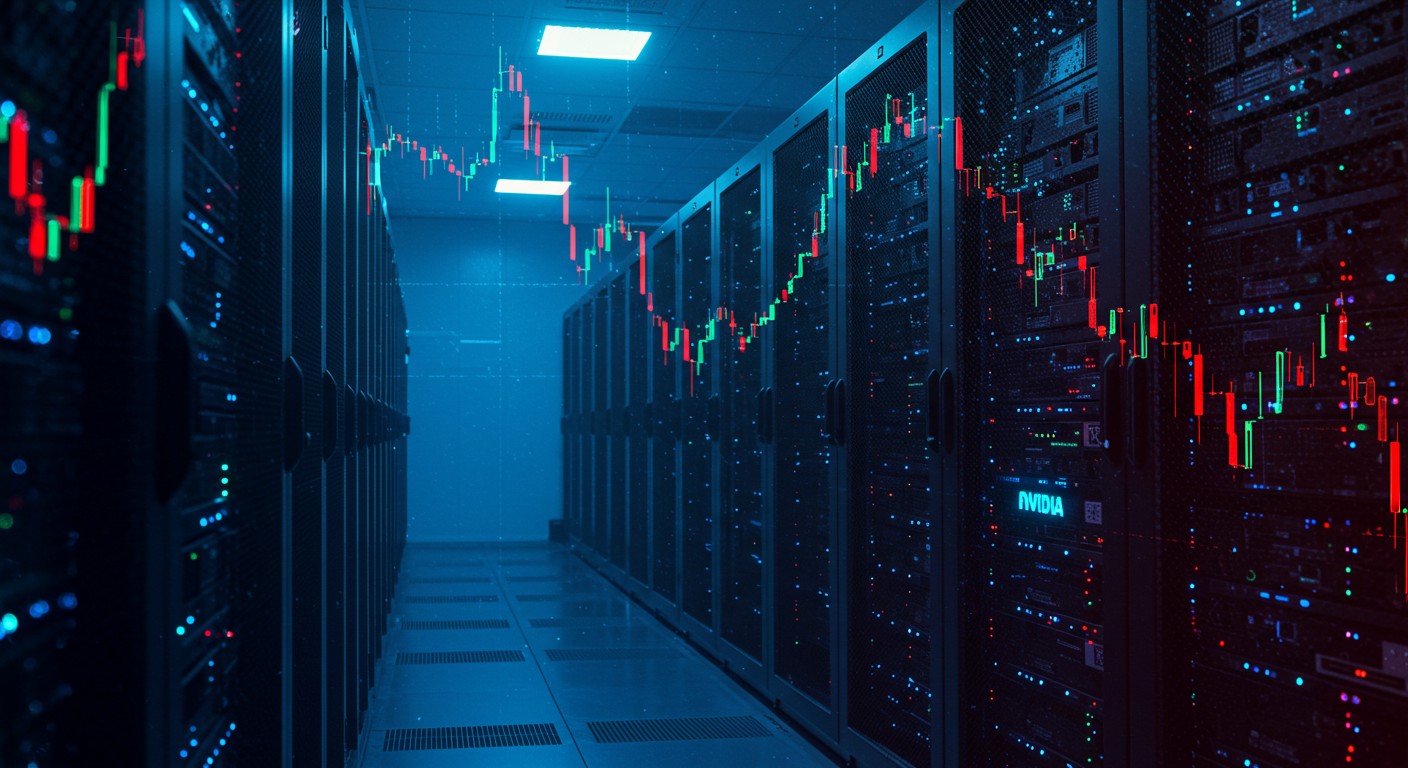

Have you ever watched a stock you thought was bulletproof take a sudden hit, leaving you wondering what’s next? That’s exactly what happened when a leading tech giant’s data center earnings came in below expectations, sending ripples through the investment world. For those tracking the semiconductor space, this moment feels like a plot twist in an otherwise blockbuster story. Let’s unpack what this means for investors, why the market reacted the way it did, and how you can navigate the turbulence.

Why Nvidia’s Data Center Miss Shook the Market

The semiconductor industry has been a darling of investors for years, with one company often stealing the spotlight for its role in powering AI, gaming, and data centers. When recent earnings revealed a shortfall in data center revenue, the market didn’t take it lightly. Shares slid, and analysts scrambled to reassess their positions. But was this dip a one-off stumble or a sign of deeper challenges?

Data centers are the backbone of modern tech, fueling everything from cloud computing to machine learning. When a key player in this space reports numbers that don’t meet Wall Street’s lofty expectations, it’s like a cold splash of water on a hot streak. Investors, accustomed to consistent growth, started questioning whether the company’s dominance is as unshakable as it seemed.

Markets thrive on certainty, but they punish surprises—even small ones.

– Financial analyst

What Caused the Revenue Miss?

Let’s break it down. The shortfall wasn’t a complete shock if you’ve been following the broader tech landscape. Supply chain constraints, particularly in semiconductor fabrication, have been a nagging issue for the industry. Add to that the intense competition from rivals carving out their own slices of the data center pie, and you’ve got a recipe for a tough quarter.

Another factor? The market’s expectations were sky-high. Analysts had priced in near-perfection, leaving little room for error. When the numbers came in, they weren’t disastrous—just not the home run everyone wanted. This gap between reality and hype triggered the sell-off, as investors recalibrated their enthusiasm.

- Supply chain bottlenecks: Limited chip production slowed delivery timelines.

- Competitive pressure: Rivals are gaining ground in AI and cloud computing.

- Overheated expectations: Wall Street’s forecasts were arguably too optimistic.

The Bull Case: Why Some Investors Are Still Optimistic

Despite the dip, not everyone’s hitting the panic button. The company’s guidance for the next quarter was solid, signaling confidence in its long-term growth. For those with a longer horizon, this could be a classic case of a short-term blip in a much bigger success story. After all, the demand for AI infrastructure and cloud computing isn’t slowing down anytime soon.

Personally, I’ve always found that moments like these separate the reactive traders from the strategic investors. The company’s fundamentals—its leadership in AI, gaming, and autonomous vehicles—remain rock-solid. Plus, its investments in cutting-edge tech like generative AI and quantum computing suggest it’s not resting on its laurels.

A single quarter doesn’t define a company’s trajectory. Look at the bigger picture.

– Tech industry strategist

The Bear Case: Risks You Can’t Ignore

That said, it’s not all rosy. The data center miss raises legitimate questions about whether the company can maintain its breakneck growth. Competition is heating up, with rivals rolling out chips tailored for AI and machine learning at lower price points. Could this erode market share over time?

Then there’s the macroeconomic angle. Rising interest rates and global economic uncertainty could dampen demand for high-cost tech infrastructure. If businesses tighten their budgets, data center spending might take a hit, and that’s a risk no investor can brush off lightly.

- Competitive threats: New players are challenging the status quo.

- Economic headwinds: Inflation and rate hikes could curb spending.

- Valuation concerns: High stock prices leave little margin for error.

How Should Investors Respond?

So, what’s the play here? If you’re an investor, this moment calls for a clear-eyed look at your goals. Are you in it for the long haul, or are you looking for quick gains? The answer shapes how you approach this dip.

For long-term investors, this could be a buying opportunity. The company’s track record and forward-looking investments make a compelling case for holding steady or even adding to your position. But if you’re more risk-averse, you might want to wait for clearer signs of recovery before jumping in.

| Investor Type | Strategy | Risk Level |

| Long-Term | Hold or Buy on Dip | Low-Medium |

| Short-Term | Monitor for Recovery | Medium-High |

| Risk-Averse | Wait for Stability | Low |

One thing’s certain: don’t let emotions drive your decisions. Market dips like this often spark knee-jerk reactions, but the savviest investors stay calm and stick to their strategy. Maybe it’s time to revisit your portfolio diversification to balance out any overexposure to tech.

What’s Next for the Semiconductor Space?

Looking beyond this single company, the semiconductor industry is at a crossroads. The race to power the next wave of AI and cloud computing is intensifying, and no one’s guaranteed to stay on top forever. But the demand for chips isn’t going anywhere—global digital transformation practically ensures it.

Perhaps the most interesting aspect is how this moment highlights the volatility of tech stocks. They’re not just investments; they’re bets on the future of innovation. And while that future is bright, it’s also unpredictable. Investors who can stomach the ups and downs might find themselves well-positioned for the next big wave.

The semiconductor industry is a rollercoaster—thrilling, but not for the faint of heart.

Lessons from the Dip

If there’s one takeaway from this earnings report, it’s that even the strongest companies aren’t immune to surprises. The market’s reaction might feel like an overreaction, but it’s a reminder to stay vigilant. Diversify, do your homework, and don’t get swept up in the hype.

In my experience, these moments of uncertainty are when the best opportunities emerge. Whether you’re a seasoned investor or just dipping your toes into the market, now’s the time to ask yourself: Are you ready to ride out the storm, or is it time to adjust your sails?

Investment Wisdom: 50% Research 30% Patience 20% Discipline

The tech world moves fast, and so does the stock market. By staying informed and strategic, you can turn moments like these into opportunities rather than setbacks. What’s your next move?