Every once in a while, a chart does something that makes even the most jaded traders sit up and pay attention. Right now, Pi Network is doing exactly that.

I’ve been watching PI for months through all the sideways grinding, the fake-out rallies, and the endless “when mainnet?” chatter. And honestly? The price action was starting to feel like a bad relationship you know you should leave but just… can’t. Until this week. Something genuinely interesting is showing up on the charts, and it’s one of those rare setups that actually has a decent shot at marking the real bottom.

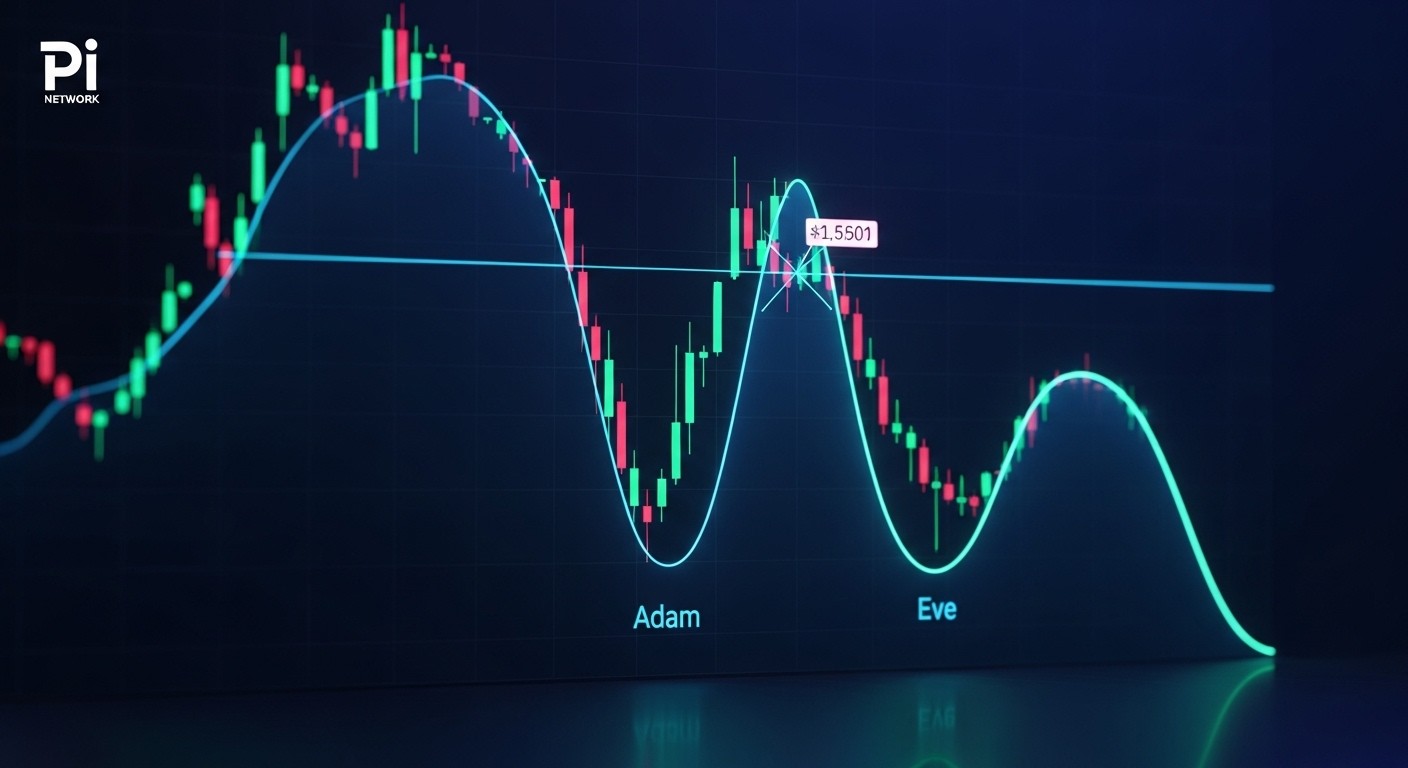

The Adam and Eve Pattern Taking Shape in Pi Network

For the non-chart nerds: the Adam and Eve is a classic double-bottom reversal pattern, but with a twist. The first bottom (Adam) is sharp and V-shaped – panic selling, capitulation, the whole drama. The second bottom (Eve) is rounded, calmer, more constructive. When you see both on the same chart, it usually means the smart money has stepped in after the weak hands got shaken out.

And that’s exactly what Pi Network is printing right now.

Breaking Down the Two Bottoms

Let’s go back a few months. PI had that nasty drop – straight down, high volume, pure fear. That was Adam. Classic retail panic combined with some leveraged liquidations. The kind of move that leaves bag-holders staring at their screens at 3 a.m. wondering why they ever touched crypto.

Then something changed. Instead of continuing the bleed, price started grinding sideways-to-up on declining volume. Sellers got exhausted. Buyers started nibbling. What we’re seeing now is Eve – that beautiful, rounded saucer shape that screams accumulation.

In my experience, when you get this exact combination – sharp panic low followed by months of higher lows and decreasing sell pressure – you’re usually looking at the early stages of something explosive.

Why the Point of Control Matters More Than You Think

Here’s the part that really gets me excited: price is holding firmly above the point of control (POC) of the entire range.

For anyone not familiar with volume profile, the POC is basically where the most trading actually happened. It’s the price level the market thinks is “fair.” When price trades above the POC for an extended period, it tells you buyers are in control. When it trades below, sellers dominate.

Right now? PI is chilling comfortably above its POC like it belongs there. That’s not random. That’s institutional-level absorption of every sell order that comes in. Someone – or more likely, a lot of someones – is building a position.

The Neckline: Where Everything Gets Decided

All double-bottom patterns live or die by the neckline. For Pi Network, that resistance sits roughly between $0.21 and $0.28. We’ve tested it multiple times and gotten rejected. Classic stuff.

But here’s what’s different this time: volume is drying up on the approaches, the rounded bottom is mature, and we’re getting higher lows with each test. These are the exact ingredients that precede clean breakouts.

Every major altcoin rally I’ve traded started with a multi-month base, a clear pattern, and a decisive neckline break. Pi Network is checking every box right now.

Measuring the Move: Where Could Price Actually Go?

Classic technical analysis gives us a pretty straightforward target. You measure the depth of the pattern (from the lows to the neckline) and project that distance upward from the breakout point.

For PI, that puts the minimum target around $0.35–$0.38. That’s roughly 65-70% from current levels. Not life-changing money for early miners who got in at fractions of a cent, sure. But for anyone who’s been watching this thing trade sideways for a year? That’s the kind of move that makes you finally feel like the wait was worth it.

- Conservative target: $0.35 (pattern measurement)

- Moderate extension: $0.45 (previous range high)

- Aggressive target: $0.60+ (if we get real FOMO)

The Fundamental Catalyst Nobody’s Talking About

Technical patterns don’t form in a vacuum. While the chart is doing its thing, Pi Network has quietly been checking off regulatory boxes that actually matter. The team recently stated they believe the project meets Europe’s MiCA requirements – which is a really big deal if you understand how strict European regulators have become.

Translation? Legitimate exchange listings could be coming sooner than most people think. And nothing moves price like fresh liquidity and new buyers who couldn’t access the token before.

I’ve seen this movie before. Projects that combine clean technical setups with incoming regulatory clarity tend to absolutely rip when the breakout finally happens.

Risks and Why This Still Might Fail

Look, I’m excited about this setup, but I’m not drinking the Kool-Aid either. There are still very real risks:

- Mainnet delays have burned holders for years

- The broader crypto market is still correcting hard

- Failed breakouts happen all the time

- That $0.21–$0.28 zone has rejected price multiple times

The difference now is that each rejection has come on lower volume, and the overall structure keeps improving. Failed patterns usually look messy. This one keeps getting cleaner.

What I’m Watching Over the Next Few Weeks

If you’re holding PI or thinking about a position, here’s what actually matters:

- Can price hold the rounded bottom support near $0.18–$0.20?

- Does volume start picking up as we approach the neckline again?

- Are we getting higher timeframe confirmation (weekly close above $0.28)?

- Any legitimate exchange listing announcements?

One decisive weekly close above $0.28 with expanding volume would be my personal green light. Until then, this is a high-probability setup, not a guaranteed win.

The Adam and Eve pattern in Pi Network is one of the cleanest reversal setups I’ve seen in the altcoin space all year. Combined with improving fundamentals and what looks like genuine accumulation, it’s hard not to get at least a little excited.

Will it play out perfectly? Probably not – nothing ever does in crypto. But the risk/reward here looks better than it has in a very long time. Sometimes the market gives you these gifts. The question is whether you’re paying enough attention to notice.

Disclosure: I currently hold a position in PI and would add on a confirmed breakout. This is not financial advice – do your own research and never risk more than you can afford to lose.