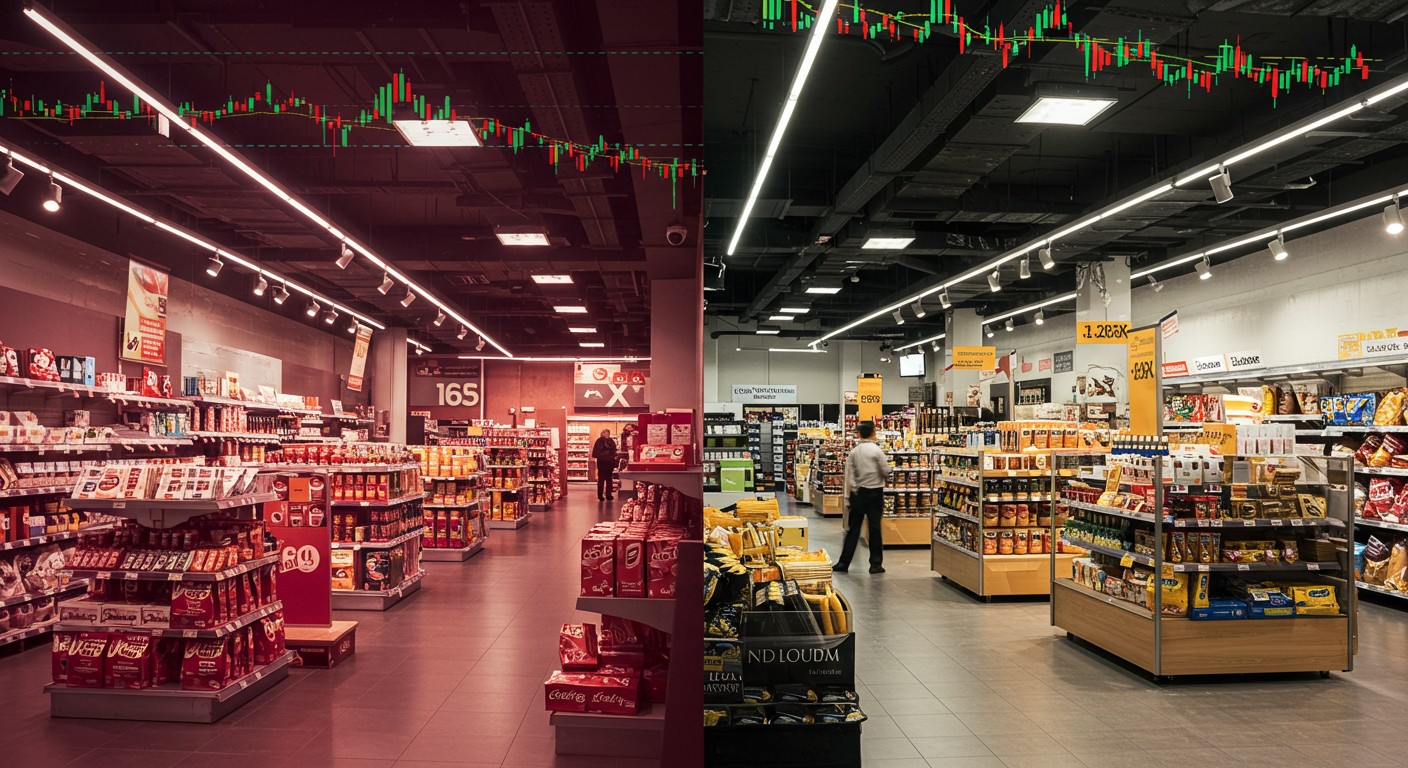

Have you ever walked into a store and felt the pulse of opportunity? That’s what the retail sector feels like right now—alive with potential, yet tricky to navigate. Some companies are struggling under the weight of economic shifts, while others are thriving, almost defying gravity. I’ve been digging into the market lately, and let me tell you, the retail space is a goldmine for investors who know where to look.

Why Retail Stocks Are a Hot Topic Today

The retail industry is like a chessboard—every move matters, and the stakes are high. With global trade policies stirring the pot, some retailers are getting hit hard, while others are cashing in on the chaos. Economic slowdown fears and tariff talks have sent shockwaves through the market, creating a divide between winners and losers. Let’s break down what’s happening and why it’s a prime time to rethink your portfolio allocation.

The Pullback Play: Buying Low in Retail

One major retailer has seen its stock tumble about 25% from its peak earlier this year. That kind of drop raises eyebrows, but it also screams opportunity. Why? Because not all pullbacks are created equal. This company dominates e-commerce, cloud services, and even digital advertising—a trifecta that’s hard to beat. Despite the dip, its fundamentals remain rock-solid.

Analysts recently slashed their earnings forecasts, citing slower growth and rising costs. But here’s where I lean in: those same analysts still see a 35% upside from current levels. The company’s ability to capture market share during tough times is unmatched. Consumers are hunting for deals, and this retailer’s platform is their go-to. Plus, its cash reserves mean it can keep investing while others pull back.

Smart investors buy when others panic—great companies don’t stay cheap forever.

– Veteran portfolio manager

I’m not saying it’s a slam dunk. There’s real risk here—tariffs could bite, and shipping costs aren’t getting cheaper. But for long-term players, this feels like a moment to act. The stock’s trading well below its historical highs, and I’d argue it’s oversold. Sometimes, you’ve got to trust the numbers over the noise.

The High-Flyer: Time to Trim or Hold?

On the flip side, there’s a retailer that’s been crushing it. While the broader market wobbles, this off-price giant is hitting new highs. Its secret sauce? Buying excess inventory from other retailers at dirt-cheap prices and selling it to bargain-hungry shoppers. In a world of supply chain chaos, that’s a winning formula.

Here’s the catch: the stock’s up significantly, even as the market’s taken a breather. That kind of outperformance makes me pause. I love the company’s long-term story—value retail thrives in uncertainty—but at these levels, it’s starting to feel frothy. Locking in some gains might be the prudent move, especially if you’re sitting on a 100% return from a couple of years ago.

- Strength: Benefits from oversupply as retailers misjudge demand.

- Challenge: Market may have already priced in its tariff-proof edge.

- Opportunity: Cash flow supports expansion into new markets.

Perhaps the most interesting aspect is how this retailer sidesteps the tariff trap. While others scramble, it’s scooping up discounted goods and passing savings to customers. But with the stock at all-time highs, I’d rate it a hold for now—great business, but the price needs to cool off.

What’s Driving the Retail Divide?

So, why are some retailers sinking while others soar? It’s not just luck. The market’s reacting to a few key forces, and understanding them is critical for any investor. Let’s unpack the big ones shaping the retail landscape right now.

Tariffs and Trade Uncertainty

Trade policies are like a storm cloud over retail. New tariffs could jack up costs for companies reliant on global supply chains. But here’s the twist: not every retailer gets hit the same way. Those with flexible sourcing—like our off-price star—can dodge the bullet, while others drown in higher fulfillment costs.

Take the e-commerce giant we mentioned earlier. It’s got the scale to absorb some of those costs and the tech to optimize pricing. Smaller players? They’re not so lucky. That’s why I think the big dogs will keep winning, even if the headlines sound grim.

Consumer Behavior Shifts

Shoppers are changing, and fast. With wallets pinched, they’re hunting for value—whether it’s online deals or discount racks. This plays right into the hands of retailers offering price transparency or deep discounts. The data backs it up: off-price retail sales are projected to grow 5% annually through 2027, outpacing traditional retail.

I’ve noticed this myself—friends are bragging about their thrift store finds or online steals. It’s not just a trend; it’s a mindset. Retailers that get this shift are pulling ahead, while those stuck in old models are fading fast.

Inventory Management Mastery

Inventory is the lifeblood of retail, and right now, it’s a battlefield. Some companies overstocked, expecting a demand boom that never came. Others, like our high-flyer, thrive by snapping up that excess at fire-sale prices. It’s a classic case of opportunistic buying—and it’s paying off big.

| Retailer Type | Inventory Strategy | Market Impact |

| E-commerce Giant | Scale-driven, tech-optimized | Gains market share |

| Off-price Retail | Buys distressed inventory | Thrives on chaos |

| Traditional Retail | Overstocked, rigid | Faces losses |

The lesson? Retailers who adapt win. Those who don’t are left holding the bag—literally.

How to Play Retail Stocks Right Now

Alright, so the retail sector’s a mixed bag—some stocks are screaming buys, others are flashing warning signs. How do you make sense of it? I’ve put together a game plan based on what’s working in today’s market. Here’s my take on smart investing in retail.

Step 1: Spot the Oversold Gems

Stocks down big from their highs aren’t always duds. Look for companies with strong balance sheets and diverse revenue streams. The e-commerce titan we talked about? It’s a textbook case. Despite the drop, its cash flow and growth potential make it a compelling buy.

Don’t just chase the dip, though. Check the numbers—revenue growth, debt levels, and market positioning. If the story still holds, a 25% discount could be your ticket to long-term gains.

Step 2: Take Profits Strategically

When a stock’s riding high—like our off-price champ—it’s tempting to hold forever. But markets don’t reward complacency. Trimming your position locks in gains and frees up cash for other opportunities. I’d rather sell a bit now than wish I had later.

Profit is only real when you take it off the table.

– Seasoned trader

That said, don’t ditch the whole position. If the company’s still got legs, keep some skin in the game. Balance is key.

Step 3: Diversify Across Retail

Retail’s not a monolith. Spread your bets across e-commerce, off-price, and maybe even specialty retail if the valuation’s right. This way, you’re not banking on one horse to win. A mix of growth stocks and value plays keeps your portfolio resilient.

- Identify leaders in each retail segment.

- Compare their risk-reward profiles.

- Allocate based on your investment horizon.

In my experience, diversification doesn’t just reduce risk—it opens doors to unexpected winners. Retail’s volatile, but that’s where the rewards hide.

The Bigger Picture: Retail’s Role in Your Portfolio

Retail stocks aren’t just about quick trades—they’re a cornerstone of a balanced portfolio. They give you exposure to consumer trends, economic cycles, and even tech innovation. But like any sector, they come with baggage. The trick is knowing when to lean in and when to step back.

Right now, I’m bullish on retailers that can navigate tariffs and tap into value-conscious shoppers. The e-commerce giant’s a buy for its long-term upside, while the off-price leader’s a hold after its epic run. Both have a place in a portfolio, but timing matters.

What’s your take? Are you diving into retail stocks, or sitting this one out? Whatever you choose, keep an eye on the fundamentals—because in retail, the only constant is change.

Retail Portfolio Snapshot: 40% E-commerce leaders 30% Off-price retail 20% Specialty retail 10% Cash for flexibility

That’s my framework, but tweak it to fit your goals. The retail sector’s a wild ride, but for those who play it smart, the rewards can be massive.