Have you ever wondered what happens when the systems we rely on start to fray at the edges? I’ve been thinking about this a lot lately, especially with whispers of changes at one of the most critical institutions for retirees. Reports suggest significant shifts in how a major government agency operates, and it’s raising eyebrows among those planning for their golden years. The stakes are high, and the ripple effects could touch millions.

Why Retirement Systems Are Under Scrutiny

The backbone of retirement for countless Americans is facing turbulence. Word on the street is that a key department, responsible for keeping sensitive data safe and ensuring benefits flow smoothly, might see its workforce slashed. This isn’t just about numbers on a spreadsheet—it’s about real people who depend on these systems to pay their bills. I can’t help but wonder: how do you cut staff without cutting corners?

The Role of Technology in Benefits

Think about the last time you logged into an online portal to check your finances. Now imagine that portal crashing, leaving you in the dark about your money. That’s the kind of chaos some worry about if staffing levels drop in departments managing benefit claims processing. These teams don’t just push paper—they maintain the digital arteries of retirement systems, from websites to secure databases.

A stable system is the bedrock of financial trust for retirees.

– Policy analyst

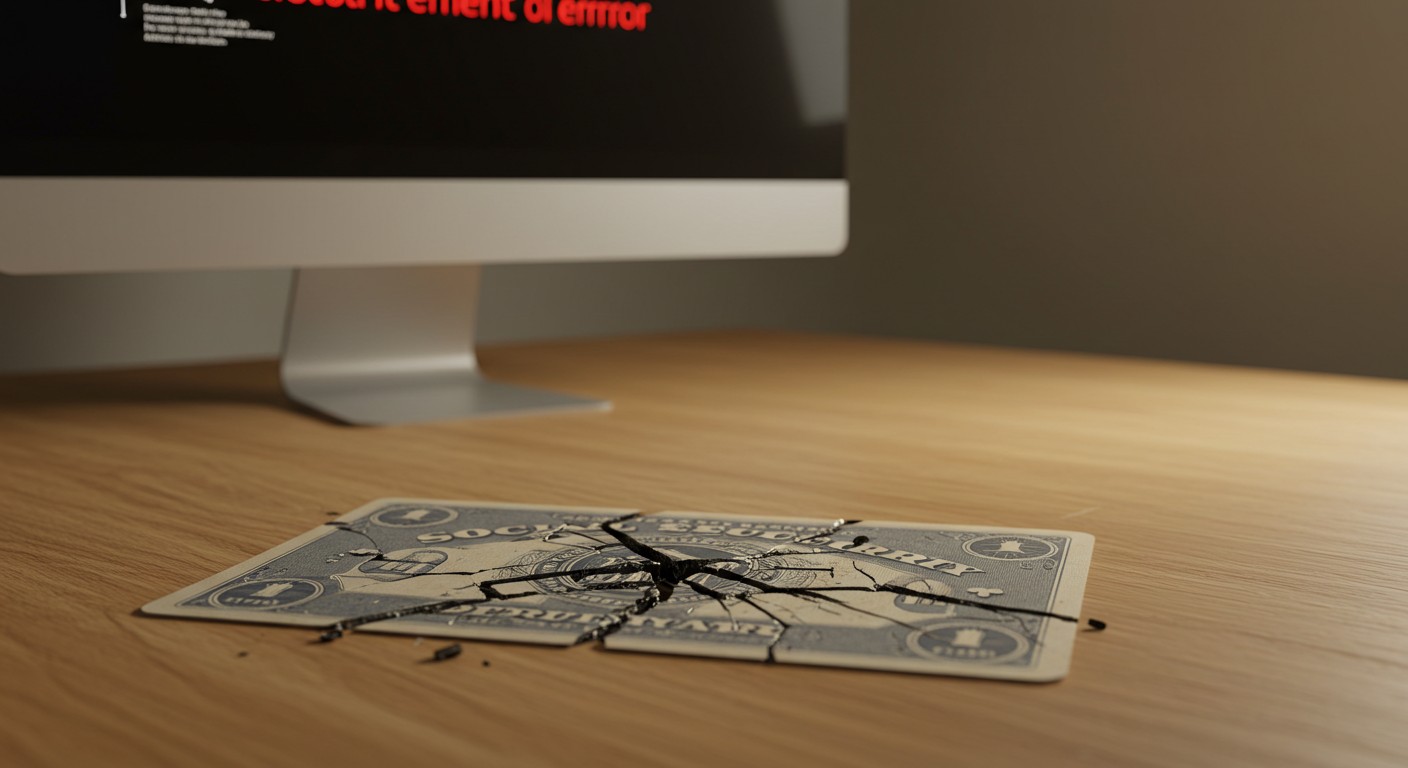

Recent hiccups, like website outages or error messages, have already frustrated users. If you’ve ever gotten a “service unavailable” notice when checking your account, you know the sinking feeling. Cutting staff who keep these systems humming seems like playing with fire, especially when millions rely on timely access.

Data Security at Risk?

Here’s where things get dicey. Protecting sensitive data isn’t just a nice-to-have—it’s non-negotiable. The folks handling cybersecurity for retirement benefits are like the guardians of a digital vault. Fewer guardians could mean weaker defenses, and in my experience, that’s a recipe for trouble. Cyber threats don’t take a day off, so why would we scale back the team fighting them?

- Data breaches can expose personal details like Social Security numbers.

- Weak systems invite hackers to exploit vulnerabilities.

- Trust in public institutions erodes when security falters.

I read somewhere that strong cybersecurity is like insurance—you don’t notice it until you need it. If staffing cuts lead to even one major breach, the fallout could be catastrophic for retirees already stretched thin.

The Push for Efficiency

Now, I get it—efficiency matters. There’s been chatter about streamlining government operations, and who doesn’t want taxpayer dollars spent wisely? But there’s a difference between trimming fat and cutting muscle. Some argue that reducing staff in critical areas could backfire, creating bottlenecks instead of breakthroughs.

| Area | Potential Impact of Cuts |

| Website Maintenance | More outages, slower fixes |

| Data Security | Higher breach risk |

| Claims Processing | Delays in benefit payments |

Perhaps the most interesting aspect is how these changes tie into broader debates about government size. Efficiency sounds great on paper, but when it disrupts lives, you’ve got to question the math.

Voices of Concern

Lawmakers have been vocal about the risks. They’ve pointed out that staffing levels are already at historic lows, and further reductions could strain an already creaky system. Imagine trying to call a helpline only to get endless hold music—that’s what happens when field offices are stretched thin.

Cutting staff now is like pulling bricks from a foundation.

I’ve found that when politicians start writing letters, it’s usually a sign things are serious. They’re not just worried about optics—they’re hearing from constituents who can’t access their accounts or get answers.

What’s Driving the Changes?

At the heart of this is a bigger question: how do you balance modernization with reliability? Some say new policies, like changes to labor agreements, could make it easier to shuffle staff around. Others argue that replacing experienced workers with less specialized ones risks breaking what’s already working.

According to experts, maintaining government accountability is key to ensuring public services don’t falter. Without skilled staff, even the best intentions can fall flat.

Impact on Retirees

Let’s zoom out for a second. If you’re nearing retirement, or already there, delays in benefits could mean real hardship. A missed payment might mean choosing between groceries and meds. That’s not abstract policy—it’s personal.

- Delayed payments: Late benefits disrupt budgets.

- Website issues: Inability to check account status adds stress.

- Reduced support: Fewer staff mean longer wait times for help.

I can’t shake the feeling that retirees deserve better than uncertainty. They’ve paid into the system their whole lives—shouldn’t it deliver when it counts?

A Path Forward

So, what’s the fix? Some propose boosting funding to hire more staff, not fewer. Others suggest investing in tech to make systems more resilient. Either way, the goal is clear: keep benefits flowing without a hitch.

Learning about public service improvements can offer insights into how agencies adapt. For now, though, the focus is on preventing disruptions.

Why It Matters to You

Whether you’re decades from retirement or already cashing checks, this affects you. A shaky system undermines confidence in the future. And honestly, who has time for that kind of stress? Planning for retirement is hard enough without wondering if the safety net will hold.

Retirement security isn’t just a promise—it’s a pact.

– Financial planner

In my view, the real challenge is finding a balance. Modernize, sure, but don’t sacrifice reliability. Retirees aren’t asking for miracles—just a system that works.

Looking Ahead

The debate over staffing and systems isn’t going away. Lawmakers are pushing back, and retirees are watching closely. Maybe this is a wake-up call to rethink how we protect the programs millions depend on. What do you think—can we innovate without leaving people behind?

For now, the uncertainty lingers. But one thing’s certain: retirement planning just got a bit more complicated. Stay informed, and keep an eye on your benefits—it’s your future, after all.