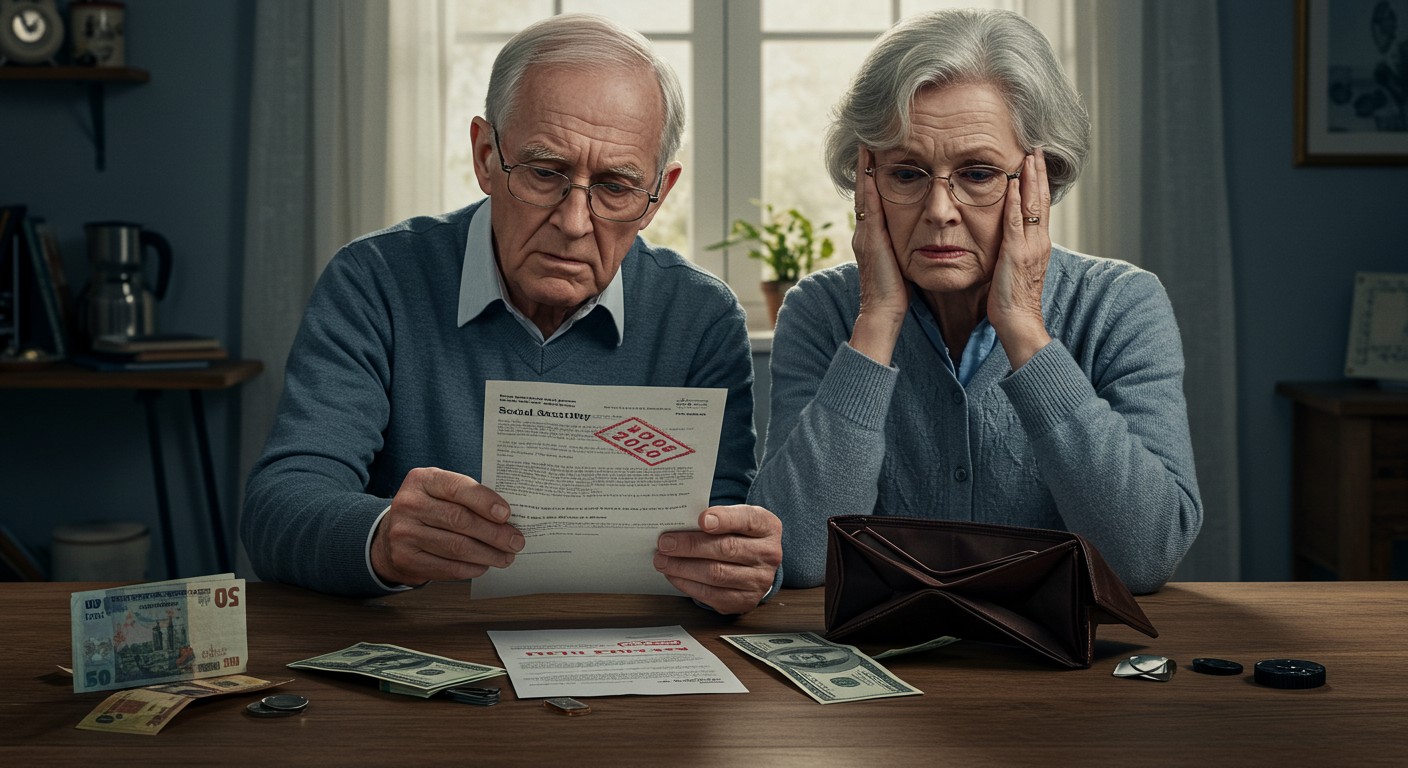

Have you ever opened a letter that turned your world upside down? For thousands of retirees relying on Social Security, that’s exactly what happens when a notice of overpayment arrives. It’s not just a clerical error—it’s a financial gut punch. The Social Security Administration (SSA) recently shifted gears, moving from a jaw-dropping 100% withholding rate to a still-painful 50% clawback for certain beneficiaries. While this change might seem like a relief, losing half your monthly benefits can still spell disaster for those scraping by. Let’s unpack what this means, why it’s happening, and how you can navigate the storm.

The Overpayment Crisis: A Financial Wake-Up Call

Imagine this: you’ve been receiving your Social Security checks like clockwork, budgeting every penny for rent, groceries, and meds. Then, out of the blue, you get a letter saying you owe thousands because the SSA paid you too much. Worse, they’re docking 50% of your benefits until it’s paid back. This isn’t a rare horror story—it’s a reality for countless retirees, especially those on Title II benefits like retirement, survivors, or disability insurance.

The SSA’s overpayment issue stems from a mix of human error, outdated systems, and beneficiaries not reporting changes fast enough. Maybe you started a part-time job, or your marital status changed, and the SSA didn’t catch up. Suddenly, you’re on the hook for thousands, through no fault of your own. According to experts, these clawbacks can push seniors into economic hardship, threatening their ability to afford basics like housing or food.

Losing half your income overnight is like trying to live on half a loaf of bread—it’s not enough to sustain you.

– Senior advocacy expert

Why the 50% Withholding Rate Hurts

Let’s be real: Social Security isn’t a windfall. For many, it’s the only thing keeping the lights on. The SSA’s decision to slash benefits by 50% for overpayment recovery—down from a briefly enforced 100%—might sound like progress, but it’s still a massive hit. If your monthly check is $1,500, you’re now left with $750. Try covering rent, utilities, and groceries with that. For some, it’s a fast track to missed bills or even homelessness.

What’s frustrating is the timing. The SSA gives you just 90 days to respond to an overpayment notice before the clawback kicks in. Miss that window, and you’re stuck with the default 50% cut. Experts warn this can be especially brutal for low-income seniors who rely on every dollar. In my view, it’s hard to see this as anything but a system punishing those least equipped to fight back.

How Overpayments Happen

Overpayments aren’t always someone’s fault—they’re often a glitch in the system. Here’s a quick rundown of the usual culprits:

- Reporting delays: You get a side gig or inherit money, but the SSA isn’t notified in time.

- Agency errors: Data entry mistakes or slow processing can lead to miscalculated benefits.

- Life changes: Marriage, divorce, or a spouse’s death can alter your benefit amount, but the SSA might not adjust quickly.

When these issues pile up, the SSA sends a notice demanding repayment—often in full. If you can’t pay upfront (and let’s face it, most can’t), the agency starts withholding. The kicker? You might not even know you were overpaid until the letter arrives.

The Rollercoaster of Withholding Rates

The SSA’s approach to overpayment recovery has been a wild ride. A few years back, the default withholding rate was a reasonable 10%—tough but manageable. Then, in a head-scratching move, the agency jacked it up to 100%, essentially wiping out entire benefit checks. After backlash, they settled on 50% for Title II benefits as of April 2025. Supplemental Security Income (SSI) beneficiaries, meanwhile, still face a 10% clawback.

Why the flip-flopping? The SSA claims higher withholding rates could save billions over a decade. But at what cost? I can’t help but wonder if the folks making these decisions have ever tried living on a fixed income. For retirees, this isn’t just numbers on a spreadsheet—it’s their lifeline.

The 100% withholding rate was like pulling the rug out from under seniors. Even 50% feels like a kick when you’re down.

– Retirement policy analyst

Navigating the Overpayment Maze

Facing an overpayment notice? Don’t panic, but don’t ignore it either. You’ve got options, though the process can feel like wading through molasses. Here’s what you can do within that critical 90-day window:

- Request a waiver: If the overpayment wasn’t your fault and repaying would cause hardship, ask the SSA to forgive the debt.

- Negotiate a lower rate: You can propose a smaller withholding percentage, like 10%, if 50% is too steep.

- Seek reconsideration: If you think the SSA’s math is off, challenge the overpayment amount.

Sounds straightforward, right? Not so fast. The SSA’s staff have a lot of discretion, meaning outcomes vary. One person might get a waiver, while another gets stuck with the full 50% cut. Plus, getting an appointment at an SSA office can take weeks, eating into your 90-day window. It’s a system that demands persistence.

The Human Cost of Clawbacks

Beyond the numbers, overpayment recovery takes a toll on mental and physical health. Seniors already juggling medical bills or caregiving duties now face the stress of slashed income. Some may skip meals or meds to make rent. Others risk eviction. It’s not just about money—it’s about dignity and stability.

Advocates argue the SSA needs to rethink its approach. Why punish beneficiaries for agency errors? A fairer system might cap withholding at 10% across the board or prioritize waivers for low-income seniors. Until then, the 50% clawback remains a harsh reality for many.

| Benefit Type | Withholding Rate | Impact Level |

| Title II (Retirement, Disability) | 50% | High |

| Supplemental Security Income | 10% | Moderate |

Protecting Your Finances

So, how do you shield yourself from the overpayment trap? Prevention and preparation are key. Here’s a game plan:

- Stay proactive: Report any income or life changes to the SSA immediately to avoid miscalculations.

- Double-check notices: Review SSA letters carefully and act fast if you spot an error.

- Build a buffer: If possible, set aside an emergency fund to cushion the blow of unexpected clawbacks.

It’s not foolproof, but staying on top of your benefits can save you headaches down the road. I’ve seen friends scramble when hit with unexpected SSA demands, and it’s a reminder that vigilance pays off.

What’s Next for Social Security?

The SSA’s overpayment mess isn’t going away anytime soon. With billions at stake, the agency faces pressure to recover funds while balancing fairness. Advocates are pushing for reforms, like streamlining error detection or capping withholding rates. But change takes time, and for now, beneficiaries bear the brunt.

If you’re navigating this mess, know you’re not alone. Reach out to advocacy groups or legal aid for support. And keep an eye on SSA updates—because in this game, the rules can change fast.

Living on Social Security is tough enough without the threat of clawbacks. The shift to a 50% withholding rate is a step back from the brink, but it’s still a heavy blow for retirees. By understanding your options and staying proactive, you can fight back against the system’s flaws. Have you or someone you know faced an overpayment notice? The road ahead isn’t easy, but knowledge is power.