Have you ever wished you could just peel the yield off your staked assets and trade it like any other token?

Sounds like science fiction, right? Until yesterday it pretty much was – at least outside of Ethereum’s Pendle or a couple of niche Layer 2s. But as of today, that exact mechanic just landed on Flare, and the protocol bringing it is called Spectra.

I’ve been watching yield-tokenization projects for years, and I’ll be honest: most of them feel like solutions looking for a problem. Spectra on Flare, though? This one actually makes sense from day one.

A New Financial Primitive Lands on Flare

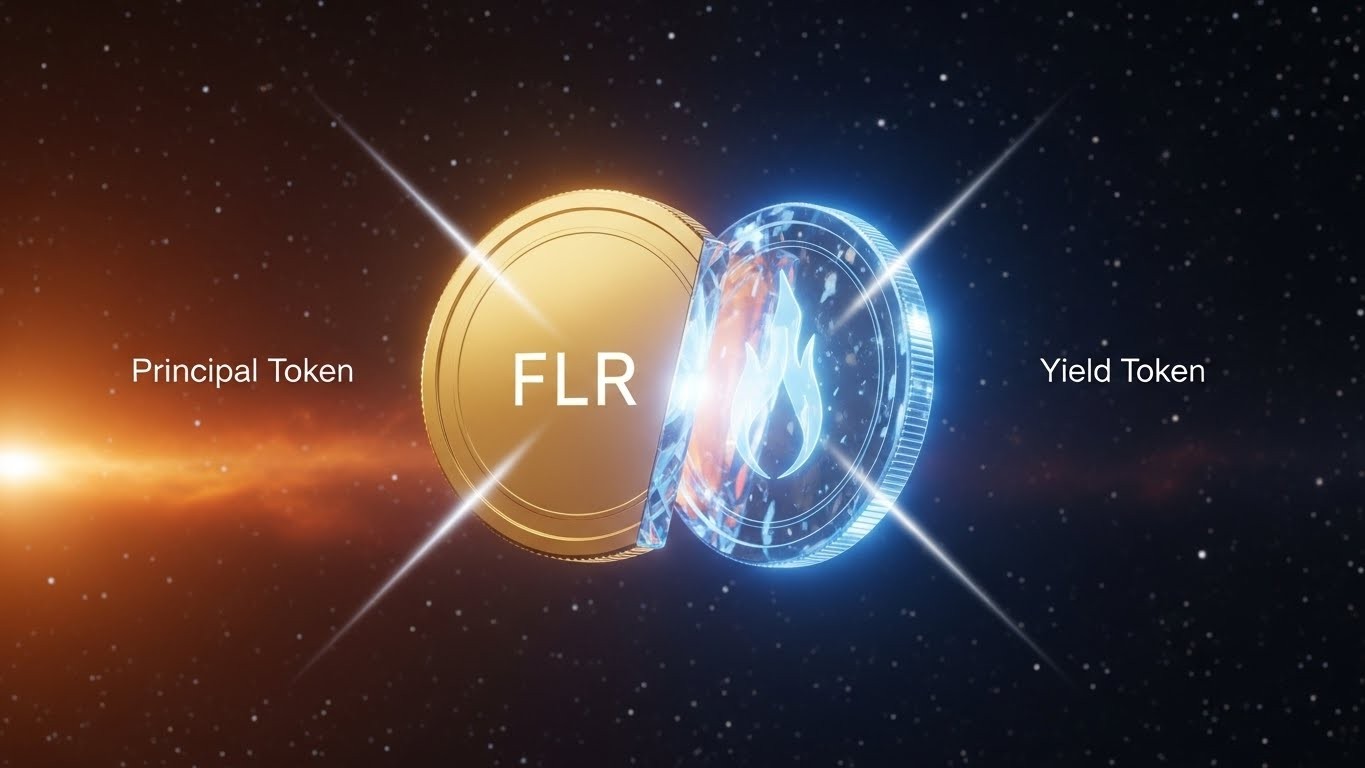

At its core, Spectra does one beautifully simple thing: it takes any yield-bearing asset (starting with sFLR, Flare’s liquid staking token) and splits it into two completely separate tokens.

- Principal Token (PT) – the “safe” part that redeems for the full underlying asset at maturity.

- Yield Token (YT) – pure exposure to whatever yield the asset generates until that maturity date.

Think of it as separating the apple from the interest it earns while sitting in the fridge. You can eat the apple now (sell the PT at discount), keep it for later (hold PT to maturity), or sell the promise of future apple pie (trade the YT).

Okay, maybe the metaphor breaks down quickly, but the idea is powerful.

Why This Matters More on Flare Than Anywhere Else

Flare isn’t just another EVM chain chasing TVL. It has two killer features that make yield tokenization feel almost inevitable:

- Native data protocols (FTSO and State Connector) that bring real-world asset prices and yields on-chain with sub-second finality.

- FAssets that let non-smart-contract assets (XRP, BTC, DOGE, etc.) generate native yield inside Flare DeFi.

When you combine those with Spectra, something magical happens: you can suddenly create fixed-rate products on assets that never had them before.

Want to lock in 8% on your XRP for six months while still holding a liquid token? Soon possible. Want leveraged exposure to Bitcoin validation rewards without running a validator? Also possible.

The Two Faces of Spectra: Fixed-Rate Savings and Yield Speculation

Most people will first touch Spectra through the “Fixed Rate” tab – it’s deliberately designed to feel familiar.

You deposit sFLR, choose a maturity (say 90 days), and receive PT-sFLR trading at a discount. Hold until maturity and you redeem 1:1 for sFLR regardless of how high or low yields went in between. You just locked in today’s implied yield.

Behind the scenes, the counterparty buying your YT is betting yields will rise. If they do, great – their YT becomes more valuable. If yields fall, they lose. Classic zero-sum, but both sides get exactly the exposure they want.

In my experience covering DeFi since 2020, the protocols that win are the ones that let users express a view they already have in their head but couldn’t trade before. Spectra nails that.

Early Pools and Liquidity Reality Check

At launch there’s essentially one main market: sFLR maturing April 2026 with decent but not insane depth (low eight figures TVL within hours – impressive for Flare).

Implied fixed yields opened around 7.2-7.8% depending on maturity, which is actually competitive with many Ethereum money markets right now. That alone should pull capital.

Next in line is stXRP from Firelight, then presumably the Bitcoin and Dogecoin FAssets. Once those drop, the design space explodes.

| Asset | Expected Launch | Unique Angle |

| sFLR | Live now | Baseline Flare staking yield |

| stXRP | Q1 2026 | First non-smart-contract asset with real fixed rates |

| FXRP, FBTC | 2026 | Cross-chain yield trading |

More Than Just Another Pendle Clone

Yes, the mechanics will feel familiar to anyone who used Pendle or Yield Protocol. But Flare’s architecture gives Spectra advantages its predecessors never had.

Transaction costs are basically zero compared to Ethereum mainnet, and finality is instant. That means retail users can actually compound strategies instead of getting eaten alive by gas.

More importantly, Flare’s data layer means oracles aren’t the weak point they usually are. When you trade YT exposure to XRP lending rates, you’re not trusting Chainlink or Pyth – you’re trusting Flare’s decentralised FTSO which has been battle-tested for years.

That reduction in oracle risk alone could bring in institutions who stayed away from earlier yield-trading protocols.

Advanced Strategies Already Being Discussed

The Flare Discord and Telegram groups are already buzzing with ideas I haven’t seen executed cleanly anywhere else:

- Long PT + short YT = synthetic zero-yield stablecoin collateral.

- Long YT + borrow against PT = leveraged real yield farming with defined downside.

- Combine PTs of different maturities into on-chain fixed-income ladders.

- Use YT as collateral in future lending markets (the holy grail).

Some of these will flop, others will become standard building blocks. That’s how mature DeFi ecosystems are born.

Risks and Reality Check

Nothing is free lunch. Smart-contract risk is real – Spectra’s code is new, even if the team has a solid reputation from previous projects.

Liquidity is still thin outside the main sFLR pool, so slippage on large trades will hurt for now. And of course, if Flare itself has issues (unlikely but possible), everything built on it feels the pain.

But compared to the upside? The risk/reward looks surprisingly good for early adopters who do their homework.

The Bigger Picture for Flare

I’ve followed Flare since the airdrop days, and the criticism was always “great tech, but where are the killer apps?”

Spectra is the first protocol that genuinely leverages everything Flare spent years building – the data layer, the FAssets system, the low fees, the speed.

If this takes off (and early indicators say it will), we’re looking at the moment Flare stops being “the chain with the airdrop” and starts being a serious DeFi contender.

Maybe the most exciting part? This is just week one. By mid-2026, fixed-rate XRP, leveraged Bitcoin yield, structured products on Songbird governance tokens – the design space is almost limitless.

Yield tokenization always felt like a “when, not if” primitive. On Flare, the “when” appears to be now.

If you’ve been waiting for a reason to pay attention to Flare again, consider this it.

(All views my own. None of this is financial advice. Always DYOR, especially with brand-new protocols.)