Yesterday felt like one of those days when the market finally remembered how to breathe again.

After a brutal November that saw profit-taking hammer the high-flyers, Tuesday brought a genuine relief rally. The Dow, S&P 500, and Nasdaq all closed in the green—nothing earth-shattering percentage-wise, but enough to remind everyone that bulls haven’t completely left the building. And honestly? It felt good to see green candles again.

What Actually Moved the Needle Yesterday

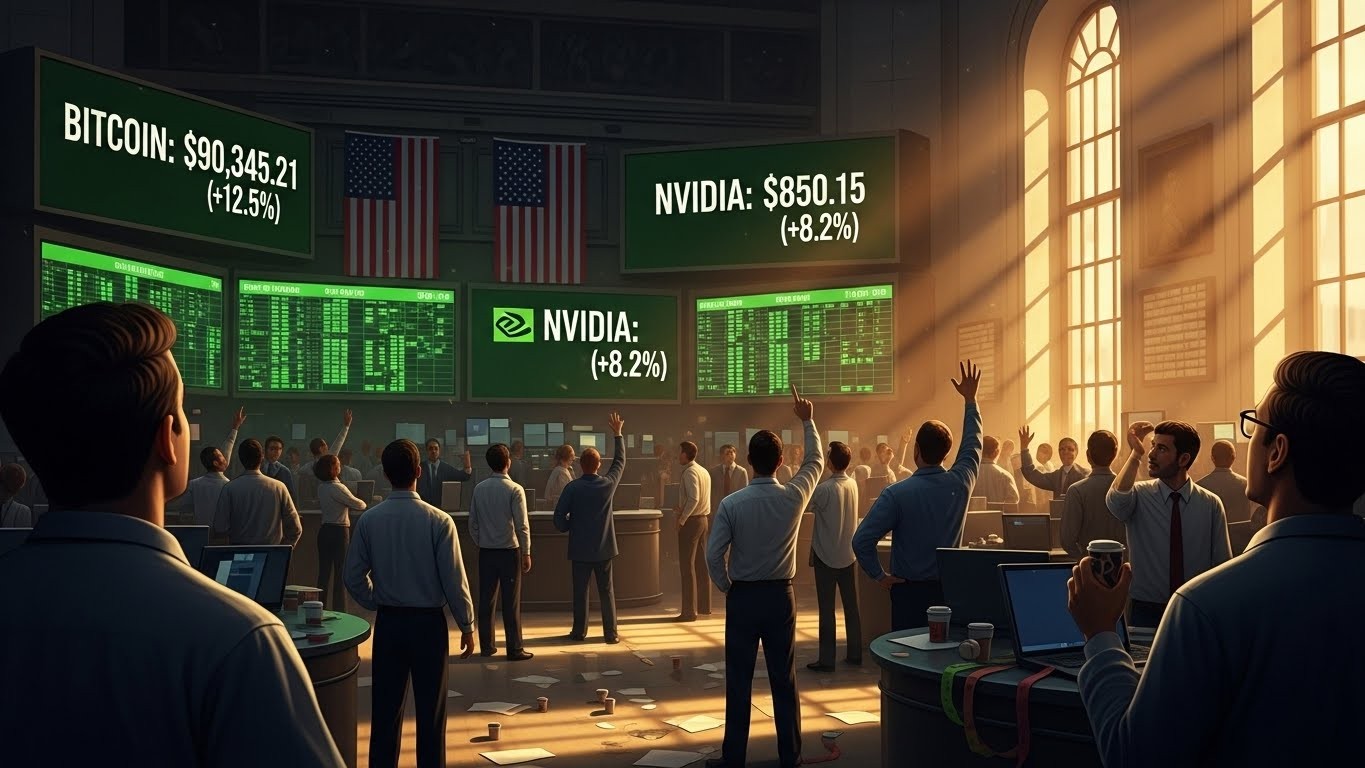

Let’s be real: Bitcoin was the spark.

The world’s biggest cryptocurrency had suffered its ugliest single-day drop since March just 24 hours earlier. Then, almost on cue, it ripped higher Tuesday—enough to drag risk assets along for the ride. When Bitcoin moves 5-8% in a day, Wall Street notices. Crypto exchanges saw massive volume, miners surged, and anything even remotely related to blockchain got a bid.

Tech stocks, especially the AI darlings that got punished last month, used the opportunity to stage a comeback. Nvidia, which had been flirting with correction territory, closed up nicely. That single name still carries so much weight in the indexes that when it catches a bid, everything looks healthier.

“I think AI earnings are going to continue to be strong… We’re going to see more contribution from more beaten-down sectors.”

— Chief equity strategist at a major U.S. bank, speaking on television Tuesday afternoon

I tend to agree. The “AI trade” still feels far from over.

After-Hours Fireworks You Might Have Missed

While most people were switching off their screens, two big earnings reports lit up the board.

Marvell Technology absolutely crushed third-quarter numbers. Revenue and earnings sailed past even the most optimistic Wall Street guesses, and guidance was strong. The stock rocketed more than 15% in after-hours trading. If you’re looking for confirmation that the semiconductor cycle is alive and well, this was it.

Meanwhile, American Eagle Outfitters surprised to the upside too. Management said the holiday shopping season is off to a “strong start,” and they raised full-year guidance. Shares jumped over 10% after the bell. Retail has been a graveyard for months, so any whiff of consumer strength gets attention fast.

Suddenly, the narrative flipped from “everything is overvalued” to “maybe the economy isn’t falling apart after all.”

Futures Tonight: The Calm After the Storm?

As I write this Tuesday night, Dow futures are up a measly 18 points. S&P and Nasdaq futures are basically flat. Classic post-rally digestion.

The market is waiting for the next catalyst, and we’ve got a big one tomorrow morning: the ADP private payrolls report at 8:15 a.m. ET. Everyone knows Friday’s official jobs report is the main event, but ADP has been a habit of setting the tone. A solid number keeps the “soft landing” story alive. Anything too hot or too cold could shake confidence ahead of the Fed meeting.

December Rally Odds Just Went Up

Here’s what a lot of traders are thinking about right now: December is historically the strongest month for U.S. stocks. Combine that with November’s sharp pullback in many growth names, and you’ve got the ingredients for a classic year-end melt-up.

Add in the fact that markets are now pricing an almost 90% chance of a Federal Reserve rate cut on December 18th—way up from just a couple of weeks ago—and risk appetite is returning.

- Bitcoin showing signs of life again

- Tech and semiconductors leading

- Retail showing early holiday strength

- Fed almost certain to cut rates this month

- Seasonal tailwinds kicking in

When you stack all of that together, it’s hard not to at least respect the bull case.

Risks That Could Derail Everything

Of course, it’s never that simple.

Valuations are still stretched in many corners—especially the mega-cap tech space. One bad AI-related earnings report in January could trigger another wave of profit-taking. Geopolitical headlines remain noisy. And if Friday’s jobs report comes in way too hot, the Fed might decide to stand pat, crushing the rate-cut trade.

Then there’s the elephant in the room: positioning. A lot of hedge funds went into November very long growth and crypto. The pullback forced some de-grossing. If everyone is now rushing back in at the same time, we could see violent two-way action.

What I’m Watching This Week

Short version:

- ADP tomorrow morning – does private payroll growth stay in the 100-150k sweet spot?

- Bitcoin holding above $85k – if it cracks, risk-off could return fast

- Semiconductor stocks (Marvell follow-through, Broadcom later this week)

- Any signs of rotation into small-caps and value – the “everything rally” we’ve been waiting for

- VIX staying under 15 – low volatility = green light for bulls

If most of those boxes get checked, I think we’re looking at S&P 500 testing all-time highs before New Year’s Eve.

Look, I’ve been doing this long enough to know that December can deliver some of the most violent moves of the entire year—both directions. But right now, the path of least resistance feels higher. The Bitcoin bounce gave the market the excuse it needed, and the fundamentals (earnings, Fed cuts, seasonality) are lining up.

Will it be a straight line? Absolutely not. But after the beating many portfolios took in November, a nice year-end rally would feel pretty sweet.

Stay nimble, keep an eye on those key levels, and maybe—just maybe—we’re about to close 2025 on a very high note.

Disclosure: The author holds long positions in Bitcoin and select technology stocks at the time of writing.