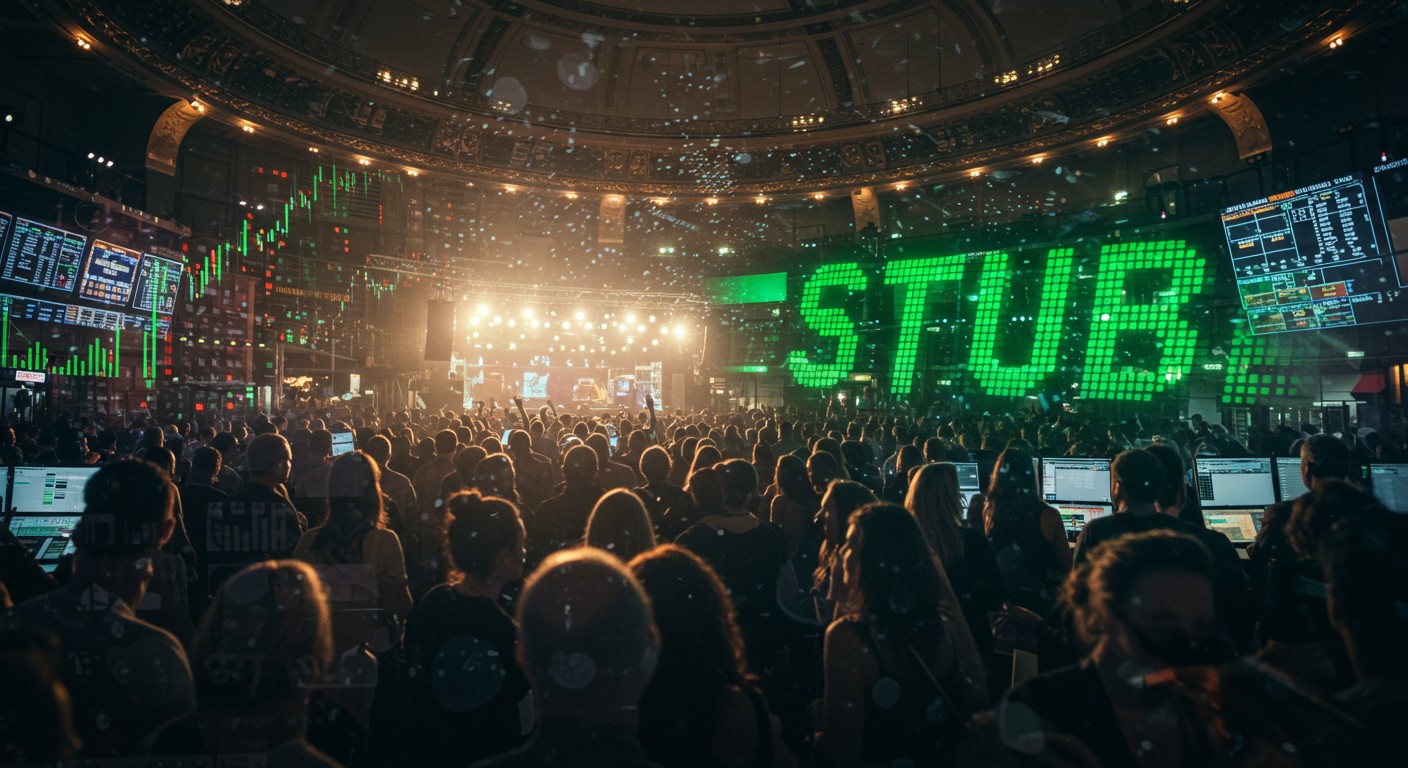

Have you ever wondered what it takes for a company to go from selling concert tickets to making waves on the stock market? The journey of StubHub, a giant in the ticketing world, is a fascinating case study. After hitting pause on its plans earlier this year, the company is now gearing up for a much-anticipated initial public offering (IPO) in September. I’ve always found the intersection of entertainment and finance intriguing—it’s like watching a rock concert and a Wall Street trading floor collide. Let’s dive into what this means for investors, the ticketing industry, and the broader market.

The Comeback of StubHub’s IPO

StubHub’s path to going public has been anything but straightforward. The company, a household name for buying and selling tickets to concerts, sports events, and theater, recently updated its IPO prospectus, signaling a fresh start after a delay in April. The pause came amid market turbulence caused by unexpected economic policies, but now, with clearer skies, StubHub is ready to take the stage again. According to industry insiders, the company is planning a roadshow after Labor Day, with its public debut expected later in September on the New York Stock Exchange under the ticker STUB.

What’s driving this renewed push? For one, the IPO market has been heating up lately. After a sluggish period marked by high inflation and rising interest rates, recent months have seen a flurry of companies—like rocket makers and AI infrastructure providers—taking the plunge. StubHub’s decision to move forward now suggests confidence in both its business model and the market’s appetite for new offerings. But what makes this ticketing titan’s IPO so compelling?

A Look at StubHub’s Financial Performance

Numbers tell a story, and StubHub’s financials are no exception. In its latest filing, the company reported a 10% revenue increase in the first quarter, reaching $397.6 million compared to the previous year. That’s a solid jump, though it’s worth noting that growth in gross merchandise sales (GMS)—the total value of tickets sold—slowed to 15% from a whopping 47% in the prior quarter. Operating income also turned positive at $26.8 million, a stark improvement from a loss the year before. However, the company still posted a net loss of $35.9 million, up slightly from $29.7 million a year ago.

“Strong revenue growth in a competitive market shows resilience, but investors should keep an eye on profitability trends,” says a financial analyst.

These figures paint a picture of a company with strong sales but lingering challenges in turning a consistent profit. The ticketing business is seasonal, with major concert tours often driving sales toward year-end. This could explain the GMS slowdown, but it also highlights the importance of timing for StubHub’s IPO. Investors will likely scrutinize these numbers closely during the roadshow.

The Competitive Landscape: A Crowded Stage

The ticketing industry is a tough crowd. StubHub faces stiff competition from giants like Ticketmaster, owned by Live Nation, as well as other secondary market players like Vivid Seats and SeatGeek. Each of these platforms is vying for a slice of the secondary ticketing market, where fans resell tickets for events. It’s a bit like a high-stakes game of musical chairs—everyone’s scrambling for the best seat.

- Ticketmaster: Dominates primary ticket sales but also competes in the secondary market.

- Vivid Seats: A key rival in the resale space, known for its user-friendly platform.

- SeatGeek: Gaining traction with innovative features and partnerships.

Despite the competition, StubHub has carved out a strong niche. Its brand recognition and global reach—bolstered by its acquisition by Viagogo in 2020 for $4 billion—give it an edge. But the question remains: can it maintain that edge as a public company under the scrutiny of shareholders?

Why Now? Timing the IPO Market

The decision to relaunch the IPO comes at a pivotal moment. The market has been on a rollercoaster, with economic policies like tariffs shaking things up earlier this year. Yet, recent months have shown signs of stabilization, with several high-profile companies successfully going public. Perhaps the most interesting aspect is how StubHub is positioning itself in this window of opportunity.

I’ve always believed timing is everything in finance, much like catching the perfect wave in surfing. StubHub’s move suggests it’s ready to ride the current market momentum. But there’s a catch—investors are becoming more selective, favoring companies with clear paths to profitability. StubHub’s mixed financials could be a double-edged sword.

| Metric | Q1 2025 | Q1 2024 |

| Revenue | $397.6M | $361.5M |

| Operating Income | $26.8M | -$0.9M |

| Net Loss | $35.9M | $29.7M |

| Gross Merchandise Sales | $2.08B | $1.81B |

This table highlights StubHub’s growth but also its challenges. The company’s ability to showcase a compelling growth story during its roadshow will be critical.

What Investors Should Watch For

For those eyeing StubHub as an investment, there are a few key areas to focus on. First, the company’s valuation—previously pegged at $16.5 billion—will be a hot topic. Will it hold up in a market that’s increasingly cautious? Second, competition remains a wildcard. The ticketing industry is not only crowded but also subject to regulatory scrutiny, especially for giants like Ticketmaster.

“Investors should look at StubHub’s ability to innovate in a competitive market while navigating economic uncertainties,” notes a market strategist.

Finally, StubHub’s seasonal sales patterns could influence its stock performance post-IPO. The company thrives on big events, but any slowdown in the live entertainment industry could ripple through its financials. It’s a bit like betting on a festival lineup—you hope for headliners but can’t predict the weather.

The Bigger Picture: What StubHub’s IPO Means

StubHub’s IPO isn’t just about one company—it’s a signal of where the live entertainment industry and the broader market are headed. The resurgence of IPOs reflects growing investor confidence, but it also underscores the need for companies to deliver consistent results. For StubHub, going public could provide the capital needed to expand its global footprint and innovate in a cutthroat industry.

- Market Confidence: A successful IPO could boost sentiment for other tech and entertainment companies.

- Innovation Push: Public funding might fuel new features or partnerships for StubHub.

- Industry Trends: The ticketing market’s growth reflects a rebound in live events post-pandemic.

In my experience, companies that go public at the right time can set the tone for their industry. StubHub’s move could inspire other players in the ticketing space to follow suit, creating a ripple effect across the market.

A Brief History of StubHub’s Journey

StubHub’s story is one of reinvention. Launched in 2000, it quickly became a go-to platform for ticket resales. Its acquisition by eBay in 2007 for $310 million marked a turning point, but the real game-changer came in 2020 when co-founder Eric Baker bought it back through Viagogo for $4 billion. That move set the stage for its current push to go public.

It’s almost poetic how StubHub has come full circle. From a startup to an eBay subsidiary, and now a standalone giant, the company has navigated choppy waters to reach this moment. Its IPO will test whether it can keep the spotlight in a crowded market.

What’s Next for StubHub?

As StubHub prepares for its IPO, the road ahead is both exciting and uncertain. The company’s ability to balance growth, profitability, and innovation will determine its success as a public entity. For investors, it’s an opportunity to bet on a brand that’s synonymous with live events but comes with its share of risks.

Will StubHub’s IPO be a blockbuster like a sold-out concert, or will it face the challenges of an oversaturated market? Only time will tell, but one thing’s clear: this is a story worth watching. Whether you’re an investor, a concertgoer, or just curious about the intersection of entertainment and finance, StubHub’s public debut is a moment to mark on your calendar.

The ticketing industry is evolving, and StubHub is at the forefront. As it steps onto the public stage, it’s not just selling tickets—it’s selling a vision of growth, resilience, and opportunity. Let’s see if the market buys it.