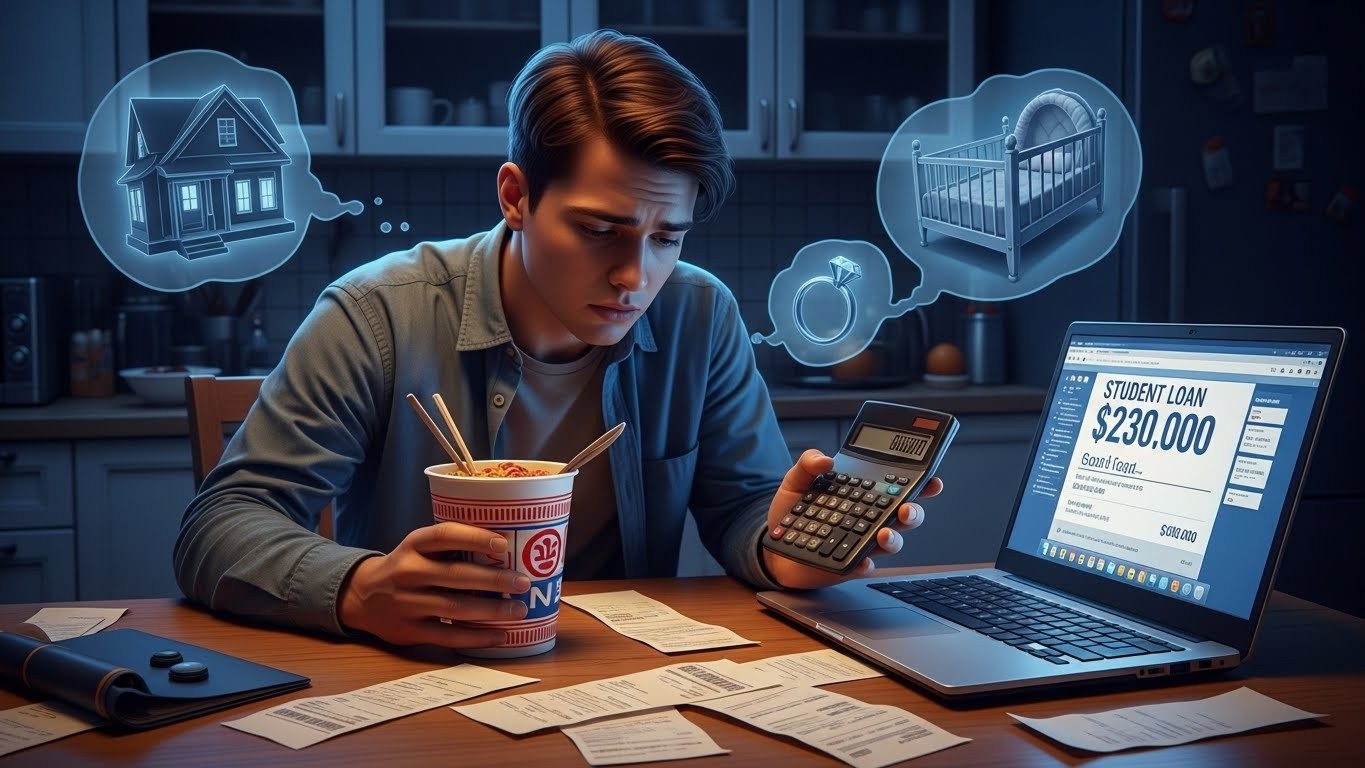

Imagine working your tail off for a degree that was supposed to open doors—only to spend the next decade deciding whether to pay the loan or buy groceries.

Sounds dramatic, right? Except for millions of Americans right now, it’s Tuesday night.

A brand-new survey just dropped numbers that should make everyone stop scrolling for a second. More than four in ten people with federal student loans say their monthly payment is the very thing pushing them to skip meals, delay doctor visits, or keep renting forever because homeownership feels like a fairy tale.

The Hidden Cost of “Investing in Yourself”

We were sold a story: get the degree, get the good job, live the good life. What nobody put in the fine print was that the bill might actually make the good life impossible.

Here’s what the latest research found when they asked over a thousand borrowers how their education debt is really hitting them:

- 42% say it’s harder to cover basic needs like food and housing

- 37% struggle more with medical bills and healthcare

- 52% have cut back on retirement savings

- 30% have delayed marriage or having kids because of the debt

Let that last one sink in for a minute. People are literally putting their future families on hold because of a loan they took out to build that future in the first place.

When “Highly Educated” Means Choosing Between Groceries and Repayment

I’ve spoken with doctors, lawyers, teachers—people who did everything “right”—and they still whisper the same thing: “I never thought I’d be here.”

One borrower told a consumer assistance program director that the food budget is always the first to get slashed. You can only cut ramen and rice so far before you’re just… hungry.

“Highly educated individuals are budgeting in ways they never imagined just to survive.”

– Director of a major borrower assistance program

And it’s not just anecdotes. The average federal student loan balance has ballooned to around $39,000 today—compared to $29,000 a decade ago and $18,000 back in 2007. Payments that used to feel manageable now eat 15-25% of take-home pay for many.

The Retirement Dream That Keeps Getting Postponed

More than half of borrowers say they’ve saved less for retirement because every extra dollar goes to the loan servicer.

Think about that compounding in reverse. Every month you send $400 to loans instead of investments is thousands—maybe tens of thousands—missing from your future self’s nest egg.

In my experience talking to people in their 30s and 40s, the regret isn’t about getting the degree. It’s about realizing at 38 that retirement feels further away than it did at 22.

Healthcare: The Expense Nobody Plans For

Thirty-seven percent of borrowers say medical care became harder to afford because of loan payments.

That means skipping the dentist, putting off therapy, ignoring that weird pain because the deductible feels impossible. We’re not talking about elective procedures—we’re talking basic health maintenance.

And when you finally do need care? You’re starting from a worse financial position because years of high loan payments left no emergency fund.

Love, Marriage, and Baby Carriages… on Hold

Nearly one in three borrowers say student debt has negatively impacted their plans to get married or start a family.

I’ve seen couples delay weddings because one partner’s $800 monthly payment would make any realistic budget implode. Others decide one income just can’t support kids when hundreds are already spoken for.

“In exchange for trying to better their future, many now face a monthly choice between making their student loan payment or buying groceries, avoiding eviction or getting critical medical care.”

It’s hard to feel romantic when your joint bank account has a $1,200 student loan auto-draft every first of the month.

Why 2025 Feels Different (and Scarier)

Here’s the part that keeps experts up at night: the safety nets are shrinking at the exact moment people need them most.

Previous administrations created affordable repayment plans tied to income and even paths to forgiveness. Many of those programs are being phased out or blocked in court.

- Unemployment deferments are disappearing for many

- New repayment plan applications are stuck in limbo

- Forgiveness timelines keep getting pushed back

Add a cooling job market—especially brutal for recent graduates—and you have a perfect storm. Over 40% of new grads are underemployed, meaning they’re working jobs that don’t even require the degree they’re drowning to pay for.

Default numbers are already climbing past 5 million, and some projections say we could hit 10 million soon. That’s not just a credit score killer—that’s wage garnishment, tax refund seizure, and zero path to building wealth.

What Can You Actually Do Right Now?

Feeling hopeless isn’t a strategy. Here are realistic moves people are making today:

- Check if you still qualify for remaining income-driven plans (some still exist)

- Look into employer student loan repayment benefits—more companies offer them than ever

- Refinance privately only if you have stable income and good credit (and understand you lose federal protections)

- Build the tiniest emergency fund first—$1,000 can prevent total derailment

- Talk openly with partners about the debt before combining finances

Most importantly: you’re not failing. The system sold you a promise it didn’t keep for millions. Recognizing that is the first step to protecting whatever future you can still build.

The degree opened some doors. The debt just slammed a lot of others. But people are still finding windows—smaller ones, sure, but windows nonetheless.

If you’re carrying this weight, know you’re far from alone. And sometimes just knowing that makes the next payment feel a tiny bit less heavy.