Imagine building a crypto empire from scratch as a high school dropout, only to watch it crumble spectacularly, landing you in a foreign prison with a sentence that defies comprehension. That’s the whirlwind story that ended abruptly for one young entrepreneur in Turkey. His sudden death has sent ripples through the cryptocurrency community, raising questions about justice, mental health, and the high-stakes world of digital assets.

I’ve always been fascinated by these rags-to-riches tales in crypto, but this one hits different. It started with promise and innovation, yet spiraled into chaos that affected hundreds of thousands. Let’s dive deep into what really happened, piecing together the timeline without the hype.

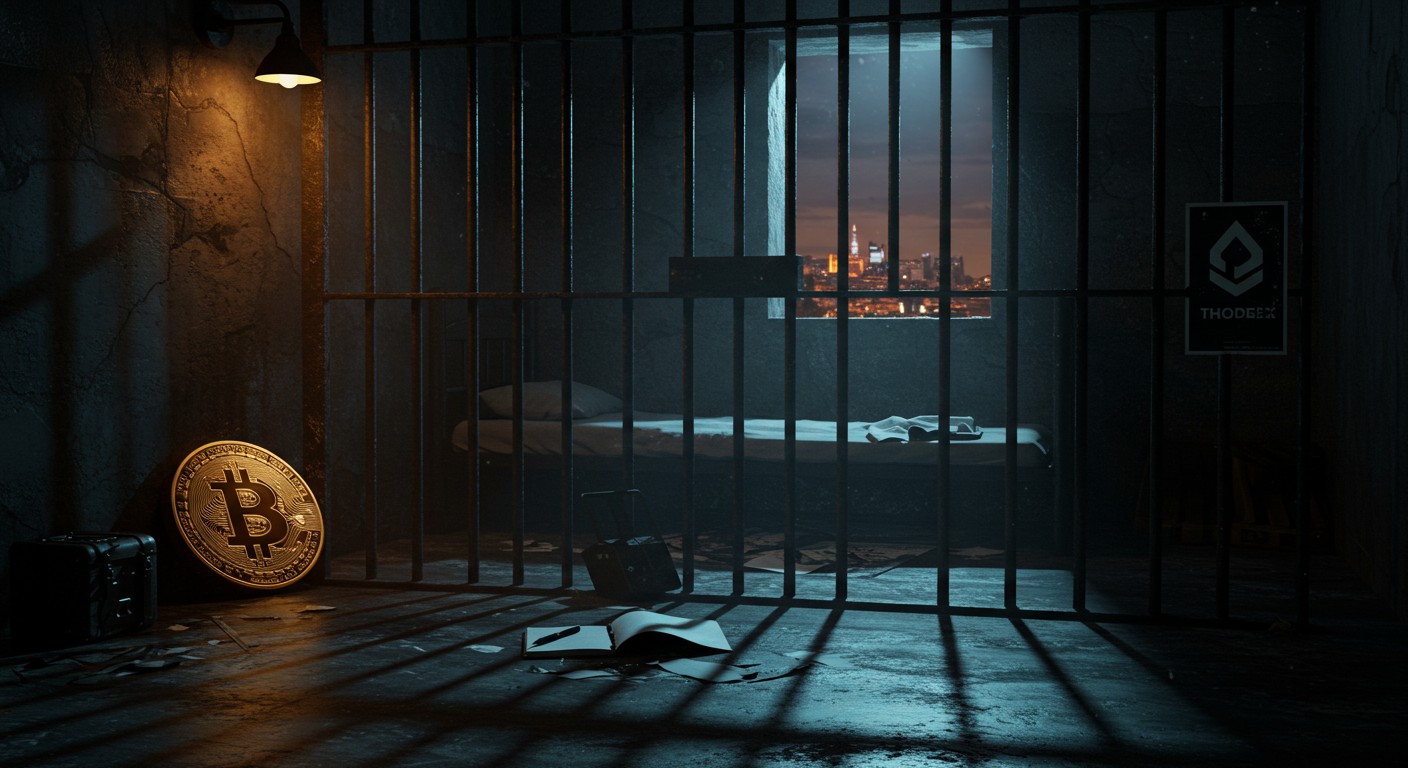

The Shocking Discovery in a Turkish Prison

On a quiet Saturday morning in early November 2025, news broke that shook the crypto world. The founder of a once-prominent Turkish cryptocurrency exchange was found lifeless in his cell. Authorities in the western city of Tekirdag confirmed the incident, sparking an immediate investigation.

At just 31 years old, he was in the prime of life—or so it seemed. But behind those prison walls, the weight of an unimaginable sentence loomed large. Officials quickly pointed to suicide as the leading theory, though details remain scarce. In my view, cases like this highlight how isolation and despair can overwhelm even the most resilient minds.

The prison, known for housing high-profile inmates, now becomes the final chapter in a saga that began nearly a decade earlier. How did a platform serving almost 400,000 users end up here? It all traces back to ambition meeting opportunity in Turkey’s booming crypto scene.

From High School Dropout to Crypto Pioneer

Picture this: a teenager in Istanbul, skipping traditional paths to chase the digital gold rush. In 2017, he launched what would become one of Turkey’s leading crypto platforms. No fancy degree, just raw drive and a knack for spotting trends.

The exchange stood out right away. It was the only one in the country offering Bitcoin ATM services at the time. Users flocked in, drawn by ease and innovation. By 2021, it boasted between 390,000 and 400,000 active accounts—a massive user base in a nation hungry for alternative investments.

Growth wasn’t accidental. Marketing played a huge role, with promotions that tapped into meme coin mania. But perhaps the most interesting aspect is how quickly things scaled. From a startup to a household name in crypto circles, all in under four years.

Success in crypto often comes fast, but so does the fall when trust erodes.

– Crypto industry observer

I’ve seen similar stories, where early wins blind founders to risks. Here, the platform’s unique features like ATMs gave it an edge, but sustainability? That was another story.

The Final Promotion That Signaled Trouble

Timing is everything in crypto, and this campaign couldn’t have been more ironically placed. From mid-March to mid-April 2021, the exchange ran a giveaway offering free Dogecoin to new sign-ups. Around four million tokens changed hands, coinciding with “Dogeday” on April 20.

Dogecoin’s price jumped 20% that day, fueling excitement. Users poured in, deposits flowed. But then, glitches started. Transactions slowed, then stopped. The platform blamed a cyberattack— a common excuse in the industry, but one that raised eyebrows.

- March 15–April 15: Aggressive promo period

- April 20: Peak of Dogecoin hype and initial disruptions

- April 21: Complete trading halt and account lockouts

Overnight, what seemed like a thriving business turned into a nightmare for investors. People couldn’t withdraw funds, panic spread on social media. Estimates of losses varied wildly, from modest figures to billions. Blockchain experts later pegged it at around $2.6 billion in missing assets.

In my experience following exchange failures, these promos often mask liquidity issues. Was this a desperate bid to attract fresh capital? The evidence suggests yes.

The Great Escape and International Manhunt

As chaos unfolded, the founder vanished. He fled to Albania, leaving users in limbo. An international arrest warrant followed swiftly in April 2021. For over a year, he evaded capture, living under the radar in a Balkan hideout.

Albanian authorities finally nabbed him in August 2022. Extradition proceedings dragged on, but by April 2023, he was back in Turkey, facing the music. Police detained him immediately upon arrival—no fanfare, just handcuffs and a transfer to pretrial detention.

This cat-and-mouse game captivated global media. It wasn’t just about one man; it symbolized broader issues in unregulated crypto spaces. How do you track someone across borders when assets are digital and anonymous?

Fleeing with user funds is the ultimate betrayal in this trust-based ecosystem.

Personally, I think these pursuits expose weaknesses in international cooperation. Crypto moves fast; law enforcement often lags.

The Trial and Historic Sentence

September 2023 marked the climax in an Istanbul courtroom. Charges piled up: aggravated fraud, heading a criminal group, money laundering. Prosecutors painted a picture of systematic deception.

The verdict? Guilty on all counts. The sentence—11,196 years, 10 months, and 15 days—sounds absurd, almost comical. But in Turkish law, it’s a symbolic stack for multiple offenses. Plus a fine of 135 million liras, roughly millions in USD at the time.

| Charge | Details |

| Aggravated Fraud | Defrauding users of billions |

| Criminal Organization | Leading a structured group |

| Money Laundering | Concealing illicit proceeds |

Critics argue such sentences are performative, not practical. What purpose does a millennia-long term serve? It deters, sure, but at what cost to the justice system?

From the bench, the message was clear: Crypto fraud won’t be tolerated. Yet, for victims, recovery remains elusive. Most funds vanished into the ether.

Dissecting the Collapse: What Went Wrong?

Exchange failures aren’t new—think Mt. Gox or FTX—but this one had unique flavors. Turkey’s economic turmoil played a backdrop. High inflation drove citizens to crypto as a hedge against the lira’s plunge.

The platform capitalized on that desperation. But internal controls? Apparently lacking. No audits, opaque operations. When withdrawals surged post-promo, liquidity dried up.

- Rapid user growth outpaced infrastructure

- Promotions attracted deposits without backing

- Alleged misuse of funds for personal gain

- Sudden halt exposed the house of cards

Blockchain analytics painted a grim picture. Funds moved to untraceable wallets, some cashed out abroad. It’s a reminder: In crypto, possession is nine-tenths of the law, until it’s not.

Perhaps the most poignant lesson is trust. Users handed over life savings based on slick marketing. Due diligence? Often an afterthought in bull markets.

Victim Impact: Stories Behind the Numbers

Behind every statistic is a human story. One user, a retiree, lost his entire pension. Another, a young family, dipped into savings for what they thought was a safe bet.

Media reports highlighted suicides linked to the stress—tragic echoes of the founder’s own end. Support groups formed online, sharing tales of dashed dreams.

Loss estimates fluctuated: Prosecutors said $24 million initially, media up to $2 billion, experts $2.6 billion. Whatever the figure, it devastated lives. Recovery efforts? Minimal, with assets scattered globally.

The real cost of crypto fraud isn’t just financial—it’s emotional wreckage.

In my opinion, regulators need better tools. Victim compensation funds, like in traditional finance, could help. But crypto’s decentralized nature complicates everything.

Broader Implications for the Crypto Industry

This isn’t isolated. Exchange collapses erode confidence, scare off institutions. Turkey tightened rules post-incident, banning crypto payments earlier but now eyeing stricter oversight.

Globally, it fuels calls for regulation. KYC, audits, insurance—basics that seem obvious now. Yet innovation thrives in gray areas; balance is key.

I’ve found that mature markets self-regulate eventually. But pain points like this accelerate change. Will we see more centralized exchanges with proof-of-reserves?

- Increased scrutiny on promotions and giveaways

- Demand for transparent liquidity reporting

- Push for international anti-fraud cooperation

- Focus on mental health for industry leaders

The irony? Crypto promises freedom from traditional banks, yet failures mimic their worst crises.

The Suicide Theory: Questions Linger

Officials lean toward suicide, but investigations continue. Prison conditions, sentence weight, isolation—factors that could break anyone.

At 31, with life ahead—or so outsiders think—the decision baffles. Was it remorse? Despair? Or something else? Conspiracy theories swirl online, though evidence points inward.

Mental health in high-stakes fields gets overlooked. Crypto’s volatility stresses everyone; founders bear the brunt.

A rhetorical question: How many more tragedies before support systems improve?

Lessons for Aspiring Crypto Entrepreneurs

If you’re building in this space, heed the warnings. Transparency isn’t optional; it’s survival.

Start small, scale responsibly. Implement checks early. And remember: Users’ money isn’t yours to gamble.

Key Takeaways for Founders: - Prioritize audits and reserves - Avoid overpromising in marketing - Build ethical foundations from day one - Prepare for worst-case scenarios

Success stories abound, but failures teach more. This one, tragically, underscores the human cost.

The Future of Crypto in Turkey Post-Tragedy

Turkey’s crypto scene rebounds slowly. New exchanges emerge with stricter compliance. Users wiser, demanding proof.

Government explores CBDCs, balancing innovation and control. This death might catalyze positive change.

Or it could scare talent away. Time will tell. For now, the industry mourns and reflects.

Wrapping up, this tale mixes ambition, greed, and sorrow. It reminds us crypto’s still wild west territory. Proceed with caution, eyes wide open.

What do you think—could better regulations have prevented this? Or is risk inherent? The conversation continues.

(Word count: approximately 3200)