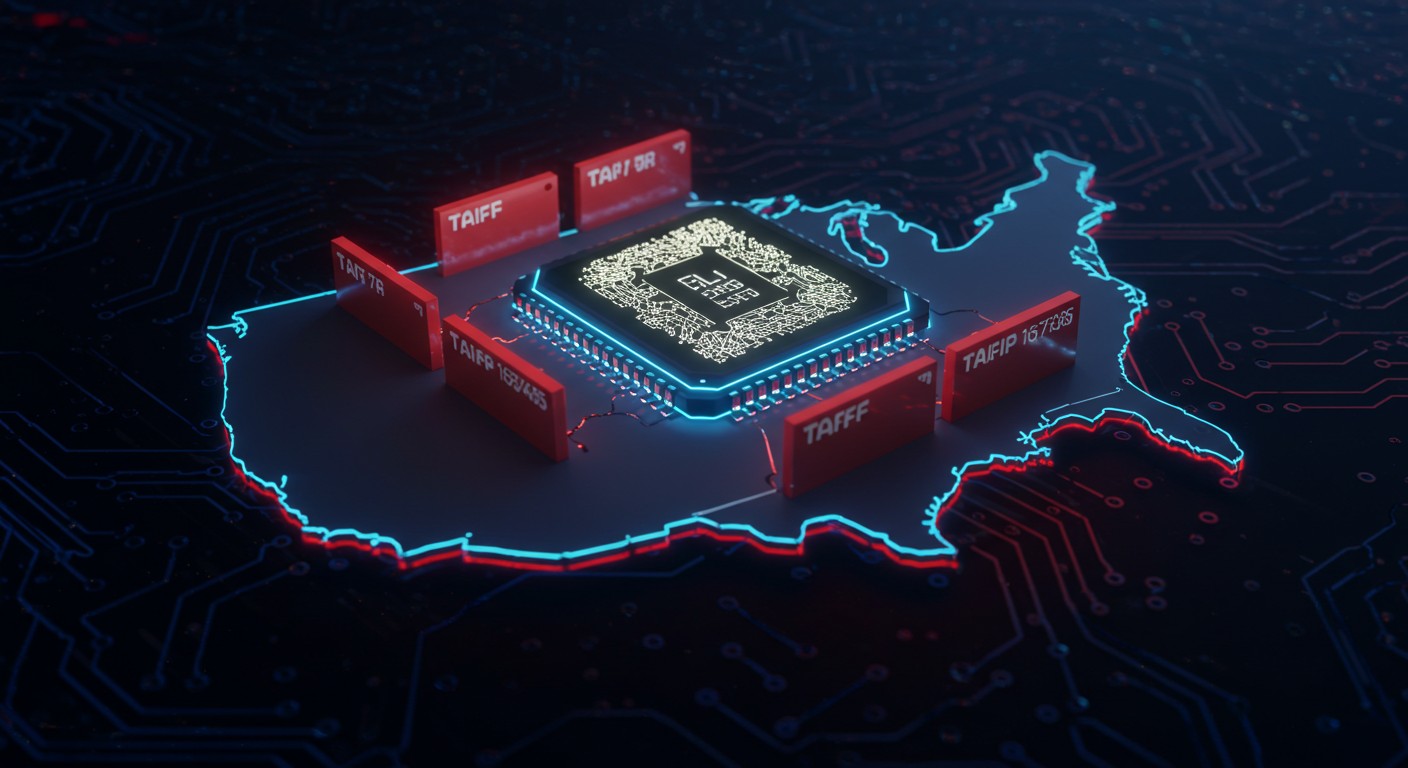

Have you ever wondered what happens when a single policy announcement sends ripples through an industry worth over $600 billion? That’s exactly what’s unfolding with the latest buzz around U.S. trade policy and semiconductors. The tech world is holding its breath, and for good reason—chips power everything from your smartphone to the cloud driving AI breakthroughs. Yet, the details of this bold move remain frustratingly vague, leaving analysts, investors, and tech enthusiasts scrambling for clarity.

Navigating the Semiconductor Tariff Storm

The semiconductor industry is no stranger to turbulence, but the latest trade policy announcement has turned heads. A proposed 100% tariff on imported chips could reshape global supply chains, but the devil’s in the details—or, in this case, the lack thereof. The promise of exemptions for companies investing in U.S.-based manufacturing adds a layer of intrigue, but what does it really mean? Let’s dive into the questions swirling around this high-stakes policy and what it could mean for the tech world.

What’s the Deal with the Tariff Plan?

The core of the proposal is a 100% tariff on semiconductor imports, a move designed to push companies toward domestic production. But there’s a catch: firms “building in the United States” might dodge this hefty tax. It’s a classic carrot-and-stick approach, but the fine print is missing. How much U.S. investment qualifies for an exemption? Is it a single factory or a full-blown supply chain? The uncertainty is keeping industry insiders on edge.

The lack of clear guidelines is like trying to navigate a maze in the dark. Companies need specifics to plan their next move.

– Tech industry analyst

Without concrete details, it’s tough to predict the full impact. The semiconductor market, valued at over $600 billion, isn’t just about chips—it’s the backbone of modern tech, from AI to electric vehicles. A misstep here could ripple across global economies, affecting everything from consumer prices to innovation timelines.

Who Gets a Free Pass?

One of the biggest questions is who qualifies for the tariff exemption. Major players like TSMC and Samsung, who’ve already poured billions into U.S. factories, seem like safe bets. For instance, TSMC’s commitment to $165 billion in U.S. investments could position it favorably. Smaller companies, however, might not have the cash to build stateside, potentially leaving them stuck with the tariff’s full weight.

In my view, this could tilt the playing field toward industry giants, consolidating their grip on the market. Smaller firms, already stretched thin, might struggle to compete if they’re hit with a 100% import tax. It’s a high-stakes game where the big dogs might come out on top.

- Major players: Companies like TSMC and Samsung, with existing U.S. investments, are likely to secure exemptions.

- Smaller firms: Those without U.S. facilities could face crippling tariffs, squeezing their margins.

- Market impact: Consolidation could favor large-cap stocks, leaving smaller players vulnerable.

Interestingly, shares of TSMC and Samsung ticked up after the announcement, suggesting investors are betting on their exemption status. But for every winner, there’s a potential loser waiting in the wings.

The Supply Chain Puzzle

Semiconductors aren’t just standalone products—they’re part of a complex, interconnected supply chain. Chips often travel across borders multiple times before ending up in your laptop or car. For example, a U.S. company might design a chip, send it to Taiwan for manufacturing, and then import it back. Would that chip face the tariff, even if the manufacturer has U.S. facilities? Nobody’s quite sure.

The global chip supply chain is like a spiderweb—pull one thread, and the whole thing shakes.

– Supply chain expert

This complexity raises more questions than answers. Are tariffs limited to raw semiconductors, or do they extend to finished products like smartphones? What about the equipment used to make chips? The lack of clarity could lead to unintended consequences, like higher costs for consumers or delays in tech rollouts.

Big Tech and AI in the Crosshairs

Cloud giants like Amazon and Google, which rely heavily on semiconductors for their AI infrastructure, could feel the pinch if tariffs disrupt supply chains. These companies are central to the U.S.’s push for AI dominance, making the stakes even higher. A recent report estimated that semiconductors drive $7 trillion in global economic activity annually, largely through applications like AI and big data.

Perhaps the most intriguing angle is how this policy might accelerate domestic production. Some companies are already moving in that direction—take Apple, for instance, which recently announced it will source chips from a Texas plant. This could signal a broader trend of tech giants reshoring their supply chains to avoid tariffs. But at what cost? Building factories isn’t cheap, and those expenses could trickle down to consumers.

| Company Type | U.S. Investment Status | Likely Tariff Impact |

| Major Manufacturers | Significant U.S. facilities | Low (likely exempt) |

| Small Manufacturers | Limited or no U.S. presence | High (full tariff risk) |

| Tech Consumers | Relies on imported chips | Medium (cost pass-through) |

Global Trade Ripples

The global nature of the semiconductor industry means tariffs could have far-reaching effects. Countries like South Korea and Taiwan, home to chip giants like Samsung and TSMC, are watching closely. If exemptions are granted generously, these countries might breathe easier. But a stricter policy could spark trade tensions or even retaliatory tariffs, complicating an already delicate global market.

I can’t help but wonder if this move is less about economics and more about flexing geopolitical muscle. The U.S. has been vocal about reducing reliance on foreign tech, especially for critical industries like AI. Tariffs could be a blunt tool to achieve that, but they risk alienating allies and driving up costs at home.

- Domestic push: Encourages U.S. manufacturing but at a high cost.

- Global tension: Risks trade disputes with key partners like Taiwan and South Korea.

- Consumer impact: Higher costs could hit electronics prices, from phones to cars.

What’s Next for Investors?

For investors, the tariff talk is a mixed bag. Stocks of major chipmakers with U.S. investments, like TSMC and Samsung, could see a boost if exemptions are confirmed. But smaller players or companies reliant on imported chips might take a hit. The uncertainty makes it a tricky time to place bets in the semiconductor space.

Here’s my take: keep an eye on the fine print. Once the policy details drop, the market will react fast. For now, diversification might be the safest play—spreading investments across big players and emerging tech firms could hedge against the unknowns.

Investors hate uncertainty, but they love opportunity. This tariff plan is both.

– Financial strategist

The Bigger Picture

At its core, this tariff plan is about more than just chips—it’s about reshaping the global tech landscape. The push for domestic manufacturing aligns with broader goals of economic independence and technological leadership. But the road to get there is fraught with challenges, from supply chain snarls to geopolitical pushback.

What strikes me most is the balancing act. On one hand, incentivizing U.S. production could spark innovation and job growth. On the other, misjudging the policy’s scope could disrupt a delicate ecosystem, leaving consumers and businesses to bear the cost. It’s like walking a tightrope over a canyon—exciting, but one wrong step could be costly.

As the tech world waits for more details, one thing is clear: the semiconductor industry is at a crossroads. Whether this tariff plan becomes a catalyst for growth or a stumbling block depends on how the policy takes shape. For now, all eyes are on the next move—and the answers it might bring.