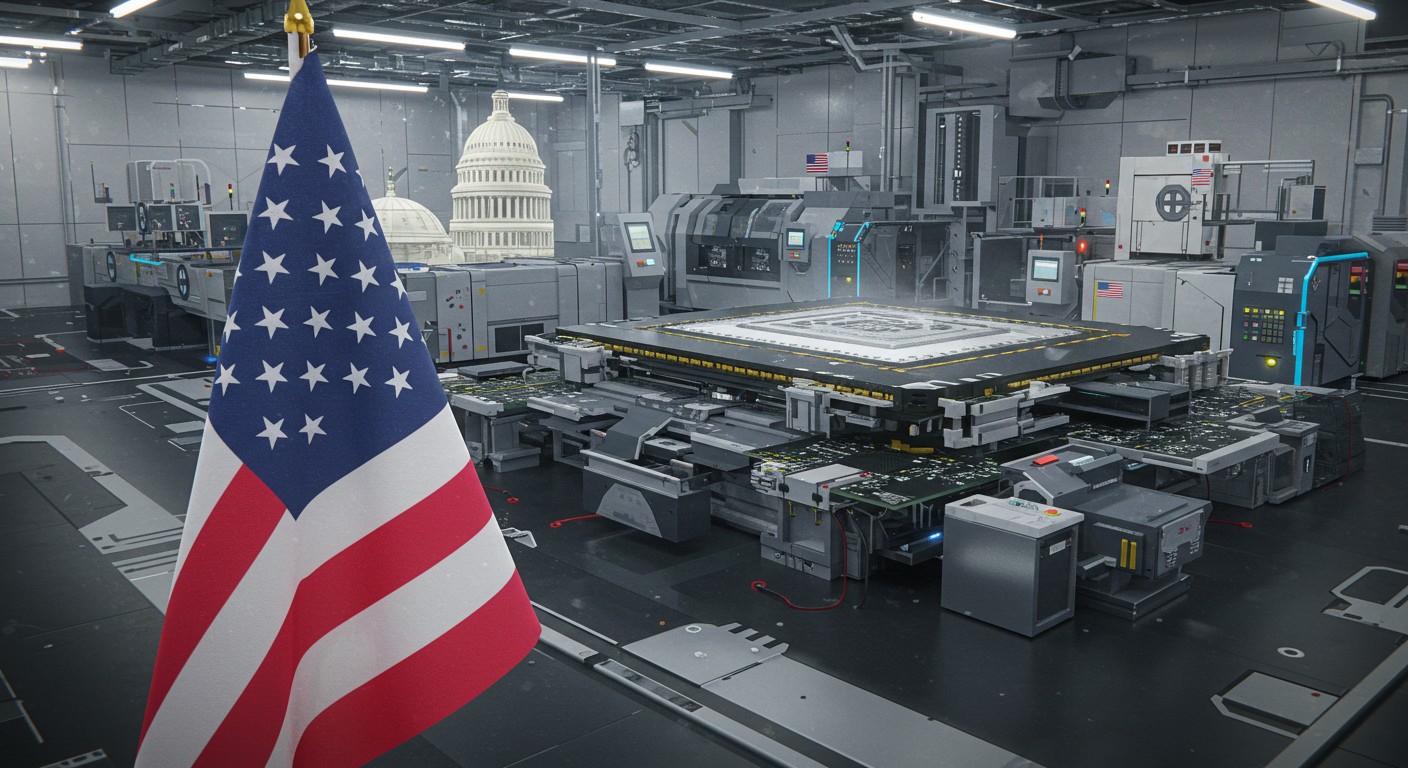

Imagine a world where the U.S. government isn’t just regulating tech giants but actually owning a piece of them. Sounds like something out of a sci-fi novel, right? Yet, here we are in 2025, with President Donald Trump announcing a groundbreaking deal that hands the U.S. government a 10% stake in Intel, one of America’s most iconic chipmakers. This isn’t just a headline—it’s a seismic shift that could redefine the tech landscape, spark debates about government overreach, and reshape investor confidence. Let’s dive into what this deal means, why it’s happening, and whether it’s a stroke of genius or a risky gamble.

A Bold Move in the Chip Wars

The tech world is buzzing after Trump’s announcement that Intel has agreed to give the U.S. government a 10% equity stake. This isn’t a small deal—valued at roughly $10 billion based on Intel’s current market cap, it’s a rare and bold intervention in corporate America. I’ve always thought the government’s role in business should be minimal, but this move feels like a calculated play in a high-stakes game. With global chip shortages and geopolitical tensions, especially with China, securing a foothold in a key player like Intel could be a masterstroke for national security.

It’s a great opportunity to help revive a company that’s fallen behind its competitors.

– U.S. President, August 2025

The deal, set to be formalized at a White House event, stems from negotiations involving the CHIPS and Science Act, a 2022 law designed to boost domestic semiconductor production. Instead of doling out grants, the administration is converting some of Intel’s $10.9 billion in allocated funds into equity. This isn’t just about money—it’s about influence. By owning a chunk of Intel, the government gains a seat at the table in one of the most critical industries of our time.

Why Intel? The Struggles of a Tech Titan

Intel, once the king of chipmakers, has had a rough decade. The company missed the mobile computing revolution sparked by the iPhone and has struggled to keep pace in the artificial intelligence boom, where rivals like Nvidia and AMD are eating its lunch. In 2024, Intel posted a staggering $18.8 billion loss—its first since 1986. Ouch. Add to that delays in major projects, like its Ohio semiconductor fab, and you’ve got a company in desperate need of a lifeline.

Enter Lip-Bu Tan, Intel’s CEO since March 2025. Tasked with turning the ship around, Tan’s been slashing costs and rethinking strategy. But his past investments in Chinese tech firms raised eyebrows, leading Trump to initially call for his resignation. After a White House meeting, though, the tone shifted. Trump called Tan’s story “amazing” and, apparently, saw an opportunity. Instead of ousting him, Trump pitched the idea of a government stake—a move Tan reportedly considered and accepted.

- Intel’s Challenges: Massive losses, weak product roadmap, and delays in new factories.

- Tan’s Turnaround: Cost-cutting and a focus on rebuilding Intel’s foundry business.

- Government’s Role: Converting grants into equity to secure influence and support.

This deal isn’t just about saving Intel—it’s about ensuring the U.S. doesn’t fall behind in the global chip race. Semiconductors power everything from smartphones to military systems, and relying on foreign suppliers is a risk Washington can’t afford. Personally, I think this is a smart move, but it’s not without controversy.

A New Era of State Capitalism?

Government ownership in private companies is rare in the U.S. outside of crises like the 2008 financial meltdown, when the government bailed out General Motors with a 60% stake (and lost $10 billion when it sold). So, why now? The Trump administration argues it’s about strategic industries. Chips are the backbone of modern tech, and with China flexing its muscles, the U.S. needs to secure its supply chain.

This is state capitalism, and it risks turning into crony capitalism if we’re not careful.

– Industry expert, August 2025

Critics, like some analysts I’ve read, worry this sets a dangerous precedent. When the government starts picking winners, it can distort markets and favor politically connected firms. I get it—free markets are supposed to drive innovation, not bureaucrats. But let’s be real: the chip industry isn’t a pure free market anymore. Subsidies, tariffs, and export controls are already shaping the game. Maybe a government stake is just the next logical step?

Commerce Secretary Howard Lutnick has been vocal about ensuring taxpayer money delivers returns, not just handouts. The government’s shares in Intel will be non-voting, meaning no direct meddling in day-to-day operations. Still, the optics of Washington as a major shareholder raise questions. Will other chipmakers like TSMC or Micron face similar pressure? Lutnick says no, but investors are watching closely.

SoftBank’s $2 Billion Bet: A Vote of Confidence

Just days before Trump’s announcement, Japanese tech giant SoftBank dropped a bombshell: a $2 billion investment in Intel at $23 per share. That’s a 2% stake, making SoftBank one of Intel’s top shareholders. The timing couldn’t be more intriguing. With Intel’s stock jumping 7% after the government deal news, it’s clear investors see this as a vote of confidence.

SoftBank’s CEO, Masayoshi Son, called Intel a “trusted leader in innovation.” That’s high praise from a guy known for big bets on tech’s future. I find it fascinating how this aligns with Trump’s “America First” agenda. SoftBank’s also snapping up assets like Foxconn’s Ohio EV plant, signaling a broader push to invest in U.S. tech. Could this be the start of a new era where global players and the government team up to revive American manufacturing?

| Investor | Stake | Value |

| U.S. Government | 10% | ~$10 billion |

| SoftBank | 2% | $2 billion |

The combined firepower of SoftBank and the U.S. government could give Intel the breathing room it needs to rebuild its foundry business. But there’s a catch: Intel’s product roadmap is still shaky, and its factories aren’t attracting customers fast enough. Money helps, but execution is everything.

Trump’s Broader Tech Strategy

This Intel deal isn’t an isolated move. Trump’s second term has been marked by aggressive economic statecraft. He’s pushed for revenue-sharing deals with Nvidia and AMD on AI chip sales to China, securing billions in government revenue. He’s also taken a “golden share” in Nippon Steel’s partnership with US Steel and a major stake in rare-earth producer MP Materials. It’s a pattern: leverage government power to control strategic industries.

I’ll be honest—this approach makes me a bit uneasy. The idea of the government cozying up to corporations feels like a slippery slope. Yet, in a world where China’s pouring billions into its own chip industry, maybe the U.S. has no choice but to play hardball. The question is whether this will spark innovation or stifle it.

- Secure Supply Chains: Reduce reliance on foreign chips.

- Boost Manufacturing: Revive U.S. production via deals like Intel’s.

- National Security: Protect critical tech from geopolitical rivals.

The Intel deal fits neatly into this playbook. By tying up with a struggling giant, Trump’s betting on a comeback that could bolster U.S. tech dominance. But investors should keep an eye on the risks—political meddling could scare off customers or create regulatory headaches.

What’s Next for Intel and Investors?

For Intel, this deal is a lifeline but not a cure-all. The company’s still grappling with a weak product roadmap and fierce competition. Tan’s cost-cutting—slashing 25% of the workforce by year-end—shows he’s serious about efficiency. But can he deliver the innovation needed to compete with Nvidia’s AI chips or TSMC’s manufacturing prowess? That’s the billion-dollar question.

For investors, the news is a mixed bag. Intel’s stock surged 7% on the announcement, and Wall Street’s buzzing with optimism. But some analysts are skeptical, rating Intel a “hold” with a target price suggesting an 8% downside. The government’s involvement could stabilize Intel’s finances, but it might also introduce regulatory overhang. If you’re a risk-tolerant investor, Intel’s low valuation and strategic importance make it tempting. For the cautious, though, waiting for clearer signs of a turnaround might be wiser.

Intel’s a bet on America’s tech future, but it’s not without risks.

– Financial analyst, August 2025

Perhaps the most interesting aspect is how this deal could ripple across the tech sector. Will other chipmakers face similar government pressure? Could this spark a wave of public-private partnerships? Only time will tell, but one thing’s clear: the U.S. is doubling down on its tech ambitions.

The Bigger Picture: Chips and Global Power

Let’s zoom out. Semiconductors aren’t just about gadgets—they’re about global power. Whoever controls chip production controls the future of AI, defense, and economic growth. The U.S. has been playing catch-up since Asia took the lead in manufacturing. This Intel deal, combined with SoftBank’s investment and Trump’s broader strategy, signals a full-court press to reclaim that dominance.

I can’t help but wonder if this is the start of a new era. The government’s not just investing in Intel—it’s betting on America’s ability to innovate and compete. If successful, this could mean more jobs, stronger tech, and a more secure supply chain. If it fails, though, we could see billions in taxpayer money go down the drain, like the GM bailout. It’s a high-stakes gamble, and I’m both excited and nervous to see how it plays out.

Intel’s Turnaround Plan: - Cut 25% of workforce by 2025 - Refocus on foundry business - Leverage government and SoftBank funds - Compete in AI and advanced manufacturing

In the end, this deal is about more than Intel. It’s about America’s place in a tech-driven world. Whether you see it as a bold step forward or a risky overreach, one thing’s certain: the chip wars just got a lot more interesting.