Imagine waking up to news that a single policy shift could unravel years of ambitious climate goals, potentially reshaping an entire state’s economic landscape. That’s exactly the scenario unfolding in California, where a recent executive action from the White House is stirring up a storm. It’s the kind of move that makes you wonder: how much power does one decision hold over a state’s vision for a greener future? Let’s dive into what this means for investors, policymakers, and anyone keeping an eye on the intersection of politics and sustainable finance.

A Bold Move Against California’s Climate Framework

The latest executive order from President Donald Trump sets its sights on California’s cap-and-trade program, a cornerstone of the state’s efforts to curb greenhouse gas emissions while generating significant revenue. This isn’t just a policy tweak—it’s a direct challenge to California’s identity as a global leader in climate innovation. For those unfamiliar, cap-and-trade is a market-based system that sets a ceiling on emissions and lets companies buy or sell permits to pollute within that limit. It’s a clever way to incentivize cleaner operations without outright bans, and it’s been a cash cow for the state, raking in billions annually.

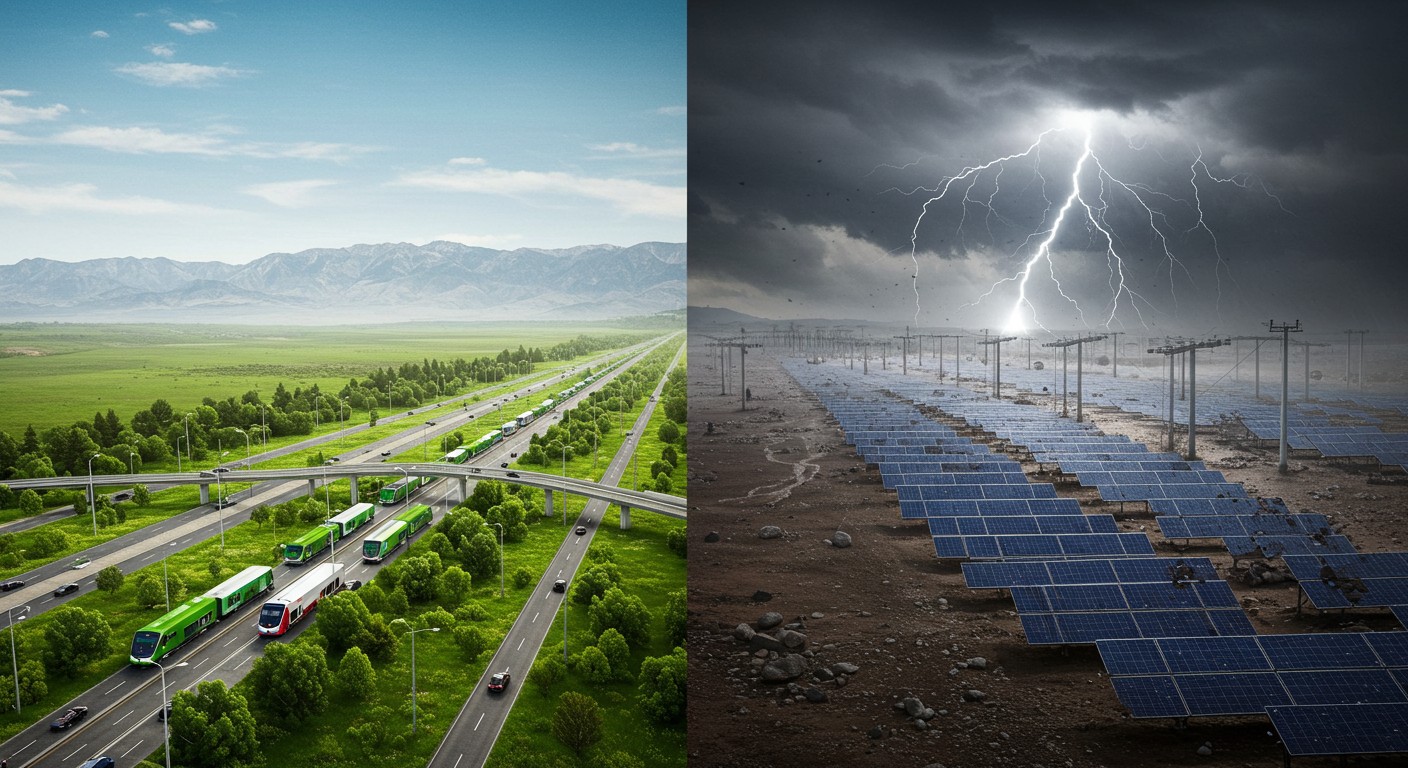

But here’s where it gets messy: Trump’s order argues that this program oversteps state authority, burdens businesses, and clashes with federal priorities. If successful, the administration could choke off funding for critical projects, from high-speed rail to local transit systems. As someone who’s watched policy battles unfold, I can’t help but think this feels like a high-stakes chess game—one where the environment, economy, and political power are all on the board.

How Cap-and-Trade Fuels California’s Ambitions

To grasp the stakes, you need to understand what cap-and-trade does for California. According to financial experts, the program generates around $4.4 billion each year, funding a slew of initiatives aimed at decarbonizing the economy. Think electric buses, solar incentives, and, yes, the controversial high-speed rail project. These aren’t just feel-good measures—they’re investments in a future where clean energy drives growth.

Cap-and-trade is a rare win-win: it cuts emissions while funding innovation.

– Environmental economist

The money gets divvied up strategically. For instance, in the state’s 2025–2026 budget, roughly $936 million goes to high-speed rail, $374 million supports intercity transit, and $187 million boosts low-carbon transit operations. These figures aren’t pocket change—they’re lifelines for projects that could redefine how Californians move and live. But with Trump’s order looming, that cash flow is suddenly at risk.

The Ripple Effects on Transit and Beyond

If the administration manages to dismantle cap-and-trade, the fallout would be immediate. The high-speed rail project, already struggling to connect Merced to Bakersfield by the early 2030s, could grind to a halt. Without federal grants—unlikely under this administration—and with no cap-and-trade revenue, the project might be shelved indefinitely. Honestly, I’ve always been skeptical about the rail’s cost-effectiveness, but losing it entirely would still sting for those banking on a greener commute.

Other transit programs aren’t safe either. Many local initiatives, like expanded bus routes or light rail, rely on cap-and-trade funds to keep moving. These projects often face criticism for high costs and low ridership, but they’re part of a broader vision to reduce car dependency. Cut the funding, and you’re not just killing projects—you’re stalling a cultural shift toward sustainability.

- High-Speed Rail: Faces potential cancellation without cap-and-trade funds.

- Local Transit: Expansion plans could be scaled back or scrapped.

- Green Incentives: Programs for clean energy adoption may lose steam.

A Legal Battle on the Horizon

Don’t expect California to roll over. The state has a history of fighting federal overreach, and this time’s no different. Trump’s order tasks Attorney General Pam Bondi with identifying state laws that “burden” domestic energy development, explicitly calling out California’s cap-and-trade as a target. But taking it down won’t be easy. A previous attempt during Trump’s first term, which argued the program overstepped by partnering with Quebec, fizzled out in court.

Here’s the kicker: that 2019 lawsuit ended with a District Court ruling in California’s favor, and the Biden administration dropped the appeal. Legal precedent now makes it trickier for Bondi to retry the same argument. She’ll need a fresh angle—maybe claiming the program violates federal commerce laws or imposes unconstitutional taxes. Whatever the approach, California’s ready with a war chest for litigation.

California’s legal team is battle-tested and won’t back down easily.

– Policy analyst

What’s at Stake for Investors?

For those with money in the game, this is more than a policy spat—it’s a signal to reassess portfolios. The uncertainty around cap-and-trade could ripple through sectors tied to California’s green economy. Companies involved in renewable energy, transit infrastructure, or carbon credit trading might face headwinds if the program falters. On the flip side, traditional energy firms could see a boost if regulatory burdens ease.

Here’s a quick breakdown of potential impacts:

| Sector | Potential Impact |

| Renewable Energy | Reduced funding for incentives |

| Transit Infrastructure | Project delays or cancellations |

| Carbon Markets | Decline in trading activity |

| Fossil Fuels | Eased regulatory pressures |

Smart investors will keep an eye on how this legal battle unfolds. A prolonged fight could create volatility in green bonds or ETFs tied to sustainable projects. Personally, I’d be cautious about doubling down on California-centric green investments until the dust settles.

The Bigger Picture: State vs. Federal Power

Zoom out, and this isn’t just about cap-and-trade—it’s about who gets to call the shots. California’s long positioned itself as a climate trailblazer, often at odds with federal priorities. This clash feels like the latest chapter in a tug-of-war over state autonomy. Can a state chart its own course on environmental policy, or does the federal government have the final say?

It’s a question that could end up at the Supreme Court, especially with a conservative majority likely in place through 2029. If Bondi’s team escalates the case, the ruling could set precedents for how states handle everything from emissions to energy taxes. For investors and policymakers alike, that’s a development worth watching.

Navigating the Uncertainty

So, where does this leave us? If you’re invested in California’s green economy—or just curious about the interplay of politics and finance—this executive order is a wake-up call. The potential loss of cap-and-trade revenue could stall projects, shift market dynamics, and spark a legal showdown. But it also opens opportunities for those who can navigate the chaos.

My take? Stay diversified, keep an eye on court rulings, and don’t bet the farm on any one outcome. California’s resilience and the federal government’s muscle make this a tough one to call. What do you think—will the state hold its ground, or is this the end of its climate dominance?

This battle’s just getting started, and the outcome could reshape how we think about climate investments and state power. Whether you’re rooting for California’s green vision or skeptical of its approach, one thing’s clear: the stakes couldn’t be higher.