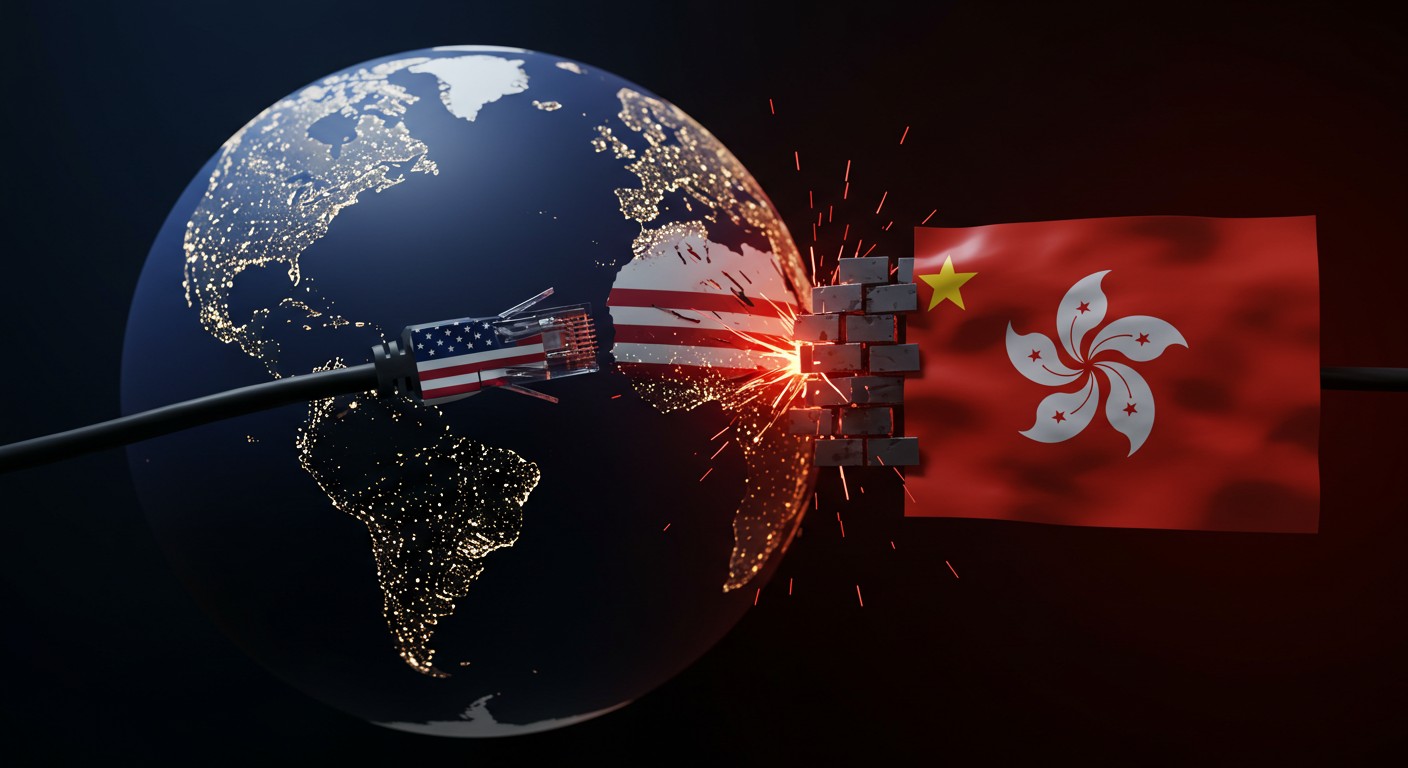

Have you ever wondered what happens when global communication networks get caught in the crossfire of international politics? It’s not just about dropped calls or slower internet—it’s about trust, security, and the invisible threads that connect our world. Recently, the U.S. made a bold move to restrict one of Hong Kong’s largest telecommunications companies, HKT, from accessing its networks. The reason? National security concerns tied to HKT’s connections with China. This decision isn’t just a technicality; it’s a signal of deeper tensions shaping the future of global communication.

Why the U.S. Is Targeting HKT

The U.S. Federal Communications Commission (FCC) has taken a decisive step by launching proceedings to potentially block HKT Trust, HKT Ltd, and its subsidiaries from interconnecting with American networks. This isn’t a random jab—it’s part of a broader strategy to safeguard U.S. telecommunications from foreign influence, particularly from China. HKT, a major player under the umbrella of PCCW, has been asked to justify why its access to U.S. networks shouldn’t be revoked. The stakes are high: HKT facilitates direct exchanges of calls and data with U.S. carriers, a critical link in global connectivity.

Protecting our networks from foreign adversaries is non-negotiable.

– FCC Official

The concern stems from HKT’s parent company, PCCW, which has an 18.4% stake held by China Unicom, a state-linked entity already barred from U.S. networks in 2022. The FCC fears that such ties could expose sensitive U.S. data to foreign surveillance or interference. In my view, it’s a classic case of “better safe than sorry,” but it raises questions about where we draw the line between security and global cooperation.

The Bigger Picture: U.S.-China Trade Tensions

This move against HKT isn’t happening in a vacuum. It’s part of an escalating trade war between the U.S. and China, where technology and telecommunications are key battlegrounds. The U.S. has been tightening the screws on Chinese-linked companies for years, from Huawei to China Telecom. Each step sends ripples through global markets, and HKT’s case is no exception. Shares of HKT dropped over 5% in Hong Kong trading, while PCCW saw a 3.6% dip, reflecting investor jitters.

Why does this matter? Because telecommunications isn’t just about phone calls—it’s the backbone of everything from online banking to international diplomacy. When trust in these networks falters, the consequences are far-reaching. Imagine trying to run a business when your international calls or data transfers are suddenly cut off. It’s not just inconvenient; it’s a potential economic disaster.

- Direct impact: HKT’s restricted access could disrupt services for businesses relying on U.S.-Hong Kong connectivity.

- Market fallout: Share price drops signal investor concerns about HKT and PCCW’s global operations.

- Geopolitical signal: The U.S. is doubling down on isolating Chinese-linked firms.

Who’s Behind HKT and Why It’s Complicated

HKT is no small fry in the telecom world. As a subsidiary of PCCW, it accounts for roughly 90% of the group’s revenue, with about 13% of that coming from regions outside Greater China and Singapore. The company is majority-owned by a prominent Hong Kong business tycoon, whose family has deep ties to global commerce. But here’s where it gets tricky: their business empire has been caught in the U.S.-China tug-of-war before.

For instance, another company under the same family’s umbrella recently faced roadblocks in expanding into mainland China due to regulatory pushback. Meanwhile, a major deal involving global ports was stalled after objections from Beijing, highlighting how geopolitical tensions can derail even the most well-connected businesses. It’s a reminder that in today’s world, no company operates in a bubble—everyone’s playing on a global chessboard.

What’s at Stake for Global Telecom?

The FCC’s crackdown on HKT could reshape how global telecommunications operate. For one, it raises the question: how do we balance open communication networks with national security? If every country starts locking down access based on geopolitical rivalries, we could end up with a fragmented internet—a digital equivalent of the Berlin Wall. That’s not just bad for business; it’s bad for innovation and global collaboration.

From a user perspective, the impact might not be immediate. You’re probably not going to notice slower WhatsApp messages tomorrow. But over time, restrictions like these could limit the seamless flow of data we take for granted. Companies relying on international networks—think e-commerce giants, streaming platforms, or even small businesses with global clients—could face higher costs or service disruptions.

| Stakeholder | Potential Impact | Level of Concern |

| Consumers | Possible service disruptions | Low-Medium |

| Businesses | Higher costs, limited connectivity | Medium-High |

| Investors | Market volatility for HKT, PCCW | High |

The FCC’s Broader Crackdown

The HKT case is just one piece of a larger puzzle. Under its current leadership, the FCC has been relentless in targeting Chinese state-linked entities. Other companies, like China Telecom and Pacific Networks, have already been shown the door. Even online retail platforms have been swept up in the crackdown, with millions of listings for banned Chinese electronics removed from major U.S. sites.

Our networks are only as strong as our weakest link.

– Telecommunications expert

This isn’t just about telecom—it’s about control. The U.S. wants to ensure its digital infrastructure remains secure, but at what cost? In my experience, these kinds of restrictions often have unintended consequences. Smaller companies, for example, might struggle to navigate the new regulatory landscape, while larger players like HKT could pivot to other markets. But the bigger question is: are we heading toward a world where global connectivity is sacrificed for national interests?

What HKT and PCCW Can Do Next

HKT and PCCW are now in a tough spot. The FCC has put the ball in their court, asking them to prove why they should keep their U.S. network access. It’s a high-stakes game, and their response will need to address the national security concerns head-on. They could argue that their operations are independent of Chinese influence, but given China Unicom’s stake, that’s a tough sell.

- Transparency: Disclose operational details to reassure regulators.

- Divestment: Consider reducing ties with state-linked entities.

- Alternative markets: Shift focus to regions less affected by U.S. restrictions.

Perhaps the most interesting aspect is how HKT navigates this. They could double down on their Hong Kong and Asian markets, where they’re already dominant. But losing U.S. access could dent their global ambitions, forcing a rethink of their strategy. It’s a classic “adapt or perish” moment.

What This Means for You

So, why should you care about a telecom company getting the boot from U.S. networks? For one, it’s a wake-up call about the fragility of our interconnected world. If you’re a business owner relying on global supply chains or communication networks, this could mean higher costs or new barriers. If you’re an investor, it’s a reminder to keep an eye on geopolitical risks—stocks like HKT and PCCW are already feeling the heat.

For the average person, the impact might seem distant, but it’s not. The apps you use, the websites you visit, the calls you make—they all rely on a complex web of international networks. When that web starts to fray, we all feel the effects eventually. Maybe it’s time to ask: how much are we willing to sacrifice for the sake of security?

Looking Ahead: A Fragmented Future?

As the U.S. continues to tighten its grip on foreign telecoms, we’re left with some big questions. Will other countries follow suit, creating a patchwork of restricted networks? Could this push companies like HKT to align more closely with China, further deepening global divides? In my view, the path forward isn’t clear-cut. Security is critical, but so is global cooperation. Finding a balance will be the challenge of the decade.

Global Telecom Outlook: 50% Security-driven restrictions 30% Economic impacts 20% Innovation challenges

The HKT case is a microcosm of a larger struggle—one where technology, politics, and economics collide. It’s not just about one company losing access; it’s about the kind of world we’re building. A world of walls or a world of bridges? Only time will tell.