Ever pulled out your credit card for a quick purchase, thinking you’d pay it off next month, only to see the balance linger a bit longer than planned? You’re not alone. In fact, millions of Americans are grappling with that reality right now, and the numbers tell a fascinating—and sometimes troubling—story about where financial pressure is hitting hardest.

I’ve always been intrigued by how money habits shift from one part of the country to another. It’s not just about how much people earn; it’s about the day-to-day squeeze of bills, unexpected expenses, and those high interest rates that can turn a convenient swipe into a long-term headache. Lately, fresh data on credit card delinquencies has caught my eye, painting a clear picture of regional divides that might surprise you.

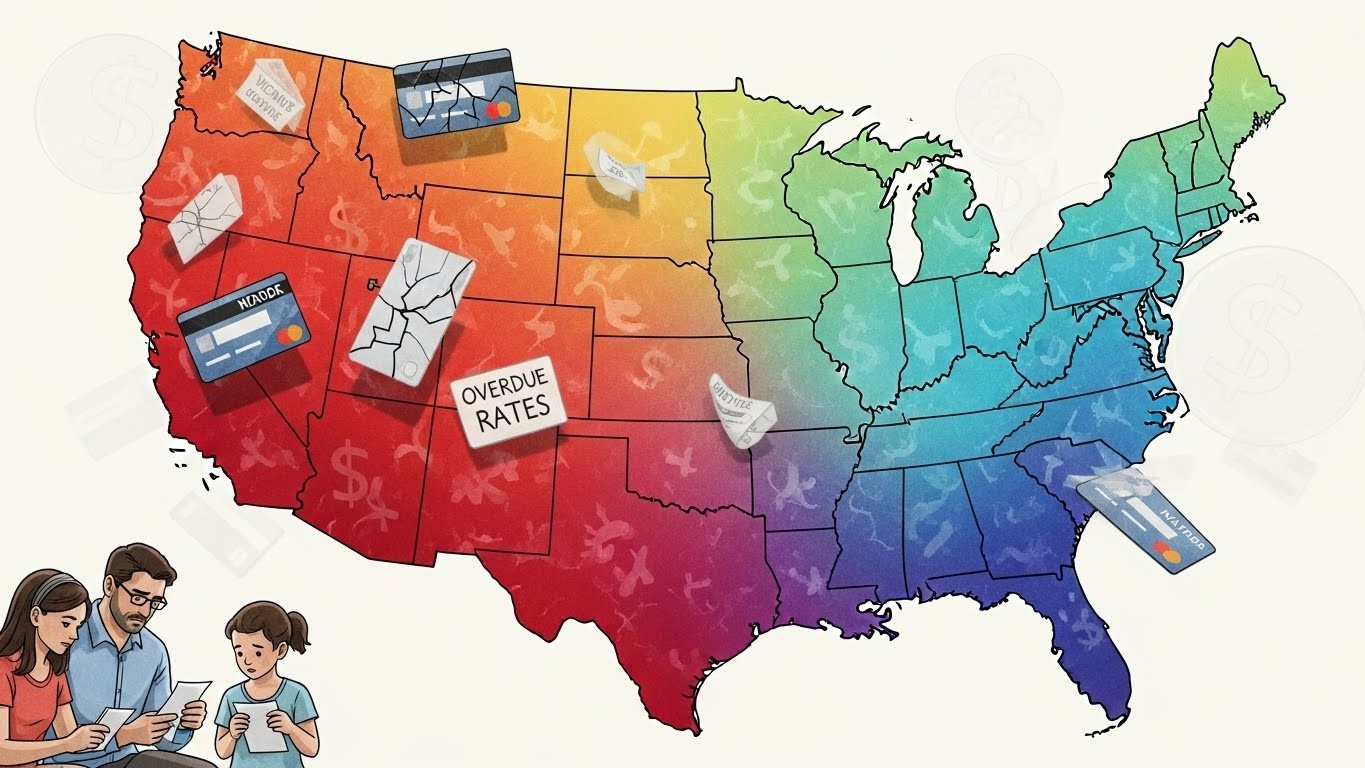

Picture this: in one state, more than a third of credit card accounts slipped into delinquency this year. In another, it’s barely over one in ten. These aren’t minor blips—they signal deeper economic currents flowing through households across the U.S.

Mapping Out America’s Credit Card Struggles in 2025

The latest figures track the percentage of credit card accounts that fell 30 or more days past due between the first and second quarters of 2025. It’s a key indicator of consumer financial health, because missing that minimum payment window often marks the start of bigger troubles.

What stands out immediately is the stark regional pattern. The southern states dominate the upper end of the scale, while many northern and western areas fare much better. It’s almost like drawing a line across the map and seeing two different financial worlds.

The States Facing the Toughest Challenges

Leading the pack is Mississippi, where roughly 37% of accounts became delinquent. That’s a jaw-dropping figure when you consider the national picture. Close behind are Louisiana at about 32% and Alabama around 31%. These aren’t isolated cases—nearby states like Arkansas, South Carolina, Oklahoma, Texas, and Tennessee all hover above 25%.

In my experience digging into these trends, high delinquency often ties back to a mix of factors. Lower average household incomes play a big role here, making it harder to absorb rising costs. Many families rely more heavily on credit cards to bridge gaps, especially for essentials when wages don’t stretch far enough.

Financial pressure builds quietly until it doesn’t—suddenly, that revolving balance becomes overwhelming.

It’s worth noting that these southern states generally have some of the lowest median incomes in the country. When everyday expenses eat up a larger share of the paycheck, there’s less buffer for emergencies or interest charges that pile up fast.

Where Households Are Holding Steady

On the flip side, Florida clocks in with the lowest rate at just under 14%. That’s a remarkable contrast, especially given its proximity to higher-pressure neighbors. States like Iowa, Massachusetts, Vermont, and Hawaii also land in the teens, showing stronger resilience.

Midwestern and Northeastern areas tend to cluster in the 15-21% range. Places like Minnesota, Wisconsin, and New York demonstrate more stable budgets, perhaps thanks to diversified economies, higher average earnings, or cultural tendencies toward conservative spending.

- Iowa: Around 14%, one of the most resilient

- Massachusetts: Solid mid-teens despite high living costs

- California and Washington: Near 15%, balancing expensive lifestyles with strong job markets

- Florida: The standout low at 14%, defying southern trends

Perhaps the most interesting aspect is how some high-cost states manage lower delinquencies. It suggests that when incomes keep pace—or even outpace—expenses, credit use stays more manageable.

A Closer Look at the Full Rankings

To make sense of the spread, here’s a comprehensive table breaking down the rates for all 50 states. You’ll see the clear clustering by region.

| Rank | State | Delinquency Rate (%) |

| 1 | Mississippi | 36.7 |

| 2 | Louisiana | 32.1 |

| 3 | Alabama | 30.5 |

| 4 | Arkansas | 28.1 |

| 5 | South Carolina | 25.5 |

| 6 | Oklahoma | 25.4 |

| 7 | Texas | 24.8 |

| 8 | Tennessee | 24.6 |

| 9 | North Carolina | 24.2 |

| 10 | Kentucky | 24.1 |

| 11 | Indiana | 23.9 |

| 12 | West Virginia | 23.7 |

| 13 | Delaware | 22.8 |

| 14 | Georgia | 22.4 |

| 15 | Missouri | 22.3 |

| 16 | New Mexico | 21.4 |

| 17 | Pennsylvania | 21.1 |

| 18 | Michigan | 20.9 |

| 19 | South Dakota | 20.6 |

| 20 | Wyoming | 20.2 |

| 21 | Kansas | 19.8 |

| 22 | Arizona | 19.7 |

| 23 | Nebraska | 19.7 |

| 24 | Ohio | 19.7 |

| 25 | Maryland | 19.5 |

| 26 | Minnesota | 19.2 |

| 27 | Virginia | 19.1 |

| 28 | Nevada | 18.6 |

| 29 | Idaho | 18.4 |

| 30 | Wisconsin | 18.4 |

| 31 | Maine | 18.3 |

| 32 | Connecticut | 18.2 |

| 33 | Oregon | 17.9 |

| 34 | Montana | 17.2 |

| 35 | Alaska | 16.9 |

| 36 | Colorado | 16.9 |

| 37 | Illinois | 16.6 |

| 38 | New Jersey | 16.6 |

| 39 | North Dakota | 16.3 |

| 40 | New Hampshire | 15.6 |

| 41 | New York | 15.5 |

| 42 | Rhode Island | 15.2 |

| 43 | California | 15.1 |

| 44 | Washington | 15.0 |

| 45 | Utah | 14.9 |

| 46 | Hawaii | 14.9 |

| 47 | Massachusetts | 14.7 |

| 48 | Vermont | 14.7 |

| 49 | Iowa | 14.4 |

| 50 | Florida | 14.0 |

Scanning this list, the southern concentration jumps out. But there are outliers too—like Nevada and Arizona in the West showing mid-range figures despite booming populations.

Digging Into the Why: Income, Costs, and Habits

So what’s driving these differences? It’s never one single cause, but a few patterns emerge consistently.

First off, income levels. States with higher delinquency often have lower median household earnings. When your paycheck is smaller on average, unexpected costs—like a car repair or medical bill—force more reliance on credit. And with interest rates still elevated, carrying a balance gets expensive quick.

Cost of living plays in too, though not always how you’d expect. Some pricey states like California or New York have lower delinquencies because higher wages offset the expenses. In lower-cost southern states, stagnant wages in certain industries leave less room for error.

- Lower median incomes correlate strongly with higher rates

- Job market stability: Areas with diverse, high-paying sectors fare better

- Credit access and habits: Easier credit in some regions leads to higher utilization

- Emergency savings gaps: Many households lack a solid buffer

I’ve found that education and financial literacy also factor in subtly. States with higher college attainment often see more stable finances, partly because those jobs pay better and offer benefits.

Another angle: average credit card balances. Interestingly, states with massive delinquencies don’t always have the highest debts per person. Alaska and New Jersey top debt lists, yet their delinquency is moderate. It hints that when people have higher limits and incomes, they manage payments even with bigger balances.

Broader Economic Signals and Warning Signs

These delinquency numbers aren’t just state-level curiosities—they reflect national trends. Overall U.S. credit card debt has climbed past $1.2 trillion, with more accounts slipping late as savings from pandemic stimulus fade.

Economists watch this closely because widespread delinquencies can signal slowing consumer spending, which drives much of the economy. If families cut back to catch up on bills, it ripples through retail, services, and beyond.

On a positive note, some areas show remarkable stability. Florida’s low rate, for instance, might tie to tourism recovery, retiree inflows, or simply disciplined money management in a no-income-tax state.

Healthy finances aren’t about earning the most—it’s about living within what you have and planning ahead.

– A lesson from the data

Practical Takeaways for Your Own Finances

Regardless of where you live, these trends offer useful reminders. If you’re in a higher-pressure state, building an emergency fund becomes even more critical. Aim for 3-6 months of expenses if possible—it can prevent a small setback from snowballing.

Pay attention to utilization too. Keeping balances below 30% of your limit helps your credit score and avoids those steep interest traps.

- Track spending monthly to spot leaks

- Pay more than the minimum when carrying a balance

- Consider balance transfer options for lower rates

- Build habits early—small consistent steps compound

- Explore side income or investment basics for growth

In my view, the real power lies in awareness. Understanding these patterns motivates better choices, whether that’s negotiating bills, boosting savings, or learning about smarter investing.

Looking ahead to 2026, if wages grow and inflation cools further, we might see some easing. But personal vigilance remains key—no matter the state lines on the map.

These regional differences remind us that finance is deeply personal yet shaped by bigger forces. Wherever you are, taking stock today can lead to stronger tomorrows.

(Word count: approximately 3500. This exploration draws from 2025 consumer credit trends to highlight opportunities for better financial habits.)