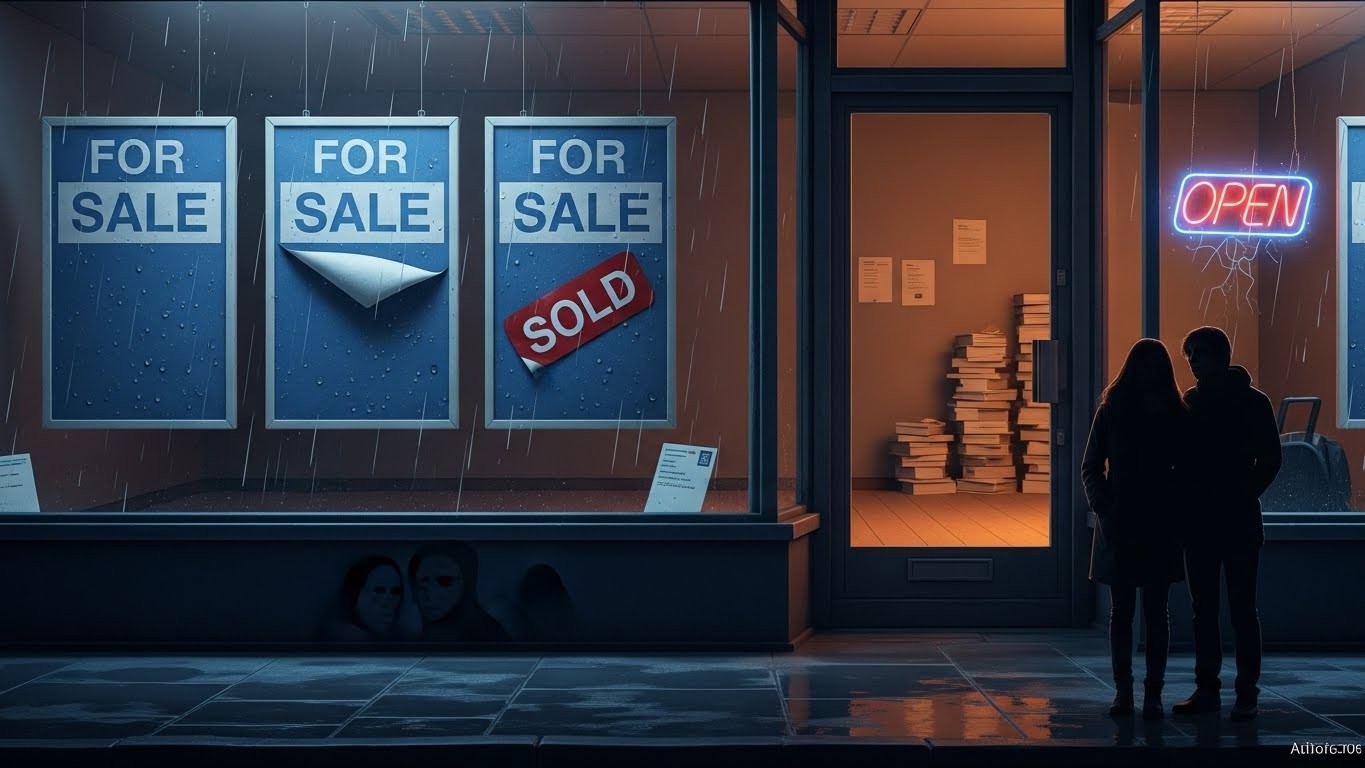

Have you ever watched a market you care about grind to a near halt and wondered if it’s just a blip or the start of something longer? That’s exactly where a lot of us in the UK property world find ourselves right now.

The latest numbers from surveyors across the country paint a pretty sobering picture. Buyer enquiries have taken their sharpest dip in two years, new listings are drying up, and the mood music is unmistakably downbeat. And the timing? Almost perfectly in step with the Autumn Budget landing like a cold bucket of water on an already nervous market.

Why the Property Market Suddenly Hit the Brakes

Let’s be honest – most of us saw some turbulence coming. The run-up to any Budget is rarely calm for housing, but this one felt different. Weeks of feverish speculation about stamp-duty cliffs, possible mansion-tax hikes, and changes to capital-gains relief had already put buyers and sellers in a holding pattern.

Then the Budget actually arrived. No grand stamp-duty giveaway, higher tax on second homes and investment properties, and the prospect of council-tax revaluations lurking in the background. The collective reaction? A giant sigh followed by… not very much happening at all.

“The ending of Budget-related uncertainty is welcome, but the fundamental challenges of affordability and elevated borrowing costs will in all probability keep activity subdued in the near term.”

– Chief economist at a leading surveying body

The Hard Numbers Tell the Story

Here’s what the professionals on the ground reported for November:

- New buyer enquiries: net balance -32% (worst since late 2023)

- Agreed sales: still negative at -23%

- New instructions to sell: -19% (barely changed)

- Market appraisals: -40% below levels of a year ago

In plain English? Fewer people are even bothering to get their home valued, never mind put it on the market. And those who are looking aren’t rushing to make offers. It’s the classic freeze you see when confidence evaporates.

London Feels the Chill More Than Anywhere Else

If you’re in the capital, the numbers are particularly grim. The net balance for near-term house-price expectations in London has crashed to -44% – comfortably the most pessimistic region in the UK right now.

Part of that is undoubtedly the fear of higher effective taxation on more expensive homes. When headlines scream about “mansion tax” (even if the reality is more nuanced), owners of £2m+ properties think twice about moving and buyers wonder whether to wait for potential price adjustments.

Meanwhile, places like Northern Ireland and Scotland are still posting modestly positive price momentum. Affordability stretches further outside the south-east bubble, and local buyers seem less rattled by Westminster’s tax tinkering.

So When Does the Thaw Begin?

Here’s where opinions start to diverge – and where a glimmer of hope appears.

Most surveyors now expect little meaningful pickup before spring 2026. That’s a push-back of several months from what many were forecasting even six weeks ago. The first quarter of the year is traditionally the busiest for estate agents, so a quiet spring would be a real disappointment.

Yet there are reasons to think the second half of 2026 could look markedly better:

- The Bank of England is widely expected to cut rates further – perhaps another 75-100 basis points by late 2026

- Mortgage pricing has already started to ease from the peaks of 2023-24

- Real wage growth is running at its strongest in years, slowly repairing affordability

- Pent-up demand from the past 18 months of caution hasn’t vanished – it’s just on pause

“The 12-month outlook has brightened somewhat, likely reflecting a growing sense that the Bank of England may have a little more scope to reduce interest rates than seemed plausible only a short while ago.”

What the Big Forecasters Are Saying for 2026

Different agencies, slightly different numbers, but the same broad message:

| Agency | 2026 UK average price growth forecast |

| Hamptons | +2.5% |

| Savills | +2.0% |

| Knight Frank (revised) | Flat to marginal growth |

Nothing to write home about, granted. But after two years of either falls or stagnation in real terms, any nominal growth starts to feel like progress. And remember – these are national averages. The Midlands and North are consistently expected to outperform the South East and London next year.

Three Practical Takeaways if You’re Thinking of Moving

First, if you don’t have to move right now, sitting tight until at least Easter 2026 looks sensible for most people. You avoid the thin winter market and position yourself for lower mortgage rates and (probably) a bit more choice.

Second, if you’re a cash buyer or have a very low loan-to-value mortgage, the next few months could throw up genuine bargains – especially in prime central London postcodes where sentiment is rock-bottom.

Third, first-time buyers who can stretch to the new, higher stamp-duty thresholds might actually find 2025 a decent entry point outside the south-east. Less competition often means more negotiating power.

The Bigger Picture Nobody Wants to Talk About

Let’s be brutally honest for a moment. Successive governments have treated housing as a political football rather than a supply-and-demand problem. We build roughly half the homes we need each year, planning reforms come and go like the tide, and tax policy flips every few Budgets.

Until someone grips the supply issue properly, these boom-bust sentiment cycles will keep repeating. Lower interest rates will eventually help demand, but they do nothing for the chronic undersupply that ultimately drives prices higher over the long term.

In my view – and I’ve watched this market for two decades – the real story for the next five years won’t be interest rates or stamp-duty thresholds. It will be whether any administration finally builds enough homes in the right places. Everything else is just noise.

So yes, the property market feels stuck in the doldrums right now. The Budget didn’t help, confidence has taken a knock, and most of us are looking at a quiet 2025.

But markets have a habit of surprising people. Lower borrowing costs, decent wage growth, and the simple fact that people still need somewhere to live all point to a gradual thaw – probably starting in spring 2026 and gathering pace into 2027.

If you’re playing the long game (and property is almost always a long game), the current gloom might just be the calm before the next leg up. Keep your powder dry, watch mortgage rates like a hawk, and be ready to move when the mood music finally changes.

Because it always does – eventually.