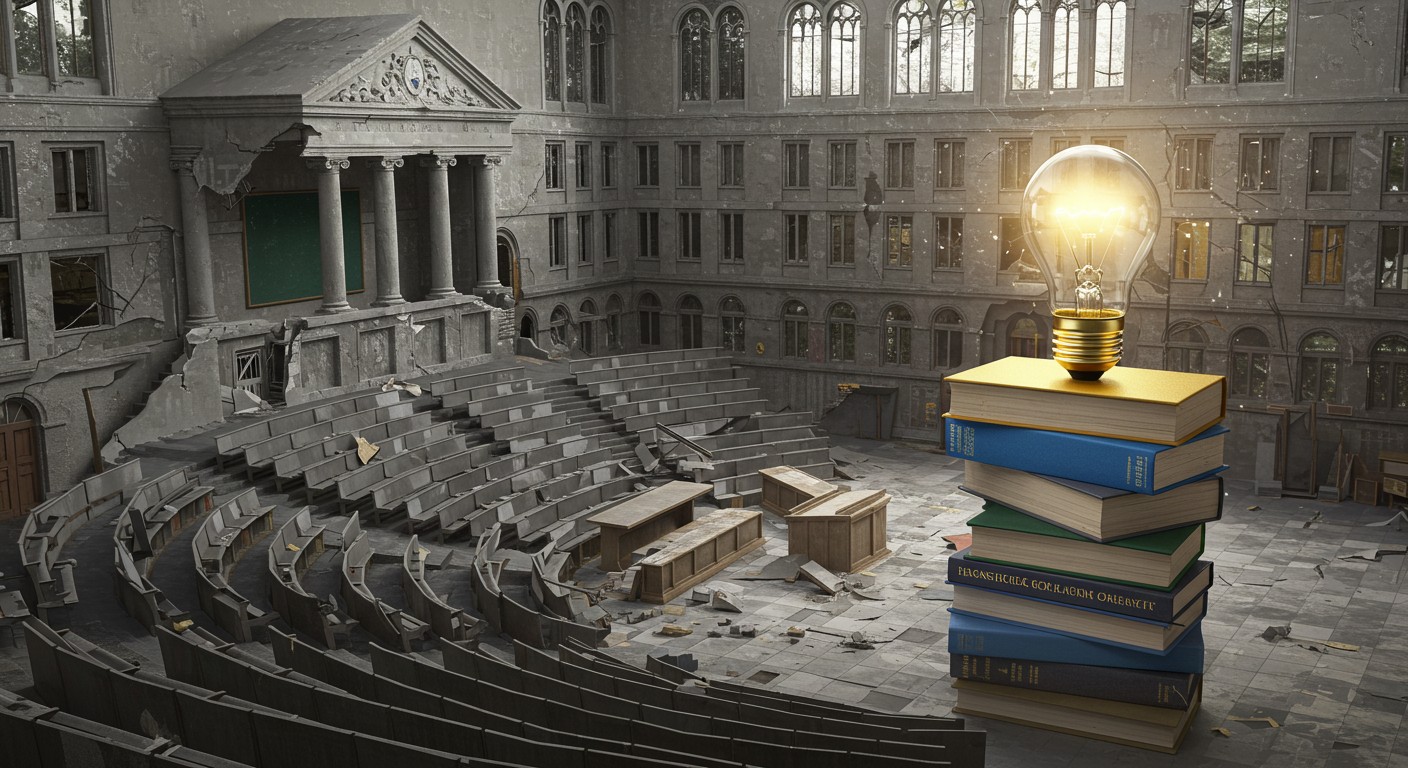

Imagine walking through the grand halls of a historic UK university, the air heavy with the scent of old books and ambition, only to find lecture rooms half-empty and whispers of budget cuts echoing in the corridors. It’s a scene unfolding across the country, where higher education institutions, once pillars of intellectual and economic strength, are grappling with a financial crisis that threatens their very existence. I’ve always believed universities are more than just buildings—they’re engines of opportunity, shaping minds and local economies alike. So, why are these bastions of learning suddenly struggling to keep the lights on?

The Perfect Storm: Why UK Universities Are in Crisis

The financial turmoil in UK universities isn’t a sudden squall but a slow-building tempest, fueled by a mix of policy missteps, economic pressures, and shifting demographics. According to recent reports, nearly 40% of universities are running deficits, with projections suggesting half will be in the red by next year. This isn’t just a numbers game—it’s a crisis that’s forcing institutions to sell off land, cut courses, and lay off staff. Let’s unpack the forces driving this storm and explore what can be done to navigate it.

The Tuition Fee Trap

At the heart of the crisis lies the issue of tuition fees. Since 2012, domestic student fees have been capped at £9,000, with a slight bump to £9,250 in 2017. Sounds reasonable, right? Except inflation has eroded their real value by over a third. Universities are losing around £2,500 per domestic student, a gap that’s impossible to bridge without drastic measures. The recent nudge to £9,535? It’s like putting a bandage on a broken leg—well-intentioned but woefully inadequate.

Universities are caught in a funding model that’s unsustainable, forcing them to rely on international students to plug the gap.

– Higher education analyst

Why hasn’t the government let fees rise with inflation? It’s a political hot potato. Raising fees risks public backlash, especially when students are already drowning in debt. But keeping them frozen is starving universities of the resources they need to deliver quality education. It’s a classic case of short-term politics trumping long-term stability.

The International Student Slump

Here’s where things get trickier. To offset losses from domestic students, universities have leaned heavily on international students, who pay uncapped fees that can reach £30,000 or more per year. Since the mid-1990s, their contribution to university revenue has skyrocketed from 5% to 25%. But recent government policies aimed at curbing immigration have slashed international recruitment by about 21% for the 2024-2025 academic year. This isn’t just a blip—it’s a seismic shift that’s left budgets in tatters.

I’ve always thought universities were smart to diversify their income streams, but this reliance on international students feels like building a house on sand. When policies change or global attitudes shift, the whole structure wobbles. And wobble it has, with institutions now scrambling to plug the gap.

Overexpansion and Overspending

Let’s talk about the elephant in the room: universities haven’t exactly been frugal. The early 2000s saw a boom in student numbers, with a 68% increase under New Labour. Then, in 2012, reforms scrapped course quotas, letting top-tier universities expand while putting pressure on less prestigious ones to compete. The result? A race to build flashy campuses and hire armies of non-academic staff—think managers and marketing pros—whose numbers grew by 60% between 2006 and 2018.

It’s not hard to see why. In a competitive market, universities needed to stand out. But instead of focusing on academic quality, many poured billions into capital projects—think Olympic-scale spending on shiny new buildings. The Economist put it brilliantly: universities now “look more broke than a student after a summer of Interrailing.” Ouch, but true.

- Capital overspending: Between 2014 and 2018, universities spent as much on buildings as Britain did on the 2012 Olympics.

- Staff bloat: Non-academic staff now make up half the workforce, with managers multiplying like academic papers in a professor’s inbox.

- Course closures: Half of universities have axed programs to save cash, risking their core mission.

The Student Squeeze

While universities struggle, students are feeling the pinch too. Soaring rents and living costs have outpaced maintenance loans, which have lost value in real terms. A staggering 68% of students now work part-time jobs, double the number from just four years ago. I can’t help but feel for these young people, juggling essays and shifts at the local café just to make ends meet. Is this really the university experience we’re selling?

The unit of resource—the money available per student for teaching—is at a record low, equivalent to £5,600 in 2012 prices. This squeezes the quality of education, with larger class sizes and fewer resources. No wonder applications are dipping, from 44.1% of young people in 2022 to 41.9% last year. If the value proposition of a degree keeps thinning, why bother?

A Looming Demographic Cliff

Here’s where it gets even bleaker. From 2030, the number of 18-year-olds in the UK is set to decline, shrinking the pool of domestic students. Meanwhile, the environment for international students is growing less welcoming, with visa restrictions and global competition heating up. Yet, bafflingly, most universities plan to balance their books by recruiting more students—25% more undergraduates and 23% more postgraduates in the next three years. That’s like betting your savings on a horse that’s already limping.

Relying on ever-increasing student numbers in a shrinking market is a recipe for disaster.

– Education policy expert

This strategy assumes demand will magically rebound, but the data suggests otherwise. Without a course correction, bankruptcies aren’t just possible—they’re likely.

Solutions: Steering the Ship to Safety

So, what’s the way out? I’ve always believed that crises, while painful, can spark innovation. Here are some practical steps to stabilize the sector, drawn from expert insights and a bit of common sense.

Index-Link Tuition Fees

First, the government needs to bite the bullet and tie tuition fees to inflation. This isn’t about gouging students—it’s about ensuring universities can cover their costs without slashing quality. A gradual increase, phased in over years, could ease the political sting while giving institutions breathing room.

Boost Maintenance Loans

Students need support too. Indexing maintenance loans to inflation would help them afford rising living costs without working themselves to exhaustion. It’s not just fair—it’s an investment in keeping higher education accessible and appealing.

Rethink the Market Model

The free-market experiment in higher education has led to waste and inequality. The government should take a firmer hand, overseeing student numbers to prevent reckless expansion. Mergers between struggling institutions could cut costs while preserving key programs, like nursing or engineering, that society desperately needs.

| Solution | Impact | Challenge Level |

| Index-linked fees | Stabilizes revenue | High (political) |

| Increased loans | Supports students | Medium |

| Mergers | Reduces overcapacity | High |

Reinvest International Student Revenue

A proposed levy on international student fees could be a game-changer—if the funds are funneled back into higher education. This could support struggling institutions and reduce reliance on volatile international markets. It’s a no-brainer, really.

Streamline Operations

Universities need to take a hard look in the mirror. Cutting administrative bloat and focusing spending on teaching rather than flashy facilities could save millions. It’s not sexy, but efficiency is the unsung hero of financial recovery.

The Bigger Picture: Why It Matters

Universities aren’t just about degrees—they’re economic powerhouses, especially in smaller towns. They employ thousands, support local businesses, and drive innovation through spin-off companies. If they fail, the ripple effects could devastate communities. But it’s not just about economics. A thriving university sector shapes critical thinkers, advances knowledge, and fuels social mobility. Letting it crumble would be like letting a lighthouse go dark—disastrous for everyone.

Perhaps the most sobering thought is what happens if we do nothing. A single university bankruptcy could unravel the entire system, as international students flee and confidence collapses. The government might be forced into bailouts, but these should come with strings attached—mergers, cost-cutting, and a new funding model.

A Call to Action

The crisis in UK universities is a wake-up call. It’s tempting to point fingers—at government policies, university overspending, or global market shifts—but blame won’t fix the problem. What we need is bold, pragmatic action: index-linked fees, smarter regulation, and a commitment to students’ futures. I’ve always believed education is the backbone of progress. Let’s not let it snap under the weight of neglect.

- Act on fees: Tie tuition to inflation to stabilize budgets.

- Support students: Boost and index-link maintenance loans.

- Manage the market: Oversee mergers and student numbers to prevent collapse.

The road ahead is tough, but not impossible. With the right reforms, UK universities can weather this storm and emerge stronger, ready to educate the next generation without breaking the bank—or their spirits.