Imagine a world where the backbone of renewable energy—batteries—gets a second chance at life through a bold corporate move. That’s exactly what’s happening as a California-based startup swoops in to rescue a fallen European giant. The deal is massive, the stakes are high, and the implications for the energy market are nothing short of electric. I’ve always been fascinated by how businesses can pivot from failure to opportunity, and this story is a prime example of that resilience.

A Game-Changing Acquisition in the Battery Industry

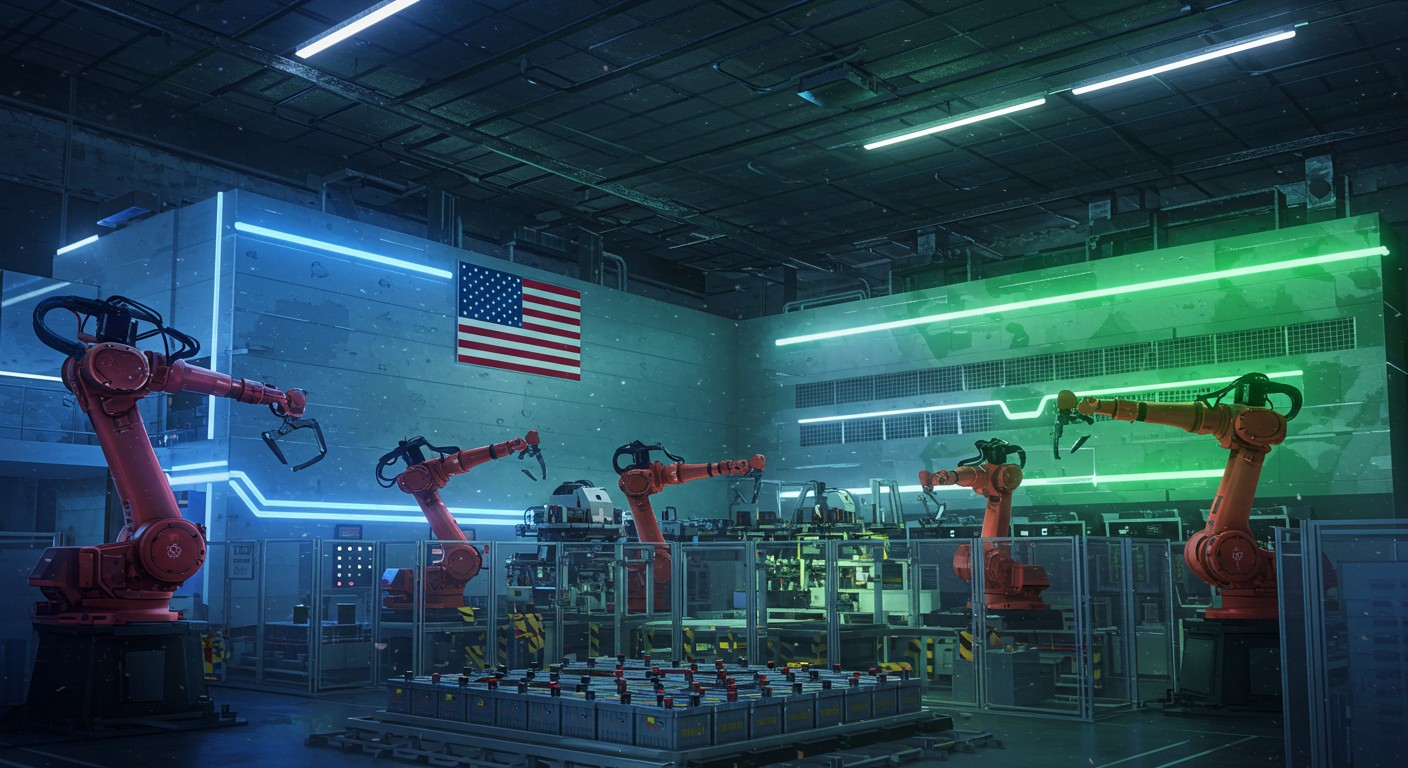

In a move that’s turning heads across the energy sector, a US company has acquired the remnants of a once-promising European battery manufacturer. The deal includes multi-billion-dollar gigafactories in Sweden and Germany, along with cutting-edge intellectual property that could redefine battery production. This isn’t just a business transaction; it’s a lifeline for an industry critical to the green energy transition. The acquiring company, based in sunny California, is betting big on revitalizing these assets to meet soaring global demand for energy storage.

The acquisition covers operational facilities with a combined capacity of 16 gigawatt-hours (GWh) of lithium-ion battery production, with another 15 GWh under construction. That’s enough to power thousands of electric vehicles or store renewable energy for entire communities. What makes this deal particularly intriguing is the startup’s plan to integrate lithium-sulfur battery technology, a potential game-changer in the industry. I can’t help but wonder: could this be the spark that ignites a new era of energy innovation?

Why the European Battery Giant Fell

Before diving into the acquisition’s potential, let’s take a step back to understand why this European company collapsed. Once hailed as a cornerstone of Europe’s energy ambitions, the firm faced a perfect storm of challenges. Delivery delays, skyrocketing costs, and funding shortages crippled its operations. By late 2024, it had no choice but to file for bankruptcy, leaving its state-of-the-art facilities dormant and its vision for a sustainable future in jeopardy.

Financial mismanagement and operational hurdles can sink even the most ambitious ventures.

– Industry analyst

The company had raised over $10 billion at its peak, backed by investors who saw it as a linchpin in reducing Europe’s reliance on foreign battery production. Yet, as costs ballooned and deadlines slipped, confidence waned. It’s a sobering reminder that even the most promising startups need airtight execution to survive. In my view, this collapse highlights the risks of scaling too fast without a robust financial foundation.

The US Startup’s Bold Vision

Enter the California-based startup, a company with a knack for seizing opportunities where others see failure. By acquiring these gigafactories, it’s not just picking up assets—it’s inheriting a legacy. The plan? Restart production immediately at the Swedish facility, continue construction in Germany, and leverage the acquired intellectual property to push the boundaries of battery technology. It’s a high-stakes gamble, but one that could pay off handsomely.

The startup isn’t stopping at lithium-ion. It’s eyeing a transition to lithium-sulfur batteries, which promise higher energy density and lower environmental impact. This could be a game-changer for electric vehicles and renewable energy storage. As someone who’s followed the clean energy space for years, I find this pivot particularly exciting—it’s like watching a phoenix rise from the ashes of a failed venture.

- Immediate production restart: The Swedish gigafactory will resume lithium-ion battery output in Q4.

- Construction continuation: The German facility’s 15 GWh expansion will move forward.

- Technology transition: Plans to integrate lithium-sulfur chemistry based on market demand.

A Strategic Expansion Across Borders

This acquisition isn’t the startup’s first rodeo. It previously snapped up a Polish energy storage division and a California-based lithium-metal battery firm, signaling a clear strategy to dominate the battery market. Now, it’s in talks to acquire a Quebec-based facility with integrated cell production, cathode manufacturing, and recycling lines. This cross-border expansion shows a company thinking globally, not just locally.

A recent $200 million funding round will fuel these ambitions, covering everything from restarting production to advancing research into next-gen batteries. It’s a bold move, especially in a competitive market where giants like Tesla and CATL loom large. But as I see it, there’s something inspiring about a startup taking on such a massive challenge—perhaps it’s the underdog story we all secretly root for.

| Facility | Location | Capacity | Status |

| Northvolt Ett | Sweden | 16 GWh | Operational |

| Northvolt Drei | Germany | 15 GWh | Under Construction |

| Northvolt Dwa | Poland | Varies | Production Q4 |

| Northvolt Six | Quebec | TBD | In Negotiation |

What This Means for the Energy Market

The implications of this deal stretch far beyond the balance sheets. For Europe, it’s a chance to reclaim a piece of its energy storage ambitions. The region has long struggled to compete with Asia’s dominance in battery manufacturing, and this acquisition could shift the tide. By restarting production and introducing new technologies, the startup is positioning itself as a key player in the global energy transition.

For consumers, this could mean more affordable and sustainable batteries for electric vehicles and home energy systems. Lithium-sulfur batteries, in particular, could reduce reliance on scarce materials like cobalt, making production cheaper and greener. But the road ahead isn’t without bumps—scaling production, integrating new tech, and competing with established players will test the startup’s mettle.

The future of energy storage hinges on innovation and bold investments like this one.

– Energy market expert

Challenges and Opportunities Ahead

No acquisition of this scale comes without risks. Restarting dormant factories, integrating new leadership, and transitioning to unproven battery chemistries are daunting tasks. The startup will need to navigate supply chain complexities and market competition while maintaining investor confidence. Yet, the opportunities are equally massive—capturing a slice of the growing energy storage market could yield billions in revenue.

In my opinion, the real wildcard here is the shift to lithium-sulfur. If the startup can crack the code on scaling this technology, it could disrupt the industry in ways we haven’t seen since lithium-ion became mainstream. But if it stumbles, the financial fallout could be significant. It’s a high-wire act, and I’m genuinely curious to see how it plays out.

- Supply chain stability: Securing raw materials for lithium-ion and lithium-sulfur production.

- Operational efficiency: Streamlining factory processes to hit production targets.

- Market adoption: Convincing manufacturers to adopt lithium-sulfur technology.

A Broader Impact on Sustainability

Beyond profits, this acquisition has implications for the planet. Batteries are the linchpin of renewable energy, enabling everything from solar grids to electric cars. By reviving these gigafactories, the startup is contributing to a low-carbon future. The potential shift to lithium-sulfur could further reduce the environmental footprint of battery production, a critical step in combating climate change.

But let’s not get too starry-eyed. The energy sector is notoriously tough, and good intentions don’t always translate to success. Still, there’s something undeniably exciting about a company taking a leap like this. It’s a reminder that innovation often comes from unexpected places—like a scrappy startup betting big on a bankrupt giant’s assets.

This acquisition is more than a business deal; it’s a bold statement about the future of energy. As the startup moves forward, all eyes will be on its ability to deliver on its promises. Will it spark a revolution in battery technology, or will it stumble under the weight of its ambitions? Only time will tell, but one thing’s certain: this is a story worth watching.