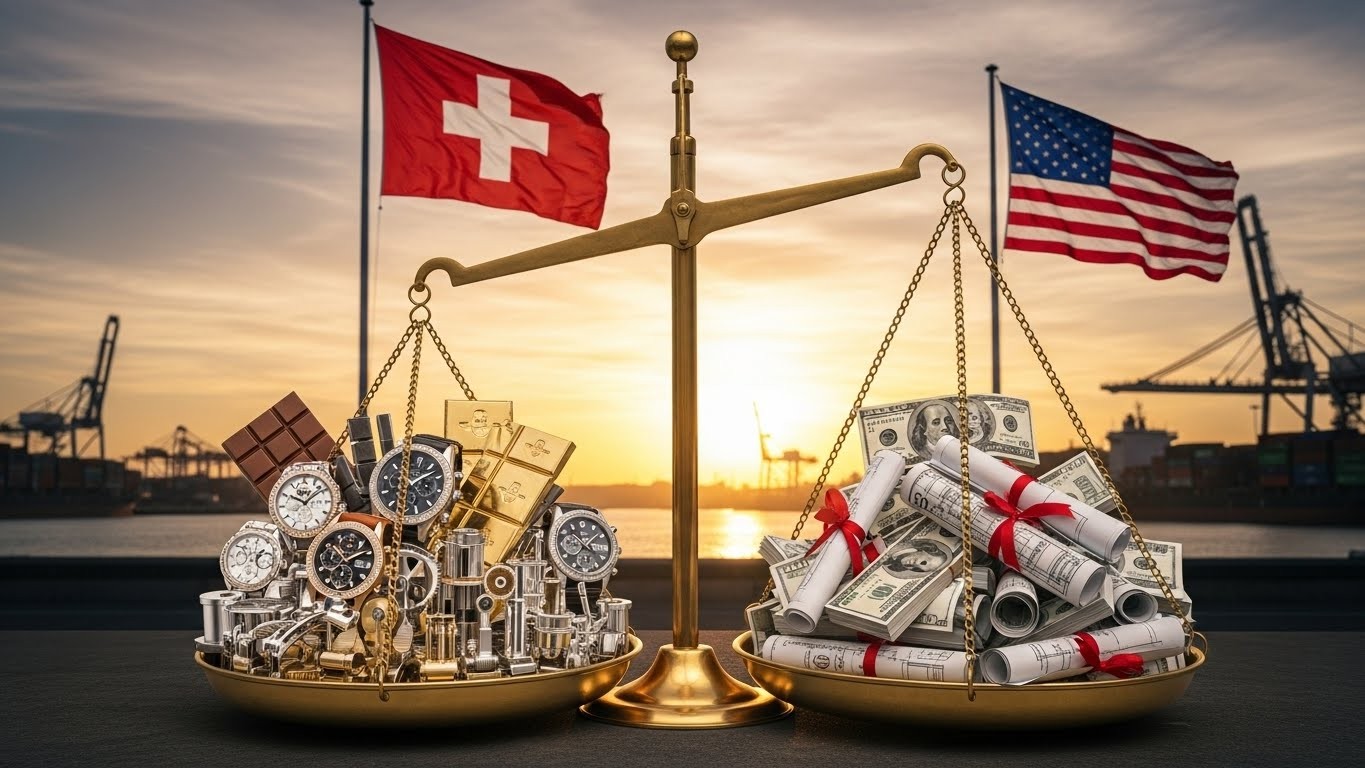

Imagine paying a punishing 39% tax on everything you ship to your biggest customer for months—then suddenly getting most of that money back plus a promise of smoother trade for years. That’s exactly what just happened to thousands of Swiss companies, and honestly, it feels like one of those quiet diplomatic victories nobody saw coming.

A Tariff U-Turn Nobody Expected

Late yesterday the Swiss government dropped a short statement that sent finance departments across Zurich, Geneva, and Basel scrambling (in the best possible way). The freshly negotiated 15% ceiling on U.S. tariffs isn’t just for future shipments—it applies all the way back to November 14. Yes, you read that right: retroactive relief. Companies that have been eating massive duties since August can now file for refunds. For some exporters that’s not pocket change; we’re talking tens or hundreds of millions flowing back into balance sheets before the end of the year.

In my experience watching trade spats, retroactive application is rare. Governments love collecting tariffs and hate giving money back. The fact Washington agreed to this tells you how badly both sides wanted the deal sealed.

From 39% Pain to 15% Ceiling Overnight

Let’s rewind a second. Over the summer the U.S. slapped a blanket 39% tariff on Swiss goods as part of a broader recalibration of trade relationships. Swiss watches, machinery, pharmaceuticals, chocolate—everything got hit. The U.S. quickly became an expensive market for a country that prides itself on precision and premium pricing.

By October the Swiss economic forecast was already being downgraded. Then the negotiators went quiet, very Swiss of them, and a month later we have a deal that cuts the average trade-weighted tariff by about 10 percentage points and caps any single category at 15%. That kind of swing changes five-year business plans in an afternoon.

“This will significantly improve access to the US market for Swiss companies.”

Swiss Federal Department of Economic Affairs

What Switzerland Actually Gave Up

Trade deals are never free lunches. In exchange for the tariff relief, Switzerland opened its own market in some interesting ways.

- Duty-free quotas for 500 metric tons of U.S. beef annually

- 1,000 metric tons of bison meat (yes, bison)

- 1,500 metric tons of poultry

- Lower tariffs on fish and certain seafood

- Removal of duties on a growing list of American products still being finalized

Those numbers sound small until you remember Switzerland isn’t exactly a huge meat-importing nation. Giving American ranchers duty-free access, even limited, is symbolically important—and probably made certain senators very happy.

The $200 Billion Commitment That Sealed It

Perhaps the most interesting piece, and the one that’s getting CFOs really excited, is Switzerland’s pledge to invest roughly $200 billion in the United States by the end of 2028. That’s not government money; it’s private-sector commitments from banks, insurance giants, pharma companies, and industrial players to build plants, expand R&D centers, and generally put money to work on American soil.

I’ve covered plenty of trade negotiations, and investment pledges this large are usually spread over a decade or more. Cramming $200 billion into four years feels aggressive—almost like Switzerland is saying, “We’ll take the tariff cut, but we’ll also supercharge our presence in your economy so everyone wins.”

Think new manufacturing facilities in the Midwest, expanded biotech campuses on both coasts, maybe even some acquisition spree money. That kind of capital deployment creates jobs, tax revenue, and political goodwill. Smart move.

Who Wins Biggest Inside Switzerland?

Not every Swiss exporter benefits equally, of course. The machinery and precision-instrument crowd probably wakes up happiest today. Same for specialty chemical and pharmaceutical firms that were getting crushed by the old rate.

Luxury watchmakers? They’ll breathe easier, though many were already absorbing or passing on costs to wealthy clients. Nestlé and the big food players might see marginal gains. But smaller mid-sized firms that live or die by thin margins—those are the ones throwing parties in canton Zurich right now.

The Bigger Trade Chessboard

Zoom out and this deal is fascinating for what it says about current U.S. trade strategy. While louder, larger economies are still negotiating or threatening retaliation, little Switzerland—population 8.7 million, roughly the size of New Jersey—slipped in, offered investments plus agricultural concessions, and walked away with retroactive relief.

It’s almost a playbook: combine high-value added exports with serious inbound investment promises, throw in some red-state-friendly agricultural access, and suddenly the tariff wall has a Swiss-shaped hole in it.

Other mid-sized exporting nations are almost certainly studying the fine print right now.

What Happens Next

Customs refunds will start flowing soon—expect a lot of Swiss controllers working weekends to file paperwork before year-end closes. The U.S. Federal Register still has to publish the expanded exemption list (aircraft parts, rubber products, generics, cosmetics, etc.), so another wave of relief is coming.

Longer term, keep an eye on where that $200 billion actually lands. If Swiss firms deliver even two-thirds of the pledge, we’re looking at one of the larger cross-border private investment surges in recent memory.

And for the rest of the world stuck behind higher tariff walls? Well, maybe the lesson is simple: sometimes quiet diplomacy, precise concessions, and a willingness to invest heavily in your partner’s economy gets you further than public complaints.

Switzerland just reminded everyone how the game can still be played—and won.