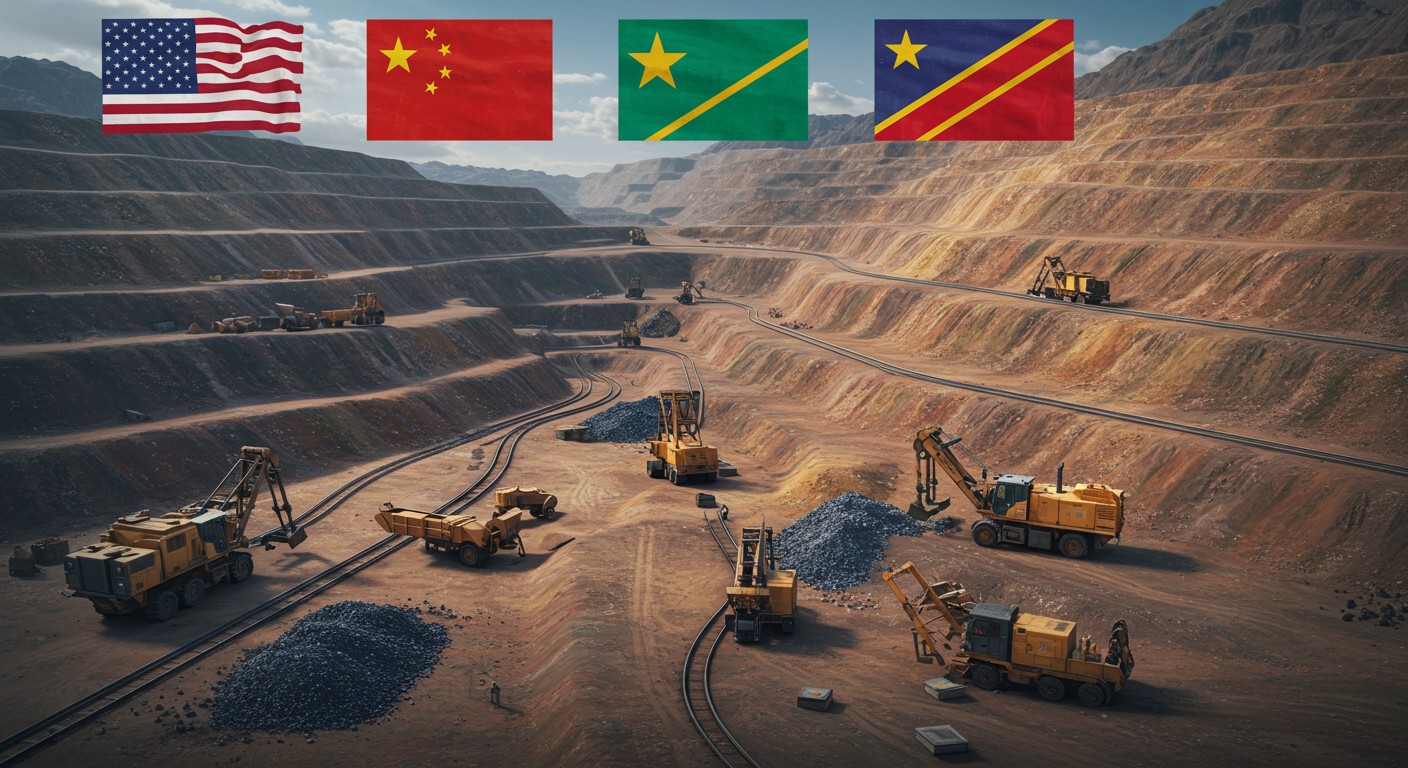

Have you ever wondered what powers the batteries in your smartphone or electric car? The answer lies deep in the heart of Africa, where a quiet but fierce competition is unfolding. The Democratic Republic of Congo (DRC), a nation rich in cobalt, copper, and lithium, has become a geopolitical chessboard for global superpowers. For years, one country dominated this treasure trove, but now another is making bold moves to catch up, reshaping the global supply chain for critical minerals. This isn’t just about mining—it’s about the future of technology, defense, and global influence.

The New Great Game in the DRC

The DRC holds the keys to the modern world. With roughly 70% of the global cobalt supply and vast reserves of lithium and copper, it’s no surprise that global powers are vying for influence. These minerals are the lifeblood of electric vehicles, renewable energy systems, and cutting-edge defense technologies. For a long time, one nation held a near-monopoly on these resources, but the tides are shifting. A new player is stepping up, and the stakes couldn’t be higher.

Why the DRC Matters

Let’s break it down. The DRC isn’t just another mining hub—it’s the epicenter of the critical minerals revolution. Cobalt, for instance, is a cornerstone of lithium-ion batteries, powering everything from your laptop to Tesla’s latest models. Lithium, another DRC gem, is equally vital for energy storage, while copper keeps the world’s electrical systems humming. The country’s mineral wealth is staggering, but its strategic importance goes beyond economics. Whoever controls these resources holds significant leverage in global markets and geopolitics.

The DRC’s mineral wealth is a double-edged sword—it’s both a blessing and a magnet for global competition.

– Industry analyst

In my view, the DRC’s role in the global economy is like the heart pumping blood to vital organs. Without its minerals, the tech and energy sectors would grind to a halt. But this wealth comes with challenges—political instability, ethical concerns, and now, a tug-of-war between superpowers.

The Shifting Power Dynamics

For years, one country built a strong foothold in the DRC’s mining sector, securing major deals and infrastructure projects. Its approach was straightforward: invest heavily, build relationships, and prioritize non-interference. This strategy paid off, with control over key assets like the Tenke Fungurume mine. But recently, another major power has entered the fray, driven by a need to secure its own supply chains and reduce dependency on foreign minerals.

The newcomer’s strategy is bold. Reports indicate that it has brokered deals to block certain acquisitions while pushing its own companies into the DRC’s mining landscape. For example, a consortium led by former military executives is now bidding for major projects, including a significant copper-cobalt operation. Meanwhile, high-profile investors, including tech billionaires, are backing exploration deals for lithium deposits. It’s a calculated push to challenge the status quo.

- Blocking strategic acquisitions to limit foreign control.

- Backing new exploration projects with private capital.

- Forming diplomatic agreements to secure mineral access.

What’s fascinating here is the speed of this shift. It’s as if the new player woke up one day and realized it couldn’t afford to sit on the sidelines any longer. The DRC’s minerals are too critical to ignore, and the race is on.

A Delicate Balancing Act

The DRC’s government is caught in the middle. On one hand, it benefits from long-standing partnerships with its dominant partner, which has poured billions into mining and infrastructure. On the other, it’s being courted by a new player offering security agreements and investment opportunities. The Congolese leadership is walking a tightrope, trying to maximize economic gains without alienating either side.

There’s room for everyone—American, European, and Chinese—in the DRC’s mineral sector.

– Congolese academic

This perspective is refreshing. Rather than picking sides, the DRC seems to be playing the long game, leveraging competition to its advantage. But can it maintain this balance without sparking tensions? That’s the million-dollar question.

The Minerals at the Heart of the Race

Let’s zoom in on the minerals driving this competition. Each one plays a unique role in the global economy, and their importance is only growing.

Cobalt: The Battery King

Cobalt is the star of the show. With the DRC supplying 70% of the world’s cobalt, it’s no wonder everyone wants a piece of the action. This mineral is critical for lithium-ion batteries, which power everything from smartphones to electric vehicles. As the world races toward net-zero emissions, demand for cobalt is skyrocketing.

Here’s a quick look at why cobalt matters:

| Application | Why It Needs Cobalt | Global Demand Growth |

| Electric Vehicles | Improves battery stability | High |

| Renewable Energy | Enhances energy storage | Moderate |

| Defense Tech | Strengthens alloys | Steady |

The DRC’s cobalt dominance gives it unparalleled leverage, but it also makes the country a target for geopolitical maneuvering.

Lithium: The Energy Storage Champion

Lithium is another critical piece of the puzzle. As the world shifts to renewable energy, lithium-ion batteries are becoming essential for storing solar and wind power. The DRC’s lithium deposits, particularly in areas like Manono, are attracting significant attention. However, legal disputes and competing claims have complicated access to these resources.

Personally, I find the lithium race particularly intriguing. It’s not just about mining—it’s about who can secure the rights to explore and develop these deposits first. The stakes are high, and the competition is fierce.

Copper: The Unsung Hero

Copper might not get the same headlines as cobalt or lithium, but it’s just as vital. From electrical wiring to renewable energy infrastructure, copper is everywhere. The DRC’s copper reserves are among the largest in the world, making it a key player in this market.

What strikes me is how copper often flies under the radar. It’s not as “sexy” as cobalt or lithium, but its steady demand makes it a cornerstone of the global economy.

The Geopolitical Chessboard

This competition isn’t just about minerals—it’s about power. The DRC’s resources give it a unique position in global geopolitics, but they also make it a potential flashpoint. Both sides are playing a high-stakes game, using diplomacy, investments, and even security agreements to gain an edge.

One side emphasizes non-interference and economic partnerships, offering infrastructure and military support. The other is leveraging minerals-for-security deals, tying resource access to regional stability. It’s a fascinating contrast in approaches, and the DRC is navigating it with surprising finesse.

The US is waking up to its critical mineral vulnerabilities and is now playing catch-up.

– Geopolitical analyst

This quote captures the essence of the race. The newcomer is moving fast, but it’s starting from behind. Can it close the gap? Only time will tell.

What’s Next for the DRC?

The DRC stands at a crossroads. It can leverage this competition to boost its economy, improve infrastructure, and strengthen its global standing. But it also risks becoming a pawn in a larger game. The government’s ability to balance these competing interests will determine its success.

- Strengthen domestic policies to ensure fair deals.

- Invest in local processing to add value to raw minerals.

- Maintain diplomatic neutrality to avoid alienating partners.

In my opinion, the DRC has a golden opportunity here. By playing its cards right, it could transform its mineral wealth into long-term prosperity. But it won’t be easy—geopolitical rivalries are notoriously tricky to navigate.

The Bigger Picture

This race for the DRC’s minerals is about more than just cobalt or lithium. It’s about securing the future of technology, energy, and defense. As the world moves toward a greener, more connected future, the demand for these resources will only grow. The question is: who will control the supply?

From where I stand, this competition feels like a modern-day gold rush. The DRC is the new frontier, and the players are all in. Whether it’s electric vehicles, renewable energy, or military tech, the minerals mined in the DRC will shape the 21st century.

So, what’s the takeaway? The DRC’s mineral wealth is a game-changer, but it’s also a test of global cooperation. Can superpowers compete without destabilizing the region? Can the DRC capitalize on its resources without losing its autonomy? These are the questions that will define the next decade.

As this competition heats up, one thing is clear: the DRC’s minerals are too valuable to ignore. The world is watching, and the outcome will ripple across industries and borders. Stay tuned—this story is far from over.