Have you ever wondered what happens when a single missing piece brings a giant to its knees? In the heart of the automotive world, a storm is brewing, and it’s not about sleek designs or cutting-edge tech. It’s about something far smaller yet devastatingly critical: semiconductors. The recent warning from a major German automaker about potential production stoppages due to a chip supply disruption has sent ripples through the industry, and I can’t help but feel this is a wake-up call for how interconnected our global economy truly is.

The Semiconductor Crisis Shaking the Auto Industry

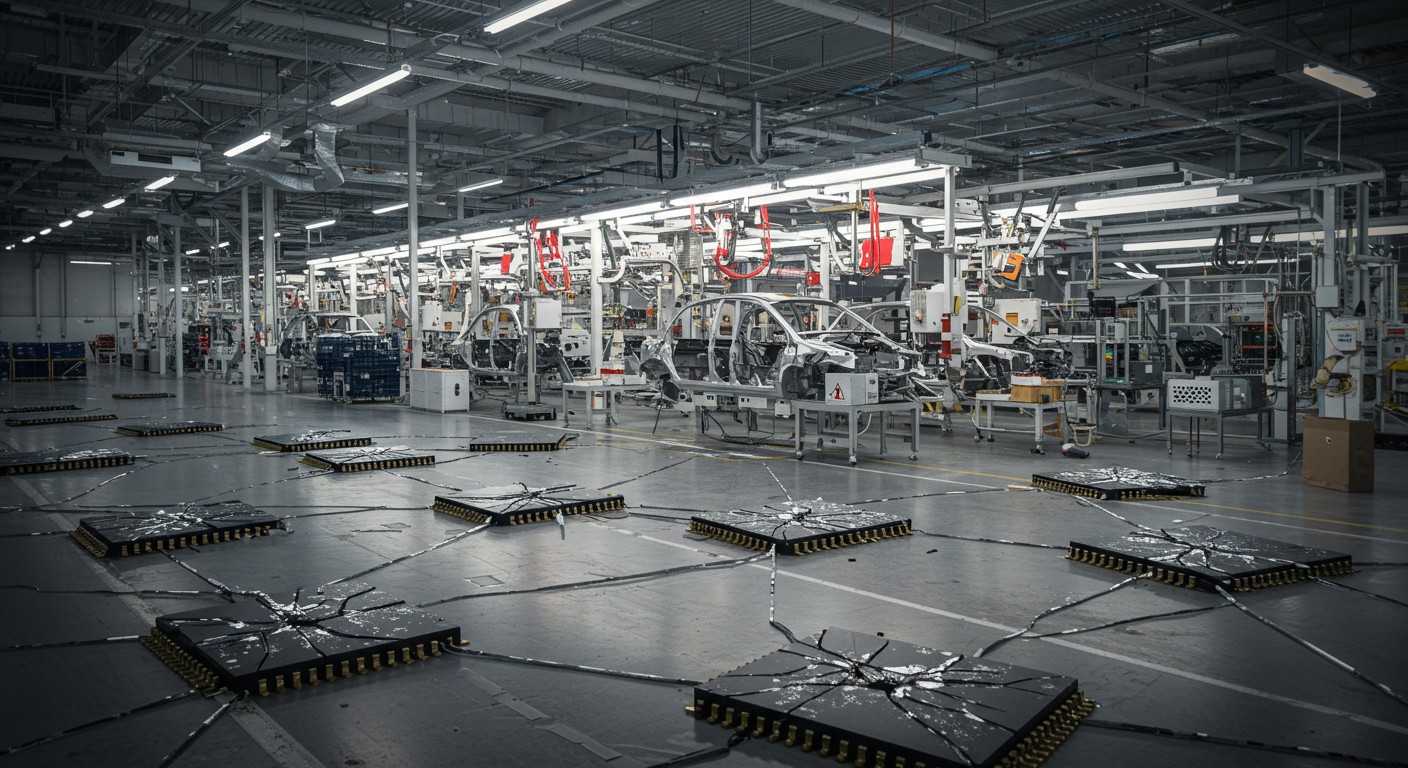

The automotive sector is no stranger to challenges, but the current semiconductor shortage feels like a punch to the gut. A leading German car manufacturer recently raised alarms about temporary production halts, not because of internal missteps, but due to export restrictions on chips from a key supplier based in the Netherlands. This isn’t just a hiccup; it’s a potential domino effect that could stall assembly lines and delay deliveries worldwide.

While the supplier isn’t directly linked to the automaker, their components are embedded in critical vehicle parts. Think of it like a recipe missing a pinch of salt—it might seem minor, but the whole dish suffers. The company is scrambling to assess risks, but the reality is stark: short-term production impacts are looming.

The global supply chain is like a house of cards—one disruption, and the whole structure wobbles.

– Industry analyst

Why Chips Matter More Than You Think

Modern cars aren’t just metal and rubber; they’re rolling computers. From infotainment systems to advanced driver-assistance systems (ADAS), semiconductors are the brains behind the operation. A single vehicle can require hundreds of chips, each performing a specific task. When the supply of these tiny components dries up, production grinds to a halt.

The current crisis stems from export restrictions tied to geopolitical tensions, specifically between China and the Netherlands. These restrictions have choked the flow of chips from a major supplier, leaving automakers in a lurch. It’s a stark reminder that global trade isn’t just about goods—it’s about politics, power, and fragile alliances.

- Critical components: Chips power everything from engines to safety features.

- Geopolitical ripple effects: Trade disputes can disrupt entire industries.

- Supply chain fragility: A single supplier issue can halt production lines.

The Domino Effect on the Auto Industry

The impact of this chip shortage extends far beyond factory floors. Dealerships may face inventory shortages, driving up prices for consumers. I’ve seen how quickly supply chain issues can turn a buyer’s market into a seller’s paradise, with waitlists stretching months. For an industry already grappling with post-pandemic recovery, this is salt in the wound.

Industry groups have warned of “significant production restrictions” in the near future. This isn’t just about one automaker; it’s a signal that the entire sector could face turbulence. Smaller manufacturers, with less negotiating power, might feel the squeeze even harder.

| Impact Area | Consequence | Severity |

| Production | Assembly line stoppages | High |

| Consumer Prices | Increased vehicle costs | Medium |

| Delivery Times | Extended wait periods | Medium-High |

Navigating the Crisis: What’s Being Done?

The automaker isn’t sitting idle. They’re in constant talks with suppliers and stakeholders to mitigate risks. But let’s be real—there’s no quick fix. Diversifying supply chains, investing in domestic chip production, or even redesigning vehicles to use fewer chips are long-term solutions, not Band-Aids for today’s mess.

Perhaps the most frustrating part is how unpredictable this crisis feels. One day, production is humming along; the next, a geopolitical spat halfway across the globe throws a wrench in the works. It’s a humbling lesson in how interconnected our world has become.

Adaptability is the key to surviving in today’s volatile market.

– Supply chain expert

What This Means for Consumers

If you’re in the market for a new car, brace yourself. Limited inventory could mean higher prices and longer wait times. I’ve always believed that timing is everything when buying a vehicle, and right now, patience might be your best ally. Dealerships may push add-ons or pricier models to offset losses, so do your homework before signing on the dotted line.

- Shop early: Beat the rush before inventory dwindles further.

- Compare prices: Dealerships may vary widely in pricing.

- Consider used: Pre-owned vehicles might sidestep supply issues.

The Bigger Picture: A Wake-Up Call for Global Trade

This chip shortage isn’t just an automotive problem; it’s a symptom of a deeper issue. Our reliance on a handful of global suppliers for critical components is a risky bet. In my view, this crisis could spark a shift toward more resilient supply chains, with companies investing in local production or alternative technologies. But that’s a big “if”—change doesn’t come cheap or quick.

The auto industry’s woes also highlight the fragility of global trade networks. A single policy change in one country can ripple across continents, affecting everything from stock prices to consumer confidence. It’s a stark reminder that no industry, no matter how powerful, is immune to disruption.

Looking Ahead: Can the Industry Bounce Back?

Despite the gloom, there’s room for optimism. The automotive industry has weathered storms before—think of the 2008 financial crisis or the early days of the pandemic. Each time, it’s emerged stronger, leaner, and more innovative. The current chip crisis might push companies to rethink their supply chains, invest in new technologies, or even accelerate the shift to electric vehicles, which could require different chip configurations.

Still, the road ahead is bumpy. Short-term disruptions are almost certain, and the ripple effects could linger for months. For now, the focus is on damage control—keeping lines running, managing costs, and reassuring investors. But the bigger question is whether this crisis will be the catalyst for lasting change.

Supply Chain Resilience Model: 50% Diversified Suppliers 30% Local Production 20% Technological Innovation

As I reflect on this, I can’t help but wonder: are we witnessing a turning point for global manufacturing? The stakes are high, and the solutions aren’t simple. But one thing’s clear—the industry, and the consumers it serves, will need to adapt to a new reality.