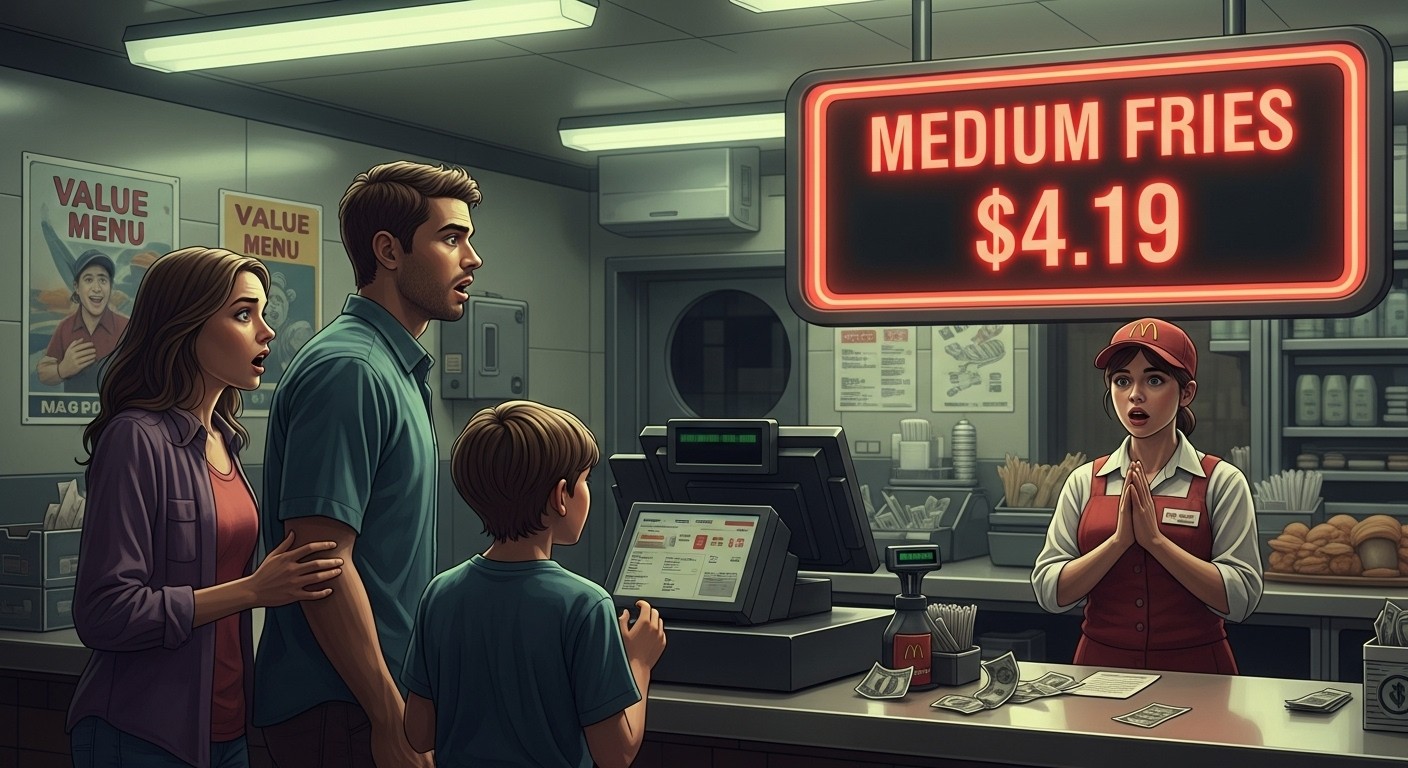

Remember when grabbing a quick burger and fries felt like the ultimate cheap treat? You’d walk out of the drive-thru with change from a ten-dollar bill and still feel like you got away with something. Those days are gone. Today a medium order of fries can set you back more than four bucks, and that single price tag has become a painfully perfect symbol of everything that’s going wrong with the cost of living in America.

It sounds almost silly to get worked up over potatoes, but that’s exactly why the outrage feels so real. When something as basic as fast-food fries jumps that much in price, it forces everyone to confront a uncomfortable truth: the life we used to take for granted is slipping away faster than most of us want to admit.

The Fast-Food Price Shock Nobody Saw Coming

Let’s start with the numbers that made jaws drop across social media recently. Between 2019 and late 2025, some of the most popular menu items at the golden arches have more than doubled – in a couple of cases they’ve nearly tripled.

| Menu Item | 2019 Price | 2025 Price | Increase |

| Medium Fries | $1.79 | $4.19 | 134% |

| McChicken | $1.29 | $3.89 | 202% |

| Big Mac | $3.99 | $7.49 | 88% |

| 10-piece Nuggets | $4.49 | $7.58 | 69% |

| Cheeseburger | $1.00 | $3.15 | 215% |

Look especially at that cheeseburger line. A buck to three-fifteen in half a decade. I don’t know about you, but I remember when the “dollar menu” actually had items that cost a dollar. Now it feels more like the “wishful thinking menu.”

It’s Not Just Greed – It’s Supply, Demand, and Years of Bad Policy

Whenever these price hikes hit the headlines, two camps immediately form. One side screams corporate greed. The other side points to inflation and supply-chain issues. The truth, as usual, lives somewhere in the messy middle.

Yes, restaurants are dealing with higher wages, energy costs, packaging costs, and rent. But they’re also operating in an environment where the money supply grew dramatically while production of actual goods stagnated. Too many dollars chasing too few goods – that’s textbook inflation, even if some officials insist on moving the goalposts when they measure it.

When the price of something as simple as french fries becomes a national topic of conversation, you know the average household budget is under serious strain.

Beef, Turkey, and the Vanishing American Herd

If you think fries are bad, brace yourself for what’s happening with protein. The U.S. cattle herd has shrunk to levels not seen since the early 1950s. Droughts, skyrocketing feed costs, and years of thin margins forced ranchers to send more animals to slaughter earlier than normal. The herd simply hasn’t recovered.

Major meatpackers are actually closing plants because there aren’t enough animals to keep them running profitably. That tightness pushes wholesale beef prices higher, which flows straight through to your hamburger and steak prices.

And before you decide to swap the burger for turkey, think again. Wholesale frozen turkey prices are projected to jump roughly forty percent year-over-year in 2025, thanks to avian flu outbreaks and steady demand.

Housing: The Dream That Doubled in Price

Food is only part of the picture. Shelter costs have arguably delivered the knockout punch to the middle-class lifestyle.

In rural counties – traditionally the most affordable places to live – the income needed to buy a median-priced home has more than doubled since 2019. You read that right: doubled. Suburban counties aren’t far behind at roughly ninety percent increase, and urban areas sit at almost eighty-eight percent.

- 2019 rural income needed: ~$36,000

- 2025 rural income needed: ~$74,500

- Suburban jump: $53,500 → $102,000

- Urban jump: $63,000 → $118,000

Unless your salary literally doubled in five years (and for the vast majority of people it absolutely did not), owning a home moved further out of reach than at any point in modern history.

Cars Went Luxury Whether You Wanted One or Not

Need wheels to get to work? Good luck. The average transaction price for a new vehicle is flirting with fifty grand. That’s not a loaded luxury SUV – that’s the average, including base-model sedans and small crossovers.

Used-car prices, which used to offer relief, remain elevated too. Chip shortages, supply-chain chaos, and manufacturers focusing on higher-margin trucks have combined to make basic transportation another budget-buster.

Meanwhile, the Job Market Turns Ice-Cold

Here’s the cruelest part of the equation: just when everything costs dramatically more, the labor market is cooling fast. Youth unemployment is climbing, recent college graduates are facing one of the toughest entry-level markets in decades, and layoff announcements keep rolling in.

Rail traffic, container shipments from Asia, and trucking tonnage are all down year-over-year. When less stuff moves, fewer people are needed to move it. Simple as that.

For the first time in modern history, a bachelor’s degree is no longer a reliable path to professional employment.

Chief economist at a labor-market research institute

The Mood of the Nation Has Shifted

Survey after survey shows the same gloomy picture. Only about one in five middle-income households expect to be better off a year from now. That’s a worse outlook than we saw at the height of the pandemic lockdowns.

Families making six-figure incomes are sitting in the dark to save on electricity, painting rocks as Christmas gifts, and racking up credit-card debt just to keep the lights on and food on the table. If people at that income level are in survival mode, imagine how the bottom half of earners feel.

I’ve talked to friends who haven’t taken a real vacation in years. Others who used to eat out once or twice a week now consider it a rare treat. The little pleasures that made the daily grind bearable are disappearing one by one.

So the next time someone rolls their eyes at the “four-dollar fries outrage,” understand what they’re really dismissing. They’re dismissing the lived reality of millions of households that are working harder than ever, yet watching their quality of life evaporate.

This isn’t about being unable to afford gourmet dining or luxury handbags. This is about the basics – food, shelter, transportation, and a sense of forward progress – becoming noticeably harder for ordinary people to secure.

We kept hearing that the economy was “strong” because stock markets were hitting all-time highs and unemployment figures looked okay on paper. But for huge swaths of the population, those headlines ring hollow when a fast-food run now requires a mental budget meeting.

The $4 fries aren’t the disease. They’re the thermometer. And right now that thermometer is flashing warning signs most of us can no longer ignore.