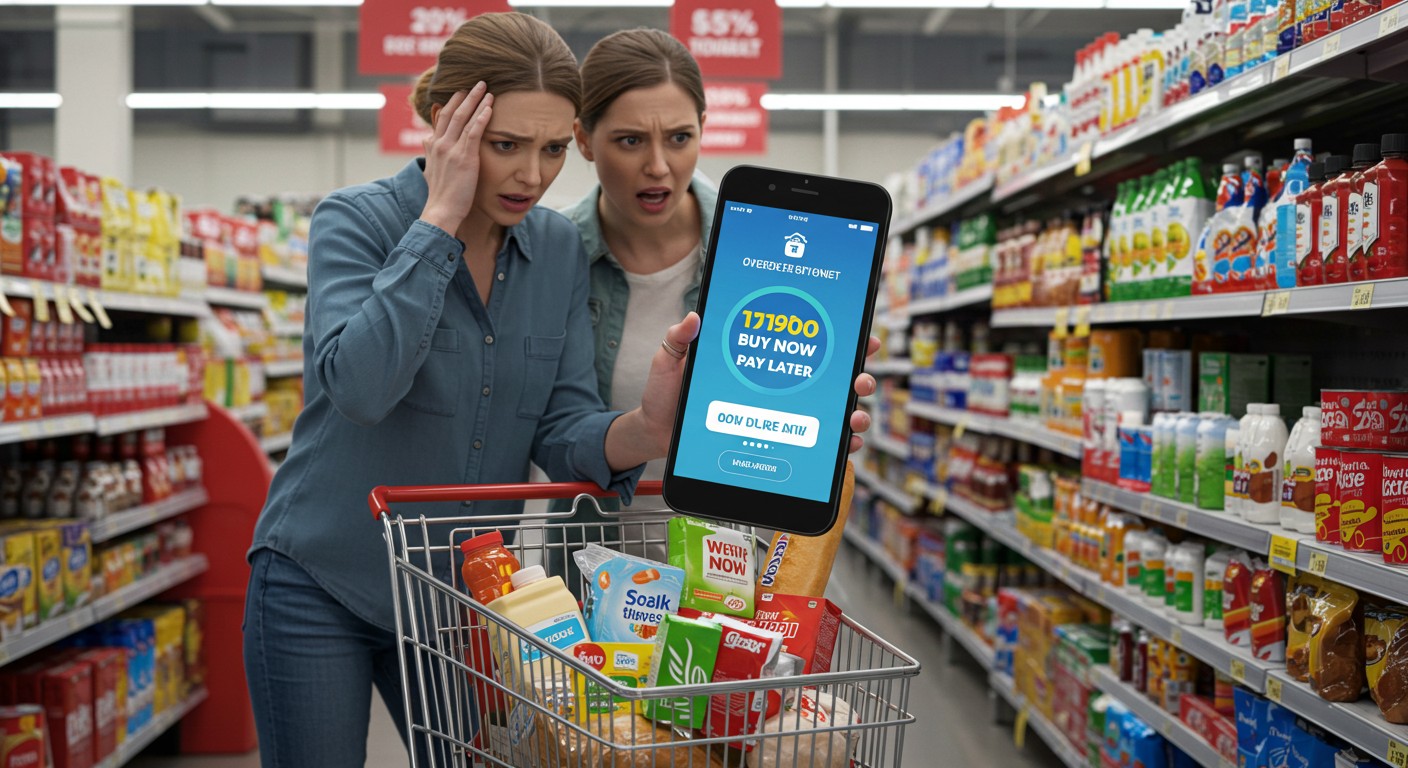

Have you ever stood in a grocery store aisle, mentally tallying your cart while wondering how you’ll cover the bill? For a growing number of Americans, that moment of hesitation is leading to a new solution: Buy Now, Pay Later (BNPL) services. Once reserved for big-ticket items like electronics or furniture, BNPL is now creeping into the checkout lanes for daily essentials—yes, even your milk and bread. But here’s the kicker: as more people lean on this financing to stretch their budgets, late payments are climbing, signaling deeper financial strain. Let’s unpack what’s driving this trend, why it’s happening, and what it means for everyday households.

The Rise of BNPL for Everyday Purchases

The idea of splitting a $50 grocery bill into four payments might sound absurd to some, but it’s becoming a lifeline for others. Recent surveys show a sharp uptick in Americans using BNPL for necessities, with 25% of users reporting they’ve financed groceries, up from just 14% a year ago. Younger generations, especially Gen Z, are leading the charge—33% of them have used BNPL to cover food costs. This isn’t just a quirky trend; it’s a red flag about the state of personal finances in an economy battered by inflation and high interest rates.

People are turning to BNPL because their paychecks aren’t keeping up with the cost of living.

– Financial analyst

Inflation has made everything from eggs to cereal pricier, while wages for many remain stagnant. Add in looming economic uncertainties—like potential tariffs—and it’s no wonder folks are looking for ways to make ends meet. BNPL offers a quick fix: no interest (if you pay on time), no lengthy credit checks, and the ability to spread costs over weeks or months. Sounds like a dream, right? Well, not so fast.

Why Groceries? The Shift in BNPL Usage

Traditionally, BNPL was the go-to for splurging on a new phone or a designer jacket. Today, the top categories are still clothing (41%) and tech (39%), but the surge in grocery purchases is what’s raising eyebrows. Why are people financing something as basic as food? The answer lies in a perfect storm of economic pressures.

- Inflation’s bite: Grocery prices have risen faster than many household incomes, forcing tough choices.

- Cash flow woes: For those living paycheck to paycheck, BNPL aligns payments with income cycles.

- Accessibility: BNPL apps are user-friendly, often integrated directly into checkout systems.

I’ve seen friends juggle multiple BNPL plans just to keep their fridge stocked, and it’s heartbreaking. It’s not laziness or overspending—it’s survival. When a gallon of milk costs $5 and your budget’s already stretched thin, splitting that cost into four $1.25 payments can feel like a godsend. But there’s a hidden cost to this convenience, and it’s not just financial.

The Dark Side: Late Payments and Regret

Here’s where things get dicey. A staggering 41% of BNPL users admit to missing payments in the past year, up from 34% the year before. Most say they were only late by a week or so, but even small delays can trigger fees, damage credit (if reported), or lock users out of future BNPL services. And let’s be honest—when you’re late on a payment for groceries, it’s not because you forgot; it’s because the money just isn’t there.

Regret is another common thread. Nearly half of BNPL users (48%) say they’ve regretted at least one purchase, with Gen Z feeling the sting most acutely—64% have second-guessed their decisions. Maybe it’s the realization that a $20 pizza order is now costing $25 with fees, or the stress of juggling multiple payment plans. Whatever the reason, the emotional toll is real.

BNPL can feel like a trap when you’re already stretched thin.

– Consumer behavior expert

Perhaps the most unsettling part is the misconception about credit scores. A whopping 62% of users believe timely BNPL payments boost their credit, but that’s not true—at least not yet. While some experts predict credit bureaus might eventually factor in BNPL performance, for now, paying on time does nothing for your score, but missing payments can hurt. It’s a lopsided deal that catches too many off guard.

How BNPL Impacts Relationships

Let’s pivot to something less talked about: how BNPL affects couples. Money is already a top stressor in relationships, and adding BNPL to the mix can crank up the tension. Imagine one partner using BNPL for groceries without telling the other, only for late payment notices to start piling up. Suddenly, you’re not just fighting about dinner plans—you’re arguing about trust and financial priorities.

| Financial Behavior | Relationship Impact | Stress Level |

| Secret BNPL Use | Erodes Trust | High |

| Missed Payments | Arguments Over Debt | Medium-High |

| Joint Budgeting | Strengthens Communication | Low |

In my experience, couples who tackle BNPL together—setting clear rules about when and how to use it—tend to fare better. It’s about transparency. If you’re both on board, BNPL can be a tool, not a ticking time bomb. But if one partner’s sneaking off to finance takeout, it’s a recipe for conflict.

Who’s Using BNPL the Most?

Not everyone’s jumping on the BNPL bandwagon equally. The data paints a clear picture of who’s most likely to swipe now and pay later:

- Gen Z (18–28): 64% have used BNPL, often for groceries or food delivery.

- Men: 53% have tried it, compared to 46% of women.

- Frequent users: 11% have used BNPL six or more times, and 23% have juggled three or more plans at once.

Why Gen Z? They’re entering adulthood in a tough economic climate, often with lower starting salaries and higher debt loads. BNPL feels like a natural fit for their digital-first, instant-gratification world. But older generations aren’t immune—29% of Boomers have used it, too, though they’re more likely to stick to bigger purchases.

Is BNPL a Solution or a Symptom?

Here’s a question to chew on: Is BNPL helping people manage their budgets, or is it masking a bigger problem? On one hand, it offers flexibility for those who need it most. If you’re short on cash but need to feed your family, splitting a grocery bill can be a game-changer. On the other hand, the rise in late payments and regret suggests BNPL is a Band-Aid on a deeper wound: financial instability.

Some argue BNPL is predatory, luring users into debt with promises of “interest-free” payments while banking on late fees. Others see it as a democratizing force, giving people access to credit traditional banks might deny. I lean toward skepticism—when you’re financing a $15 burger, something’s broken in the system. But I also get why people turn to it. Sometimes, you just need to eat.

BNPL is a tool, but it’s not a fix for systemic economic issues.

– Economic commentator

How Couples Can Navigate BNPL Safely

If you and your partner are considering BNPL—or already using it—here are some practical steps to keep it from derailing your finances or relationship:

- Talk it out: Agree on when BNPL is okay to use (e.g., emergencies only).

- Track payments: Use a shared app or calendar to monitor due dates.

- Budget first: Ensure BNPL fits into your overall financial plan, not as a crutch.

- Limit plans: Avoid juggling multiple BNPL agreements at once.

These steps aren’t foolproof, but they can reduce stress. I’ve found that couples who treat BNPL like a joint decision—rather than a solo act—tend to avoid the worst pitfalls. It’s about keeping the lines of communication open, even when money’s tight.

What’s Next for BNPL?

The BNPL boom shows no signs of slowing, especially as more retailers integrate it into their checkout systems. Some predict credit bureaus will soon factor BNPL into scores, which could be a double-edged sword—rewarding timely payers but penalizing those who slip. Others warn of a potential “BNPL bubble,” where overleveraged users default en masse, echoing the subprime crisis of the 2000s.

For now, BNPL is a mirror reflecting broader economic truths: people are stretched thin, and traditional financial systems aren’t meeting their needs. Whether it’s a lifeline or a trap depends on how you use it—and whether you can afford to pay later.

So, what’s the takeaway? BNPL for groceries might sound like a small choice, but it’s part of a bigger story about how Americans are navigating a tough economy. For couples, it’s a chance to strengthen communication—or a pitfall that can spark conflict. The key is to approach it with eyes wide open, knowing the risks and rewards. Next time you’re at the checkout, ask yourself: Is this a smart move, or am I just kicking the can down the road?