Ever feel like the economy’s sprinting toward a cliff, but nobody’s noticed the ground’s gone? I’ve been mulling over this lately, watching prices climb while quality tanks. It’s like we’re all Wile E. Coyote, mid-air, waiting for gravity to kick in. The signs are everywhere—corporations squeezing every penny, consumers stretched thin, and global trade hitting snags. So, what happens when the tricks that fueled sky-high profits run dry? Let’s unpack this mess.

The Illusion of Endless Profits

For years, companies have been raking in cash like kids at a candy store with no cashier. But this isn’t because they’re inventing better widgets or making our lives easier. No, it’s a mix of clever accounting, global loopholes, and some downright shady tactics. The economy’s been propped up by strategies that can’t last forever. And now, the cracks are showing.

Globalization’s Golden Era Is Over

Back in the early 2000s, globalization was the golden goose. Companies flocked to cheaper labor markets, slashing costs and boosting margins. By 2010, corporate profits had tripled from their 1990s levels, hitting a cool $2 trillion annually. It was a party, and everyone was invited—except the workers left behind. But here’s the kicker: that party’s winding down.

Supply chains are snarling, trade barriers are rising, and countries are rethinking open borders. The days of dirt-cheap manufacturing are fading. What’s left? Companies scrambling to keep profits high without the global crutch they leaned on for decades. It’s like trying to run a marathon after losing a shoe.

Globalization lifted profits to dizzying heights, but its reversal is pulling the rug out from under corporations.

– Economic analyst

The Dirty Tricks of Profit-Boosting

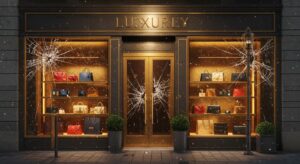

With globalization slowing, companies turned to other ways to pad their wallets. Ever notice how your cereal box is half-empty, or your “premium” subscription feels like extortion? That’s no accident. Here’s how they’ve been gaming the system:

- Price-gouging: Jacking up prices far beyond inflation, banking on consumer desperation.

- Shrinkflation: Selling less product for the same price—think thinner cans or smaller bags.

- Planned obsolescence: Designing products to break faster, forcing you to buy again.

- Immiseration: Cutting service quality to push pricey upgrades or subscriptions.

These tactics worked like a charm during the post-2020 spending spree, when stimulus checks and savings fueled demand. Profits soared to $4.3 trillion by 2024—way above what inflation would predict. But there’s a limit to how much you can squeeze before the balloon pops.

Consumers Are Tapped Out

Here’s where it gets personal. I’ve seen friends cut back on basics because their budgets can’t stretch anymore. Savings are dwindling, credit card debt’s spiking, and layoffs are creeping up. When consumers tighten their belts, companies feel the pinch. Those overpriced lattes and subscription traps? People are saying “no thanks.”

Recent data paints a grim picture. Household savings rates are at historic lows, and credit delinquency rates are climbing. If folks can’t—or won’t—spend, the whole profit machine grinds to a halt. It’s not just a blip; it’s a structural shift.

The Stock Market’s Shaky Ground

Wall Street’s been riding high, but it’s tethered to those juicy corporate profits. If earnings tank, so do stock valuations. Analysts are already whispering about a “reverse wealth effect,” where falling stock prices make consumers feel poorer, cutting spending even more. It’s a vicious cycle.

Let’s break it down with some numbers:

| Year | Corporate Profits ($T) | Stock Market Impact |

| 2000 | 0.8 | Stable Growth |

| 2010 | 2.2 | Post-Crisis Rally |

| 2024 | 4.3 | Inflated Valuations |

| 2025 (Projected) | 1.5-2.0 | Potential Correction |

If profits revert to inflation-adjusted norms—say, $1.5 trillion—stocks could take a serious hit. Investors banking on endless growth might find themselves staring at a cliff.

What’s Next for the Economy?

So, where do we go from here? The economy’s already off the cliff; we’re just waiting for the fall. Here’s what might happen next:

- Profit Crunch: Companies exhaust their gimmicks, and earnings plummet.

- Consumer Pullback: Spending drops as savings vanish and confidence wanes.

- Market Correction: Stocks adjust to reflect lower profits and grim outlooks.

- Recession Reality: Layoffs and reduced investment deepen the downturn.

It’s not all doom and gloom, though. Tough times force innovation. Companies might pivot to genuine value—better products, fairer prices. But that’s a long game, and we’re in for a rough patch first.

The economy’s been running on fumes. When reality hits, it’s going to sting.

How to Brace for Impact

I’ve been thinking about what this means for regular folks like us. If a recession’s coming, preparation’s key. Here’s a quick rundown:

- Build a cash buffer: Even a small emergency fund can soften the blow.

- Cut non-essentials: Ditch subscriptions that don’t spark joy.

- Shop smarter: Hunt for deals and avoid overpriced traps.

- Stay informed: Keep an eye on market signals to avoid surprises.

It’s not about panicking—it’s about being ready. The economy’s wobbly, but you don’t have to be.

Here’s the truth: the economy’s been coasting on tricks and illusions for too long. Corporate greed lit the fuse, but the bomb’s about to go off. Globalization’s stalling, consumers are done, and profits are set to crater. We’re not just talking a dip—this could be a full-on Wile E. Coyote moment. The question isn’t if we’ll fall, but how hard we’ll land. What do you think—can companies pivot, or are we in for a rough ride?