Have you ever watched a stock tumble despite a glowing earnings report and wondered if the market missed the memo? That’s exactly what’s happening with Dover, an industrial powerhouse that’s quietly reshaping itself into a high-margin, future-focused player. The company’s recent earnings beat expectations, yet its stock took a hit. In my view, this dip is less about Dover’s performance and more about the market’s short-sightedness. Let’s dive into why this could be a golden opportunity for savvy investors.

Unpacking Dover’s Earnings: A Misunderstood Success

Dover’s latest quarterly results were nothing short of impressive, yet the market’s reaction suggests a disconnect. The company posted a 5% year-over-year revenue increase to $2.05 billion, surpassing analyst expectations of $2.04 billion. Adjusted earnings per share came in at $2.44, beating the consensus estimate of $2.39. On top of that, Dover raised its full-year guidance, signaling confidence in sustained growth. So, why the sell-off? It’s a puzzle worth solving.

Perhaps the market is hung up on Dover’s growth rate, which isn’t as flashy as some of its peers. But I’d argue that’s missing the forest for the trees. Dover’s not just about raw revenue—it’s about strategic transformation. The company is leaning into high-growth sectors like AI data centers and biopharma, while shedding slower-moving businesses. This shift is setting the stage for stronger, more sustainable gains.

Why Dover’s Portfolio Shift Matters

Dover’s transformation isn’t just corporate jargon—it’s a deliberate pivot toward high-margin, secular growth markets. The company has been actively managing its portfolio, selling off lower-margin units and acquiring businesses that align with megatrends like AI and clean energy. For instance, its acquisition of Sikora, a high-margin player in measurement and inspection technologies, is a prime example of Dover’s knack for picking winners.

By focusing on high-growth sectors, Dover is positioning itself for long-term success in markets that matter.

– Industry analyst

These portfolio moves aren’t without challenges. They create complexity, with multiple moving parts that can confuse investors looking for a simple story. But that’s where the opportunity lies. Dover’s active portfolio management is like a chef refining a recipe—cutting out bland ingredients and adding bold flavors to create something extraordinary. The result? A leaner, more profitable company poised for acceleration.

The Power of Bookings and Momentum

One of the most telling signs of Dover’s strength is its bookings growth. Bookings, or total orders received, jumped 7% year over year and grew sequentially, signaling robust demand. Even better, Dover’s book-to-bill ratio—a key indicator of future revenue—remains above 1 across all five of its segments. In plain English, this means the company is taking in more orders than it’s fulfilling, a strong predictor of growth.

During the earnings call, management noted that early third-quarter orders are “tracking really well.” That’s not just corporate cheerleading—it’s a sign of momentum. When a company like Dover sees strength in its highest-margin segments, like clean energy components and biopharma, it’s a clear signal that the future is bright.

- 7% bookings growth: A clear indicator of rising demand.

- Book-to-bill above 1: Suggests revenue growth is sustainable.

- Strength in high-margin segments: Clean energy and biopharma are leading the charge.

Margins That Steal the Show

If there’s one area where Dover truly shines, it’s in its margins. The company reported a record adjusted EBITDA margin, with all five segments showing year-over-year improvements. This isn’t just a fluke—it’s the result of smart cost management, productivity initiatives, and a focus on higher-margin products. For example, the pumps and process solutions segment, which includes biopharma components and thermal connectors for AI data centers, saw margins expand by 180 basis points.

Why does this matter? Higher margins mean Dover is making more money on every dollar of revenue. It’s like upgrading from a budget sedan to a luxury SUV—same road, better ride. This margin expansion, coupled with strategic investments, sets Dover up for long-term profitability.

| Segment | Organic Revenue Growth | Margin Improvement |

| Engineered Products | -5% | +140 basis points |

| Clean Energy & Fueling | +8% | +80 basis points |

| Imaging & Identification | Flat | +30 basis points |

| Pumps & Process Solutions | +4% | +180 basis points |

| Climate & Sustainability | -6% | +60 basis points |

Riding the AI and Clean Energy Wave

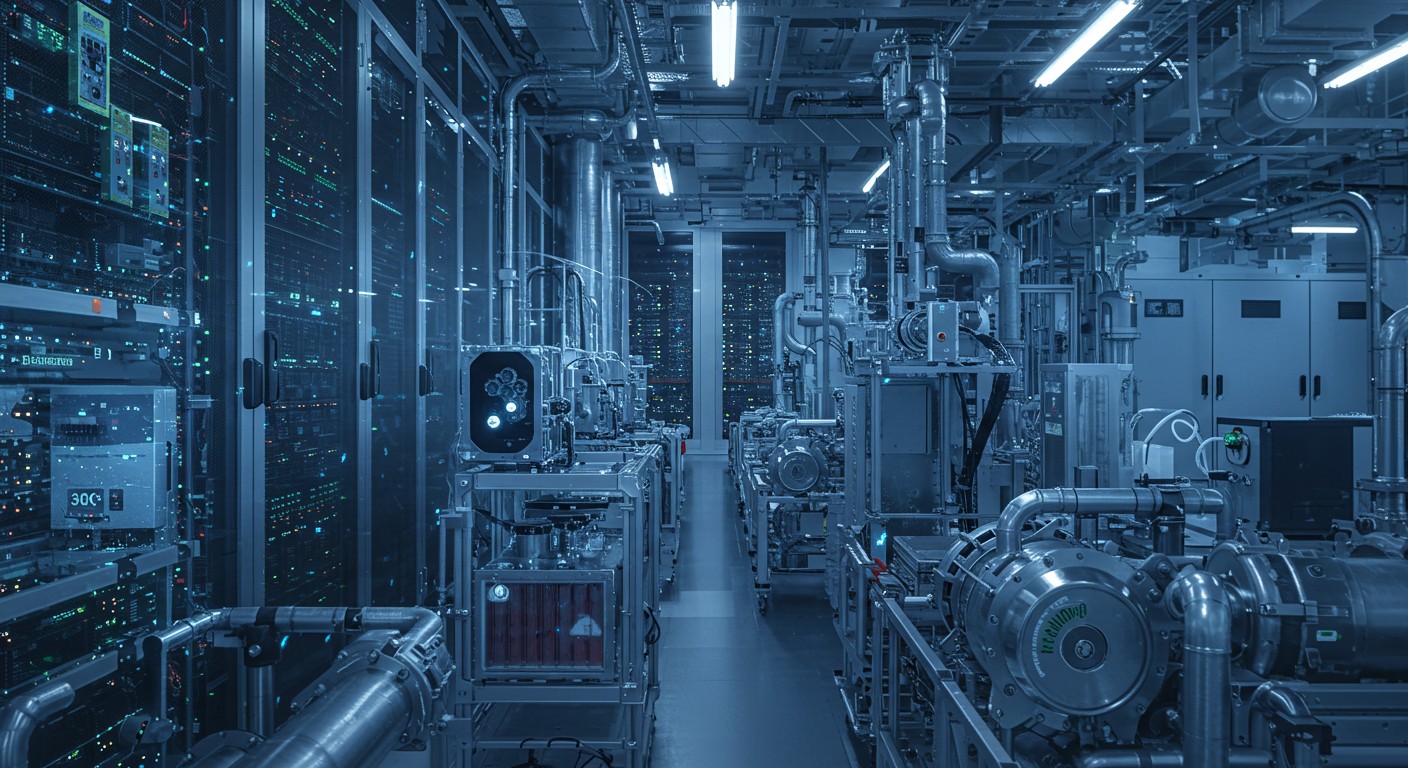

Dover’s exposure to AI data centers and clean energy is a game-changer. The company’s thermal connectors and heat exchangers are critical components in the liquid cooling systems powering AI servers. As data centers proliferate to meet the demands of artificial intelligence, Dover is well-positioned to capitalize. Similarly, its clean energy components, like CO2 refrigeration systems, tap into the growing demand for sustainable solutions.

These markets, which make up about 20% of Dover’s portfolio, are expected to grow at a double-digit clip. That’s not just a buzzword—it’s a structural tailwind that could drive significant revenue and margin growth. In my experience, companies that align with megatrends like these often outperform over the long haul.

The rise of AI and sustainability is reshaping industries, and Dover is riding both waves with precision.

A Clean Balance Sheet and Strategic Investments

Dover’s financial health is another reason to take notice. With a clean balance sheet and a sizable cash reserve, the company has the flexibility to pursue both organic and inorganic growth. Its recent acquisition of Sikora is a case in point—a high-growth, high-margin business that strengthens Dover’s position in precision technologies.

But it’s not just about acquisitions. Dover is also investing in organic growth, from expanding capacity in its fastest-growing segments to optimizing its supply chain. These moves, while not glamorous, are like planting seeds for a bountiful harvest. Management plans to share more details on cost savings from these initiatives in the next earnings report, which could further boost investor confidence.

The Bull Case for Buying the Dip

So, why should investors consider buying Dover’s stock now? For starters, the market’s reaction to the earnings report seems overblown. A 5% revenue beat, record margins, and a raised full-year outlook aren’t the stuff of sell-offs. Add to that Dover’s exposure to high-growth markets and its disciplined approach to capital allocation, and you’ve got a compelling case.

- Undervalued potential: The market is overlooking Dover’s long-term growth story.

- Strong fundamentals: Robust bookings and margin gains signal a healthy business.

- Strategic focus: Investments in AI and clean energy position Dover for the future.

I’ll admit, Dover’s story isn’t as straightforward as some of its peers. The portfolio reshaping takes time, and the market doesn’t always reward patience. But for those willing to look beyond the noise, this dip feels like a rare chance to own a piece of an industrial turnaround at a discount.

Looking Ahead: What’s Next for Dover?

Dover’s raised guidance paints an optimistic picture. The company now expects 4-6% revenue growth for the year, up from 2-4%, and adjusted earnings per share of $9.35-$9.55, a roughly 14% increase at the midpoint. These numbers reflect not just optimism but a clear strategy to capitalize on emerging trends.

Looking further out, Dover’s focus on productivity and automation could unlock even more value. By streamlining operations and reshoring parts of its supply chain, the company is reducing risks like tariffs while boosting efficiency. It’s the kind of forward-thinking that separates good companies from great ones.

In a world where markets often overreact, Dover’s recent dip feels like a classic case of mispricing. The company’s strong fundamentals, strategic vision, and exposure to high-growth sectors make it a standout in the industrial space. For investors, this could be the moment to act—before the market catches up. What do you think: is Dover the hidden gem the market’s overlooking?