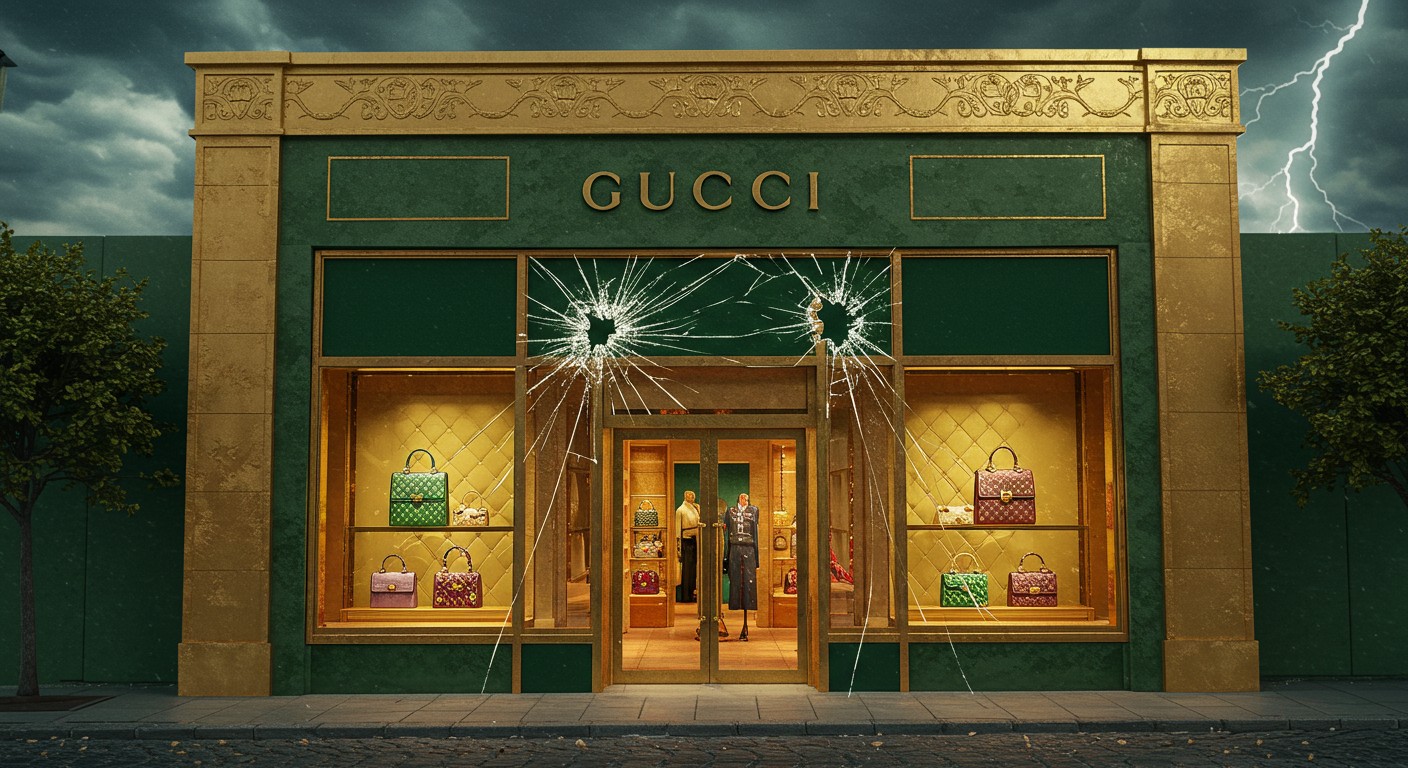

Have you ever walked past a Gucci store, dazzled by its sleek displays, only to wonder what’s happening behind the scenes? The luxury fashion world is no stranger to drama, but Gucci’s recent struggles have everyone talking. Investors, once hopeful about a grand revival, are now raising eyebrows as the brand’s first-quarter sales took a nosedive. I’ve always found it fascinating how a brand synonymous with glamour can face such turbulent times, and it got me thinking: what’s really going on with Gucci, and why are investors cooling off?

The Fall of a Fashion Titan

Gucci, a cornerstone of the luxury fashion world, has been grappling with a rough patch. Owned by the French conglomerate Kering, the brand accounts for nearly half of the group’s revenue, making its performance a critical indicator of the company’s health. But the numbers aren’t pretty. In the first three months of 2025, Gucci’s sales plummeted by a staggering 25% compared to the previous year, landing at 1.57 billion euros. That’s not just a hiccup—it’s a wake-up call.

Analysts expected challenges, but this sharp decline has left many questioning whether Gucci’s much-hyped turnaround strategy is working. According to industry experts, the brand’s inability to show even a glimmer of recovery has investors worried that the road ahead might be longer and bumpier than anticipated. It’s like watching a star athlete fumble during a crucial game—you root for them, but the missteps are hard to ignore.

The absence of any positive signs at Gucci suggests the turnaround will take far longer than expected, with profitability and cash flow suffering in the meantime.

– Financial analyst

A Broader Luxury Slump

Gucci’s woes don’t exist in a vacuum. The luxury sector as a whole has been navigating choppy waters, particularly in key markets like China. Kering’s other brands, such as Yves Saint Laurent and Bottega Veneta, aren’t exactly thriving either. YSL saw a 9% drop in sales, while Bottega Veneta, previously a standout, slowed to a modest 4% growth. These figures paint a picture of an industry struggling to regain its footing.

Why the downturn? For one, economic headwinds like tariffs and shifting consumer priorities are squeezing budgets. Luxury goods, once a status symbol, are losing their allure for some shoppers. As one retail analyst put it, when wallets are tight, even the most loyal Gucci fans might think twice before splurging on a new handbag. It’s a tough pill to swallow for a brand that’s built its identity on exclusivity and desire.

- Economic pressures: Tariffs and inflation are curbing consumer spending.

- Shifting priorities: Shoppers are prioritizing experiences over luxury goods.

- Market saturation: Too many brands are vying for the same high-end clientele.

What Went Wrong at Gucci?

Gucci’s fall from grace didn’t happen overnight. Once the darling of Kering’s portfolio, the brand has stumbled through a series of missteps that have dulled its shine. From questionable management decisions to inconsistent creative direction, Gucci has struggled to maintain its place at the top. I’ve always believed that a brand’s identity is its heartbeat, and Gucci’s seems to be skipping a few beats.

In recent years, the brand has faced criticism for losing its edge. Consumers who once flocked to Gucci for its bold, trendsetting designs now see it as less relevant. According to market researchers, Gucci is no longer “top of mind” for luxury shoppers, a devastating blow for a brand that thrives on visibility. Add to that a string of leadership changes, and you’ve got a recipe for uncertainty.

Without a clear creative vision, Gucci risks confusing its audience and diluting its legacy.

– Fashion industry expert

Kering has tried to address these issues with a multi-pronged approach. They’ve tweaked product lines, sped up supply chains, and even brought in a new artistic director, Demna Gvasalia, whose debut collection is set to hit runways in September 2025. But the jury’s still out on whether these changes will resonate with consumers. Demna’s controversial style, known for pushing boundaries, could either reinvigorate Gucci or alienate its core audience.

Investor Skepticism Grows

Investors aren’t known for their patience, and Gucci’s lackluster performance is testing their limits. Following the Q1 earnings report, Kering’s stock took a hit, closing down nearly 1%. Major financial institutions like JPMorgan and TD Cowen have slashed their price targets for Kering, with JPMorgan dropping its 12-month forecast from 195 euros to 150 euros. That’s a clear signal that Wall Street isn’t buying the turnaround hype just yet.

What’s driving this skepticism? For starters, there’s no clear timeline for recovery. Analysts predict another weak quarter and a sluggish second half, with Gucci and YSL continuing to drag down Kering’s bottom line. The lack of a unified brand strategy is another sore point. As one analyst noted, Gucci’s mixed signals—trying to appeal to both loyalists and new customers—could be doing more harm than good.

| Brand | Q1 Sales Change | Investor Outlook |

| Gucci | -25% | Bearish |

| Yves Saint Laurent | -9% | Cautious |

| Bottega Veneta | +4% | Neutral |

The China Conundrum

China has long been a golden goose for luxury brands, but it’s proving to be a tough market for Gucci. The region’s economic slowdown, coupled with new trade barriers, has dampened demand for high-end goods. Shoppers who once lined up for Gucci’s latest releases are now tightening their belts, and the brand’s struggles to adapt aren’t helping.

It’s not just about economics, though. Gucci’s brand perception in China has taken a hit. Younger consumers, particularly Gen Z, are gravitating toward newer, edgier labels that feel more authentic. Gucci, with its storied but slightly dated image, is struggling to keep up. Perhaps the most interesting aspect is how cultural shifts are reshaping luxury consumption—something Gucci needs to address pronto.

Can Gucci Bounce Back?

Despite the gloom, not everyone is writing Gucci off. Some analysts argue that the brand’s global recognition and pricing power give it a fighting chance. After all, Gucci isn’t just a name—it’s a cultural institution. The question is whether Kering can harness that legacy to stage a comeback.

Here’s what Gucci needs to focus on:

- Clarify its identity: A cohesive creative vision could win back consumers.

- Target younger audiences: Engaging Gen Z with fresh campaigns is crucial.

- Streamline operations: Faster supply chains and smarter inventory management can boost efficiency.

In my experience, brands that listen to their audience and adapt without losing their core essence tend to come out on top. Gucci’s challenge is to balance innovation with tradition—a tall order, but not impossible. The September runway show will be a make-or-break moment. If Demna’s vision clicks, it could spark renewed interest. If it flops, Gucci’s troubles could deepen.

What’s Next for Kering?

Kering’s fate is tied to Gucci’s, but the conglomerate isn’t putting all its eggs in one basket. Bottega Veneta’s relative stability offers some hope, and YSL, while struggling, still has a loyal following. The bigger picture, though, is that Kering needs to rethink its approach to the luxury market. Relying on Gucci’s past glory won’t cut it in today’s fast-changing landscape.

Investors will be watching closely for signs of progress. A weak Q2 could further erode confidence, but a strong holiday season might offer a lifeline. For now, Kering’s stock remains one of Europe’s least-loved luxury plays, down 27% year-to-date. It’s a stark reminder that even the biggest names aren’t immune to market realities.

Gucci’s global recognition and distribution control make a permanent decline unlikely, but the turnaround’s timing remains uncertain.

– Market strategist

Lessons for the Luxury Industry

Gucci’s struggles offer a cautionary tale for the luxury sector. Brands can’t rest on their laurels, no matter how iconic they are. Consumer tastes evolve, and staying relevant requires constant reinvention. I’ve always found it intriguing how luxury brands walk a tightrope between heritage and innovation—it’s a delicate dance, and Gucci’s currently tripping over its own feet.

Other brands would do well to take note. Here are a few takeaways:

- Stay agile: Adapt quickly to changing market conditions.

- Know your audience: Understand what drives your core customers.

- Invest in storytelling: A compelling narrative can reignite brand love.

The luxury market isn’t going anywhere, but it’s becoming more competitive. Brands that fail to evolve risk being left behind, just like Gucci is learning the hard way.

Final Thoughts

Gucci’s journey is a rollercoaster, and we’re all watching to see if it climbs back up or takes another dip. The brand’s Q1 flop has shaken investor confidence, but it’s not the end of the story. With the right moves—a clearer identity, smarter marketing, and a touch of creative magic—Gucci could still reclaim its throne. For now, though, the luxury giant is at a crossroads, and the path forward is anything but certain.

What do you think? Can Gucci pull off a comeback, or is it destined to fade into the background? One thing’s for sure: the fashion world is never boring.