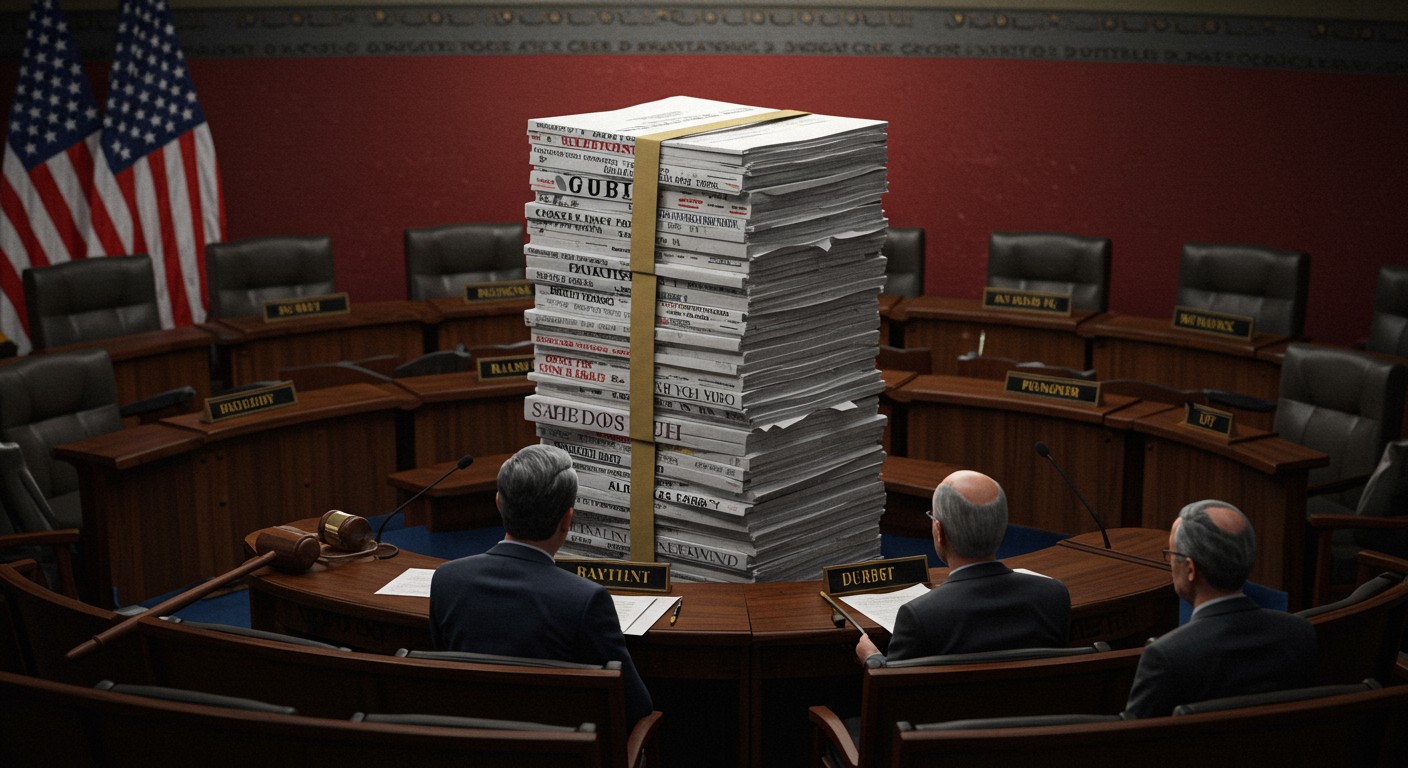

Have you ever wondered what happens when a massive budget bill gets caught in a political tug-of-war? The recent clash between the House and Senate over a sweeping new budget proposal has Washington buzzing—and not in a good way. I’ve been following the news closely, and it’s clear this isn’t just another day at the Capitol. The stakes are sky-high, with some lawmakers warning that this bill could send the nation’s debt soaring into dangerous territory. Let’s unpack what’s going on, why it matters, and what it could mean for the future of America’s economy.

The Budget Battle Heating Up

The House recently passed a hefty budget bill that’s been dubbed everything from “ambitious” to “reckless.” It’s a sprawling package of domestic policies, touching everything from infrastructure to social programs. But while some cheer its bold vision, others—especially a group of vocal Senate Republicans—are sounding the alarm. Their biggest worry? The bill’s potential to balloon the federal deficit to levels that could haunt the economy for decades.

Senators like Ron Johnson of Wisconsin are leading the charge, arguing that the bill’s spending spree doesn’t align with fiscal responsibility. In a recent interview, Johnson didn’t mince words, warning that the bill could “explode the debt.” It’s the kind of phrase that grabs your attention, isn’t it? When a seasoned senator uses language that stark, you know the debate is about to get heated.

Why the Deficit Matters

Let’s take a step back and talk about why the national debt is such a big deal. In simple terms, the deficit is the gap between what the government spends and what it takes in through taxes. When that gap grows, the government borrows more, piling onto the national debt. Right now, that debt is already in the trillions, and adding more could mean higher interest rates, slower economic growth, and less wiggle room for future crises.

The first goal of any budget process should be to reduce the deficit, not increase it.

– A prominent fiscal policy expert

A nonpartisan analysis recently estimated that the House’s bill could add $3.8 trillion to the deficit over the next ten years. That’s not pocket change—it’s a number that makes even the most optimistic economists nervous. For Senate Republicans, this is a red line. They argue that unchecked spending today could saddle future generations with a debt they can’t possibly pay off. It’s a grim prospect, and one that’s fueling their push to pump the brakes.

Senate GOP’s Game Plan

So, what’s the Senate’s next move? According to Senator Johnson, there’s enough GOP support to stall the bill until serious changes are made. The goal isn’t just to tweak a few numbers—it’s to demand a fundamental shift toward spending reduction. Johnson has been vocal about wanting to return to “pre-pandemic level spending,” a benchmark he believes would keep the deficit in check.

- Block and negotiate: Senate Republicans aim to use their leverage to force revisions, focusing on trimming costly provisions.

- Prioritize cuts: They’re pushing for reductions in discretionary spending, particularly in areas they see as bloated.

- Engage the president: The GOP wants the White House to commit to a deficit-reduction plan before the bill moves forward.

It’s a bold strategy, but it’s not without risks. Stalling the bill could lead to a political standoff, potentially delaying critical funding for programs that millions rely on. Still, for fiscal hawks, it’s a risk worth taking if it means protecting the economy’s long-term health.

The House’s Defense

Not everyone sees the bill as a fiscal disaster. House leadership, including the Speaker, has been quick to defend it, arguing that the investments it proposes are critical for the nation’s future. They point to infrastructure upgrades, job creation, and social safety nets as non-negotiables in a rapidly changing world. The Speaker has even brushed off deficit concerns, suggesting that economic growth spurred by the bill will offset any short-term borrowing.

It’s a classic divide—investment now versus caution for tomorrow. I’ve always found this tension fascinating. On one hand, you have leaders who believe bold spending is the key to prosperity. On the other, you have those who see restraint as the only way to avoid economic ruin. Both sides have valid points, but the numbers don’t lie, and that $3.8 trillion figure is hard to ignore.

What’s at Stake?

The outcome of this budget battle could ripple far beyond Washington. For everyday Americans, a growing deficit might not feel urgent, but its effects creep in over time. Higher interest rates could make mortgages and car loans pricier. Inflation could eat away at savings. And if the government’s borrowing gets out of hand, it might struggle to fund essentials like Social Security or disaster relief.

| Economic Factor | Potential Impact |

| Interest Rates | Higher borrowing costs for consumers |

| Inflation | Reduced purchasing power |

| Government Services | Possible cuts to critical programs |

For businesses, the stakes are just as high. A ballooning deficit could spook investors, leading to market volatility. On the flip side, the bill’s investments could spark growth in industries like construction and tech. It’s a gamble, and the Senate GOP is betting that caution wins out.

Voices from the Senate

Not all Senate Republicans are on the same page, but the loudest voices are united in their concern. Take Senator Rand Paul from Kentucky, who called the bill’s spending cuts “wimpy and anemic.” He’s willing to support some reductions but draws the line at anything that adds to the debt. It’s a sentiment echoed by others who see the bill as a missed opportunity to get the nation’s finances in order.

The math doesn’t add up. This bill will explode the debt, and that’s a problem we can’t ignore.

– A leading Senate fiscal conservative

What’s interesting here is the tone. These aren’t just policy disagreements—they’re warnings laced with urgency. Perhaps the most compelling aspect is how these senators are framing the debate: not as a partisan fight, but as a question of long-term survival. Can the U.S. afford to keep borrowing at this pace? It’s a question that demands an answer.

The Road Ahead

As the bill heads to the Senate, all eyes are on how this drama will unfold. Will the GOP hold firm and force major revisions? Or will the House’s vision prevail, with its promise of growth outweighing the risks? One thing’s for sure: the negotiations will be intense. I’ve seen my fair share of political standoffs, but this one feels different. There’s a sense that the decisions made now could shape the economy for years to come.

- Amendments: Expect Senate Republicans to propose changes aimed at slashing spending.

- Compromise: Both sides may need to give ground to avoid a deadlock.

- Public pressure: Voters and interest groups could sway the outcome as the debate heats up.

In my view, the Senate’s push for fiscal restraint is a wake-up call. It’s easy to get caught up in the promise of new programs, but ignoring the deficit is like maxing out a credit card and hoping the bill never comes. The question is whether Washington can find a balance—or if we’re headed for another round of gridlock.

What Can You Do?

This budget battle might feel like it’s happening in a distant bubble, but its outcomes will touch your life. Want to stay informed? Keep an eye on how your senators vote and what they’re saying about the deficit. Better yet, let them know where you stand. Public opinion can shift the needle, especially when the stakes are this high.

At the end of the day, this debate is about choices. Do we invest big now and hope for growth, or do we tighten the belt to secure the future? It’s a tough call, and one that’ll define the path forward. What do you think—can we afford to keep spending, or is it time to hit the brakes? The answer might just shape the economy for decades.