Have you ever wondered how to jump into the artificial intelligence craze without breaking the bank? I’ll let you in on a little secret: it’s not always about chasing the flashiest tech giants. Sometimes, the real gems are hiding in plain sight, quietly powering the revolution behind the scenes. That’s where a company like Cisco Systems comes in—a name you might associate with old-school networking but one that’s carving out a serious role in the AI boom. Let’s dive into why this stock is catching eyes as a budget-friendly way to play the AI game.

The AI Boom Meets Cisco’s Quiet Power

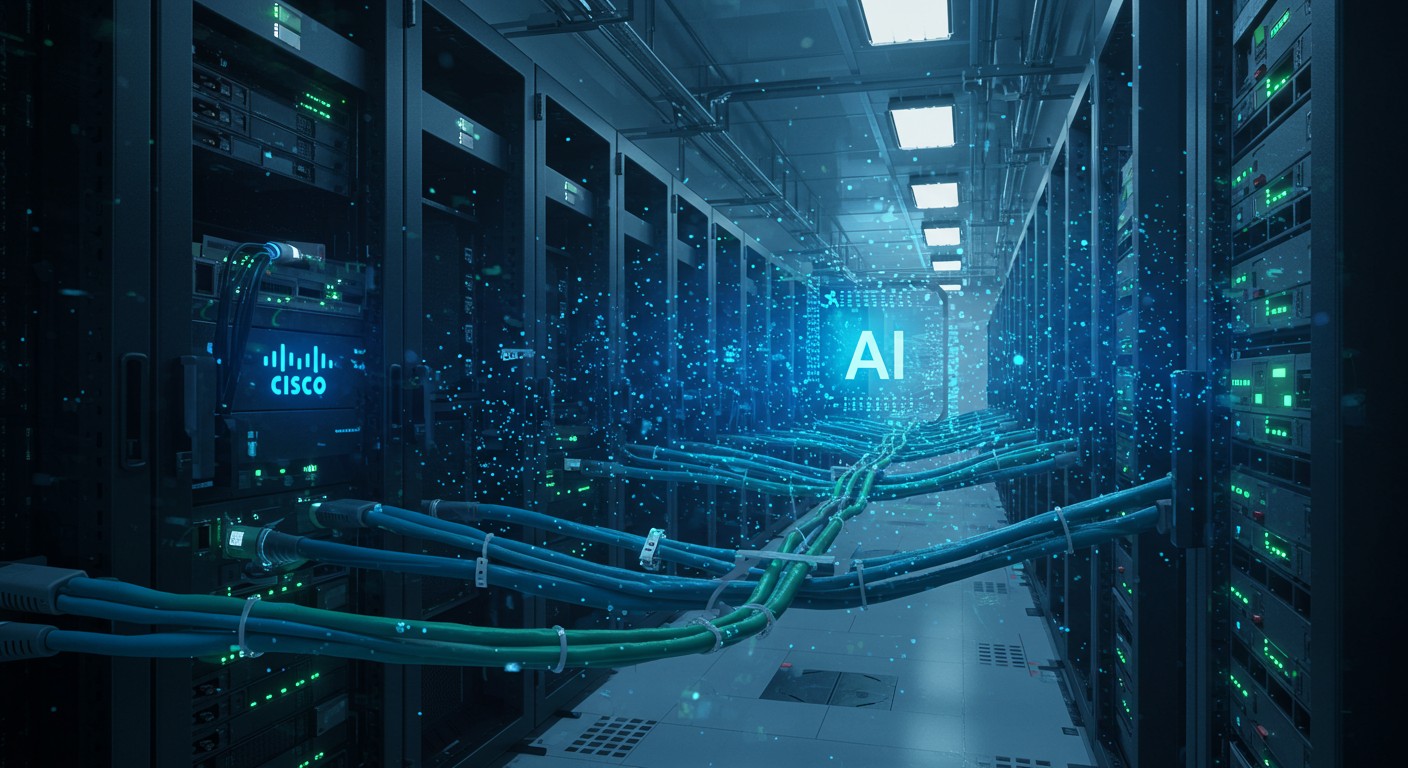

The AI wave is sweeping through industries, from healthcare to finance, and it’s no secret that investors are hungry for a piece of the action. But here’s the thing: you don’t need to splurge on high-flying stocks to get exposure. Cisco, a company known for its networking equipment, is proving to be a sneaky-smart way to tap into AI’s growth. Why? Because AI data centers—the beating heart of this tech revolution—rely on the kind of robust, high-speed connections Cisco provides.

AI isn’t just about flashy algorithms; it’s about the infrastructure that makes them work.

– Tech industry analyst

Think of Cisco as the plumber laying the pipes for AI’s skyscraper. Without those pipes—switches, routers, and cables—the whole system grinds to a halt. And as AI models grow more complex, the demand for Cisco’s gear is spiking. In my view, that’s what makes this stock so intriguing: it’s a foundational player in a booming industry, yet it’s trading at a valuation that won’t make your wallet cry.

Why Cisco Fits the AI Puzzle

Cisco’s role in AI isn’t some pie-in-the-sky dream—it’s happening now. The company’s networking equipment connects the powerful computers that run AI models in data centers. As these computers get more advanced, they need faster, more reliable networks to keep up. Cisco’s been stepping up its game, delivering solutions tailored for AI infrastructure.

- AI data centers: Cisco’s gear ensures seamless communication between servers, critical for AI workloads.

- Cloud computing: The company’s pivot to serve hyperscale customers, like major cloud providers, is paying off.

- Innovation: New AI-focused products are positioning Cisco as a go-to for data center builds.

Here’s a stat that caught my eye: Cisco recently hit its goal of $1 billion in AI infrastructure orders from hyperscale clients a full quarter ahead of schedule. That’s not just a number—it’s proof that big players trust Cisco to deliver. And with orders surging 20% year-over-year, it’s clear the company’s on the right track.

A Stock That’s Easy on the Wallet

Let’s talk numbers for a sec. Cisco’s stock is trading at about 15 times its estimated 2026 earnings per share. Compare that to the S&P 500, which is closer to 20 times earnings, and you’ve got a bargain. Analysts have pointed out that this valuation gap makes Cisco a steal, especially given its AI tailwinds. I mean, who doesn’t love a good deal?

| Metric | Cisco | S&P 500 |

| P/E Ratio (2026 Est.) | 15x | 20x |

| Year-to-Date Gain (2025) | 13% | 2% |

| Dividend Yield | ~3% | ~1.4% |

But it’s not just about the price tag. Cisco’s been outperforming the broader market, with its stock up 13% in 2025 compared to the S&P 500’s measly 2%. That kind of momentum, paired with a low valuation, is what gets investors like me excited. Plus, the company’s not stingy with its cash—it paid out $3.1 billion in dividends and buybacks last quarter alone.

More Than Just AI: Cisco’s Big Picture

Cisco isn’t a one-trick pony. Beyond AI, the company’s making waves in cybersecurity and subscription-based software. These are high-margin businesses that give Cisco a more predictable revenue stream—something Wall Street loves. The acquisition of Splunk, for example, has boosted its cybersecurity offerings, helping Cisco compete in a crowded market.

Cisco’s shift to software and subscriptions is like swapping a clunky old car for a sleek electric model.

I’ve always thought a company’s ability to evolve is what separates the winners from the also-rans. Cisco’s been around for decades, but it’s not resting on its laurels. Its focus on cloud computing, AI, and cybersecurity shows it’s ready for the future. And with a 3% dividend yield, it’s a stock you can hold while waiting for the AI story to unfold.

Navigating Market Volatility

Now, let’s address the elephant in the room: the market’s been a bit of a rollercoaster lately. Geopolitical tensions, like those in the Middle East, have sent stocks swinging. Oil prices dropped after fears of escalation eased, and stocks rallied as a result. But here’s the kicker—Cisco’s held its ground. Why? Because its business is tied to long-term trends like AI and cloud computing, not short-term headlines.

- Geopolitical noise: Markets hate uncertainty, but Cisco’s fundamentals remain solid.

- Interest rates: Lower rates could boost tech stocks, including Cisco.

- AI demand: This secular trend isn’t going anywhere, no matter the headlines.

Some might argue that Cisco’s recent 5% pop after strong earnings makes it a risky buy at its 52-week high. I get it—nobody likes chasing a hot stock. But when you zoom out, the company’s growth prospects and attractive valuation make it worth a look. Perhaps the most interesting aspect is how Cisco’s quietly positioning itself as a must-have for AI infrastructure without the hype of other tech names.

What’s Next for Cisco?

Looking ahead, Cisco’s got a lot going for it. Analysts are upbeat, with some upgrading the stock to a buy thanks to its AI-driven growth. The company’s also rolling out new innovations, like AI-optimized networking gear, that could keep the momentum going. And let’s not forget the broader market context—if the Fed cuts rates in July, as some officials have hinted, tech stocks like Cisco could get an extra boost.

Cisco’s Growth Formula: 50% AI Infrastructure 30% Cybersecurity & Software 20% Traditional Networking

But here’s where I’ll throw in a bit of caution: no stock is a sure thing. Cisco faces competition from rivals like Arista Networks, and the AI space is crowded with players vying for a slice of the pie. Still, Cisco’s track record, diversified business, and shareholder-friendly approach make it a compelling pick for those looking to dip their toes in AI without paying a premium.

Why You Should Care

So, why should you, the everyday investor, care about Cisco? Because it’s a rare chance to invest in a megatrend like AI without the sticker shock. It’s a company that’s not just surviving but thriving in a fast-changing tech world. And with its dividends, you’re getting paid to wait while the AI story plays out.

Investing isn’t about chasing hype—it’s about finding value in the right places.

– Financial advisor

In my experience, the best investments are often the ones nobody’s talking about yet. Cisco’s not the sexiest name in tech, but it’s got the chops to deliver. Whether you’re a seasoned investor or just starting out, this stock deserves a spot on your radar. So, what’s stopping you from taking a closer look?

Let’s wrap this up with a quick recap. Cisco’s a budget-friendly way to play the AI boom, thanks to its critical role in data centers, attractive valuation, and shareholder perks. The market’s volatile, sure, but Cisco’s long-term story is rock-solid. Maybe it’s time to add this quiet powerhouse to your portfolio.